A closer look at Copper

Pouring molten copper at a Copper Smelter in Chile

By Ron Hall

According to the International Copper Study Group (an intergovernmental organisation of copper producing and using countries), since 1900 when global production of copper was less than 500,000 tonnes, world mine production of the metal has grown by roughly 3% a year reaching current levels of over 20 million tonnes per annum. Despite declining ore grades, this trend will likely continue for the foreseeable future due to an ever-increasing demand for the metal especially in the production of Electrical Vehicles (EV’s) that contain some four times more copper than conventional cars. Copper ranks as the third-most-consumed industrial metal in the world, after iron and aluminum, according to the U.S. Geological Survey (USGS) and about three-quarters of that copper goes to make electrical wires, telecommunication cables and electronics.

Copper is one of the few metals that can occur in nature in a directly usable metallic form commonly known as native copper. Its historical discovery led to very early human use of the metal in several regions from around 10000 BC. Thousands of years later, it became the first metal to be smelted from sulphide ores and the first metal to be cast into a shape in a mold. Around 4000 BC it became the first metal to be purposely alloyed with tin to create bronze.

In Roman times copper was mined principally on the island of Cyprus and the name copper originates from the aes Ñyprium (metal of Cyprus) that was later corrupted to Ñuprum in Latin.

A chemical element with the symbol Cu derived from its Latin name, it is a soft, malleable, and ductile metal with very high thermal and electrical conductivity which led to its primary use as a conductor of heat and electricity.

Copper is a constituent of various metal alloys such as brass (copper and zinc), bronze (copper and tin), sterling silver (copper and silver) used in jewelry, cupronickel (copper and nickel) used to make marine hardware and coins, and constantan (also copper nickel) used in strain gauges and thermocouples for temperature measurement. The discoveries and inventions relating to electricity and magnetism of the late 18th and early 19th centuries by scientists such as Ampere, Faraday and Ohm, and the products manufactured from copper then, helped launch the Industrial Revolution.

A freshly exposed surface of pure copper has a pinkish-orange colour although its commonly encountered compounds often impart blue or green colors to such minerals as azurite, malachite and turquoise that have been used widely and historically as pigments. The metal and its compounds are often used in decorative art and copper compounds are used as bacteriostatic agents, fungicides and wood preservatives.

Copper is essential to all living organisms as a trace dietary mineral that’s crucial for forming red blood cells. Aside from hemoglobin in blood, in humans, copper is found mainly in the liver, muscle, and bone and the adult body contains between 1.4 and 2.1Â mg of copper per kilogram of body weight.

In 2013 the USGS completed a geologyâ€based, cooperative international assessment of global copper resources. They determined that two geological deposit types account for about 80% of the world’s copper supply: Porphyry copper deposits that account for about 60% of the world’s copper and where copper ore minerals are disseminated in igneous intrusions; and Sedimentâ€hosted strata bound copper deposits that account for about 20% of the world’s copper in which copper is concentrated in layers in sedimentary rocks.

Primary copper production starts with the extraction of copperâ€bearing ores and there are three basic ways of copper mining: surface (open pit), underground mining and leaching with openâ€pit mining being the predominant method. After the ore has been mined, it is crushed, ground in water and then a concentrate is produced from the slurry by a froth flotation process. The copper concentrates typically contain around 30% of copper, but grades can range from 20 to 40 per cent. The wet concentrates are typically thickened to reduce water content and then dried to reduce moisture content to less than 5%. In the following smelting process copper is further transformed into a molten “matte” containing 50â€70% copper, the balance being sulphur. The matte is treated in a converter removing sulphur as sulphur dioxide that is often further processed to produce sulphuric acid. The so-called blister copper produced contains of 98.5â€99.5% copper that is usually fire refined to remove remaining sulphur impurities before being cast into anodes that are finally electroâ€refined to produce very high purity copper cathodes as the end product.

In the alternative hydrometallurgical route, copper is extracted from mainly low-grade oxide ores and also some sulphide ores, through leaching, solvent extraction and electrowinning (the SXâ€EW process). The ICSG estimates that in 2019, refined copper production from SXâ€EW represented around 16% of total copper refined production. SXâ€EW production, virtually nonâ€existent before the 1960s, stood at 3.9 million tonnes in 2019.

Refined copper production derived from mine production (either from metallurgical treatment of concentrates or SXâ€EW) is referred to as “primary copper production”, as obtainable from a primary raw material source. However, there is another important source of raw material which is scrap. Refined copper production attributable to recycled scrap feed is classified as “secondary copper production”. Secondary producers use processes similar to those employed for primary production. ICSG estimates that in 2019, at the refinery level, secondary copper refined production reached 17% of total copper refined production.

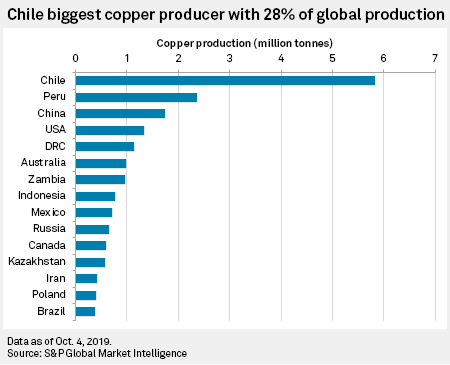

In terms of copper supply, most comes from South American countries. From less than 750,000 tonnes copper in 1960, copper mine production in South America has increased to 8.8 million tonnes in 2019, representing 43% of the global total. Asia has also exhibited significant growth increasing from just 6% to 15% over the respective period. Conversely, North America’s share declined from 36% to 13%.

Copper mining capacity is estimated to reach 29.5 million tonnes copper in 2024, with 18% being SXâ€EW production. This will be 22% higher than global capacity of 24.1 million tonnes copper recorded in 2019. Growth in copper mine capacity is expected to average 5.1% per year going forward as new capacity is added at existing and some new operations.

Asia’s share of world copper smelter output jumped from 27% in 1990 to 65% in 2019 as smelter production in China expanded rapidly and in 2019, China accounted for almost 50% of world copper smelter production, followed by Japan (8%), Chile (5%) and Russian Federation (5%) an in terms of refined copper production China is the dominant player and accounts for around 41% of world copper refined production, followed by Chile (9%), Japan (6%) and the United States (4%).

Copper, as with any merchandise, is traded between producers and consumers. Producers sell their present or future production to clients, who transform the metal into shapes or alloys, so that downstream fabricators can transform these into different endâ€use products. One of the most important factors in trading a commodity such as copper is the settlement price for the present day (spot price) or for future days. Exchanges also provide for the trading of futures and options contracts. These allow producers and consumers to fix a price in the future, thus providing a hedge against price variations. In this process the participation of speculators, who are ready to buy the risk of price variation in exchange for monetary reward, gives liquidity to the market. A futures or options contract defines the quality of the product, the size of the lot, delivery dates, delivery warehouses and other aspects related to the trading process. Contracts are unique for each exchange. The existence of futures contracts also allows producers and their clients to agree on different price settling schemes to accommodate different interests.

Exchanges also provide for warehousing facilities that enable market participants to make or take physical delivery of copper in accordance with each exchange’s criteria.

Three commodity exchanges provide the facilities to trade copper: The London Metal Exchange (LME), the Commodity Exchange Division of the New York Mercantile Exchange (COMEX/NYMEX) and the Shanghai Futures Exchange (SHFE). In these exchanges, prices are settled by bid and offer, reflecting the market’s perception of supply and demand of a commodity on a particular day. On the LME, copper is traded in 25 tonne lots and quoted in US dollars per tonne; on COMEX, copper is traded in lots of 25,000 pounds and quoted in US cents per pound; and on the SHFE, copper is traded in lots of 5 tonnes and quoted in Renminbi per tonne. More recently, mini contracts of smaller lots sizes have been introduced at the exchanges.

For decades, the copper price has been a key indicator of global economic health, earning it the moniker “Dr. Copper.” Rising prices signal a strong global economy, while a significant longer-term drop in the price of copper is often a symptom of economic instability. After bottoming out at US$2.17 per pound in mid-March 2020, the copper price has been on a steep upward trajectory ever since reaching record highs this year. This has been attributed to a supply/demand gap that’s widening as many of the world’s largest economies begin to emerge from the coronavirus pandemic coupled with supply concerns out of two of the world’s major copper producers: Chile and Peru. Earlier this port workers in Chile were calling for a strike while in Peru presidential candidate Pedro Castillo proposed nationalizing mining and redrafting the country’s constitution.

Copper’s rally in 2021 has encouraged bullish sentiment from many analysts predicting even stronger copper prices to come therefore position junior copper explorers with desirable upside potential, here are a few such companies.

Golden Arrow Resources Corp. [GRG-TSXV, GARWF-OTCQB, G6A-FSE] is a mining exploration company that is targeting gold and copper discoveries in a large South American project portfolio.

Golden Arrow Resources Corp. [GRG-TSXV, GARWF-OTCQB, G6A-FSE] is a mining exploration company that is targeting gold and copper discoveries in a large South American project portfolio.

It includes epithermal gold in Argentina, high grade copper in Chile and a district-scale orogenic gold opportunity in Paraguay.

Golden Arrow currently has seven projects in Argentina. But this year, the focus is on drilling at its Rosales copper project in Chile and the Tierra Dorada gold project in Paraguay.

The 100%-owned Rosales copper project covers 3,444 hectares and is located less than 90 kilometres from the mining centre of Copiapo in Region 111, Chile. The area is an established mining region, with multiple copper and gold mining projects nearby, including the Margarita Mine, an underground copper mining operation which lies adjacent to the Rosales properties.

Golden Arrow recently launched its first reverse circulation drill program at the Rosales project. The program is designed to test the large conductive zones identified in a recent geophysical survey.

“We have multiple targets near-surface and at depth exhibiting hallmarks of high-grade, stratabound or mantos-style copper deposits, so we are very excited to have the drills turning to test the interpretation,” said Brian McEwen, Vice-President, Exploration and Development at Golden Arrow.

“We have multiple targets near-surface and at depth exhibiting hallmarks of high-grade, stratabound or mantos-style copper deposits, so we are very excited to have the drills turning to test the interpretation,” said Brian McEwen, Vice-President, Exploration and Development at Golden Arrow.

The first phase of drilling will include 1,400 metres in four holes to test both the upper and lower conductors and confirm the geophysical interpretation. The subsequent 1,600 metres will be used to test the extent of the anomalies as well as other targets. The program is expected to continue through the fourth quarter of 2021.

Golden Arrow is also gearing up for drilling on the Tierra Dorada project, where the company is targeting orogenic (high-grade vein-hosted) gold on this district-scale high-grade gold project located in one of the last frontiers of mineral exploration in South America.

The nearly 64,000-hectare, road-accessible Tierra Dorada project includes two separate property blocks of 34,566 and 24,288 hectares, situated six kilometres apart. The city of Villa Florida is in the centre of the project at 80 kilometres above sea level.

The company is gearing up to drill after identifying new targets while completing a shallow drilling program that intersected high-grade gold.

Recent exploration has focused on the Alvaro area of the project to delineate high-grade, quartz vein-hosted gold prospects and to refine targets for a full-scale follow-up drilling program.

Drilling highlights include an intercept at the Alvaro target of 143.5 g/t gold over 0.5 metres within 6.0 metres averaging 14.53 g/t gold at 3.0 to 9.0 metres depth.

Golden Arrow’s exploration and development strategy is led by a highly experienced management team, that includes Executive Chairman, CEO and President Joe Grosso, who has been active in Argentina since the country opened its mining sector to foreign investment in 1993.

Grosso has successfully formed strategic alliances and negotiated with mining industry majors such as Barrick Gold Corp. [ABX-TSX, GOLD-NYSE], Teck Resources Ltd. (TECK.B-TSX, TECK.A-TSX, TECK-NYSE), Newmont Corp., [NGT-TSX, NEM-NYSE], Viceroy (now Yamana Gold Inc. [YRI-TSX, AUY-NYSE]) and Vale SA [VALE-NYSE] of Brazil, and government officials at all levels.

“There is lots of experience in the group and money in the bank,” said McEwen during a recent interview with Resource World. The company has $17.5 million in cash and a large equity holding in SSR Mining Inc. SSRM-TSX, NASDAQ, SSR-ASX].

Aside from Rosales and Tierra Dorada, Golden Arrow is engaged in earlier stage exploration at its Argentina projects, including Flecha de Oro, which includes the Las Esperanza, Puzzle and Maquinchao properties. They cover 9,968, 1,952, and 2,000 hectares respectively in central Rio Negro Province.

Flecha de Oro lies within the Somuncara Massif, where low and high sulphidation gold systems have been an exploration target since the first gold discovery in the area in 1995.

Flecha de Oro lies within the Somuncara Massif, where low and high sulphidation gold systems have been an exploration target since the first gold discovery in the area in 1995.

At the La Esperanza property, Golden Arrow has identified similarities in size and geological style to the Cerro Vanguardia district to the south in Santa Cruz province that has produced 4.5 million ounces of gold.

However, after initial work at the Puzzle property, Esperanza has been prioritized for on-going exploration. It hosts multiple vein corridors defined by outcropping quartz veins, boulders and

Highlights from two separate trenches located approximately 160 metres apart included 5.0 metres, averaging 2.98 g/t gold, including 2.0 metres averaging 6.21 g/t in trench TE-10, and a one-metre interval averaging 5.5 g/t gold in trench TE-6 located 160 metes east in the same vein.

Meanwhile, Golden Arrow shares traded at 17.5 cents on September 24, 2021, in a 52-week range of 21 cents and 14.5 cents leaving the company with a market cap of $20.4 million, based on 116.35 million shares outstanding.

Pacific Ridge Exploration Ltd. [PEX-TSXV, PEXZF-OTCQB] goal is to become one of British Columbia’s leading copper-gold exploration companies.

Pacific Ridge Exploration Ltd. [PEX-TSXV, PEXZF-OTCQB] goal is to become one of British Columbia’s leading copper-gold exploration companies.

The company has a strong technical team, veteran explorer Dr. Gerry Carlson is the Executive Chairman, and is led by President and CEO Blaine Monaghan, who has a track record for creating shareholder value – he’s helped raise more than $100 million for exploration projects around the world and has worked for a number of companies that were subject to M&A.

Pacific Ridge also benefits from an attractive share structure with only 53.9 million shares outstanding and a recent market cap of $7.5 million. On October 29, 2021, the company’s shares traded at 14 cents in a 52-week range of 33 cents and $0.05.

The company’s flagship asset is the Kliyul copper-gold project, which is located in the prolific Quesnel Trough, approximately 50 kilometres southeast of Centerra Gold Inc.’s [CG-TSX, CAGDF-OTC] Kemess project.

Over 60 square kilometres in size, Kliyul is situated in a similar environment to other copper-gold porphyry deposits and mines in B.C. such as Kemess, Mt. Milligan, Red Chris, and Newmont Corporation’s [NGT-TSX, NEM: NYSE] Saddle North (Newmont acquired GT Gold in May of this year for US$311 million ).

Kliyul hosts a number of porphyry targets along an underexplored 4-km long mineralized trend. However, most of the historic drilling at Kliyul focused on a near-surface copper-gold magnetite skarn at the Kliyul Main Zone. Deeper drilling in 2006 encountered a porphyry system. Teck Resources Limited [TECK.A-TSX, TECK: NYSE] followed up on this drilling in 2015 and returned significant copper-gold porphyry mineralization, drill hole KLI-15-34 intercepted 245 metres of 0.75% copper equivalent.

“Pacific Ridge’s Kliyul project displays telltale signs of a potentially high-grade copper-gold porphyry at depth,” said Quinton Hennigh, a Geologic and Technical Director of Crescat Capital LLC, which recently participated in Pacific Ridge’s non brokered private placement that raised $1.5 million. “Although Kliyul has only seen limited drilling to date, evidence of a high-grade porphyry driver includes the presence of the copper rich mineral, bornite, in certain drill intercepts and gold grades that are sometimes considerably higher than most B.C. porphyry systems,” he said.

“Pacific Ridge’s Kliyul project displays telltale signs of a potentially high-grade copper-gold porphyry at depth,” said Quinton Hennigh, a Geologic and Technical Director of Crescat Capital LLC, which recently participated in Pacific Ridge’s non brokered private placement that raised $1.5 million. “Although Kliyul has only seen limited drilling to date, evidence of a high-grade porphyry driver includes the presence of the copper rich mineral, bornite, in certain drill intercepts and gold grades that are sometimes considerably higher than most B.C. porphyry systems,” he said.

“The hypothesis Pacific Ridge has developed is that the underlying porphyry at Kliyul may be like that which generated the deep high-grade Red Chris porphyry further to the northwest,” Hennigh said.

In August, 2021, Pacific Ridge launched its fully funded diamond drill program at Kliyul.

“Although Kliyul has seen limited drilling, significant copper-gold porphyry mineralization was intersected in several historic holes,” said Monaghan. “We plan to follow up these holes with the goal of extending the mineralization laterally and to depth.”

In a September 22, 2021 press release Pacific Ridge said all of the three holes drilled during the maiden program encountered classic copper-gold porphyry-style mineralization consisting of sulphides, pyrite, chalcopyrite and lesser bornite in veins and as disseminations.

The company said mineralization at the Kliyul Main Zone was successfully extended to the west and to depth.

“We are very pleased with the results from the drill program,” said Monaghan. “Based upon the mineralization styles observed in the 2021 diamond drill cores, we are confident that we will equal or better the historic drilling results from the Kliyul Main Zone.” He said the findings from the drill campaign will be used to build an expanded drill program in 2022.

“We are very pleased with the results from the drill program,” said Monaghan. “Based upon the mineralization styles observed in the 2021 diamond drill cores, we are confident that we will equal or better the historic drilling results from the Kliyul Main Zone.” He said the findings from the drill campaign will be used to build an expanded drill program in 2022.

Although Kliyul is Pacific Ridge’s focus, the company is growing its pipeline of high-quality copper-gold projects located in B.C. , which includes Redton and RDP.

Redton covers 3,460 hectares and adjoins NorthWest Copper Corp.’s [NWST-TSXV, NWCCF-OTCQX] Kwanika project. Kwanika hosts a measured and indicated resource of 223.6 million tonnes of grade 0.27% copper, 0.25 g/t gold and 0.87 g/t silver, containing 1.32 billion pounds of copper, 1.83 million ounces of gold and 6.27 million ounces of silver. Shares of NorthWest recently jumped on news that it had intercepted 235.45 metres of 2.92% copper equivalent from Kwanika – Redton is less than 2km away from that drill hole.

RDP covers 3,800 hectares and is located about 40 kilometres west of Kliyul. RDP contains several porphyry copper-gold targets that have been explored intermittently since the early 1970s. Limited drilling at RDP has returned 0.11% Cu and 0.64 gpt Au over 122.95 m from the Roy target and 0.67% Cu and 0.93 gpt Au over 58.8 m from the Day target.

It should also be noted that Pacific Ridge has three gold projects in the Yukon, which it plans to spin out over time. The most advanced project is Mariposa where Pacific Ridge intercepted 2.44 gpt Au over 38.9 m in 2011.

Solaris Resources Inc. [SLS-TSX; SLSSF-OTCQB] is responsibly and sustainably advancing a portfolio of copper and gold projects in the Americas.

Solaris Resources Inc. [SLS-TSX; SLSSF-OTCQB] is responsibly and sustainably advancing a portfolio of copper and gold projects in the Americas.

The company is on the verge of publishing an updated resource estimate for its flagship Warintza open-pit copper porphyry project in southeastern Ecuador. The resource will cover the high-grade Warintza Central zone, which continues to expand to the east, north and south and looks set to overlap its most recent discovery at Warintza East. Both deposits are set within a 7km x 5km cluster of five porphyry occurrences exposed at surface on the project.

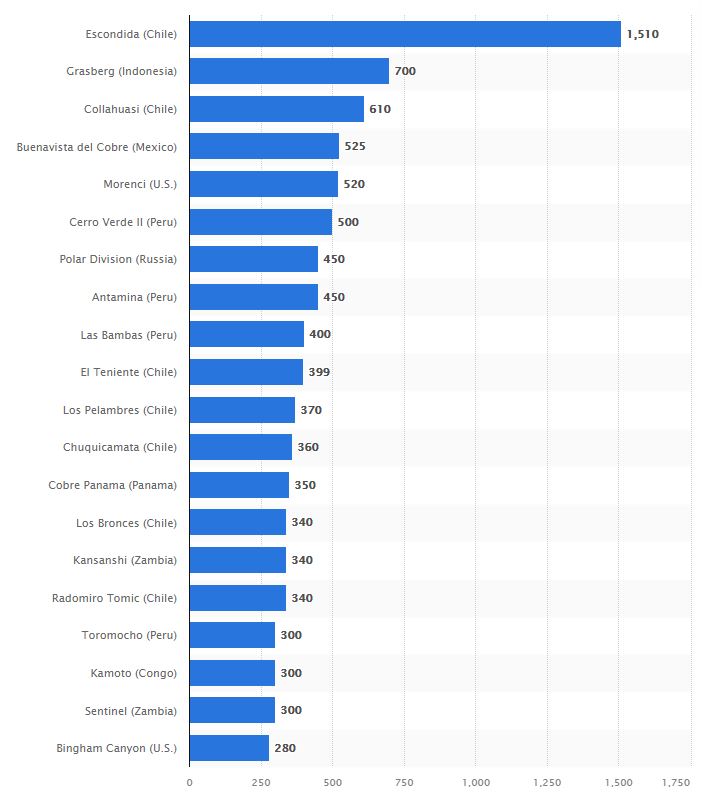

Warintza was discovered in the early 2000s by geologist David Lowell who co-defined the porphyry copper model, now the world’s dominant deposit type for copper, and was involved in more than a dozen major discoveries, including the giant La Escondida deposit in Chile, which is now the world’s largest copper producer, and the 8Moz Pierina gold deposit in Peru.

Warintza had sat dormant for nearly 20 years due to a breakdown in social license for the project from local communities long prior to the emergence of a formal mining sector in the country. Sentiment began to change in 2014 when the government shifted policy to encourage mineral development. The improvement in sentiment was fueled by Lundin Gold acquiring and developing the Fruta del Norte project in a socially and environmentally responsible manner.

This improved sentiment created an opening for Solaris to successfully restart a dialogue with the communities surrounding Warintza leading to a consensus on the restart of activities and the institution of an informed and innovative CSR program resulting in the signing of an Impacts and Benefits Agreement for the responsible advancement of the project.

This improved sentiment created an opening for Solaris to successfully restart a dialogue with the communities surrounding Warintza leading to a consensus on the restart of activities and the institution of an informed and innovative CSR program resulting in the signing of an Impacts and Benefits Agreement for the responsible advancement of the project.

The company has been working hard since to show that raising the bar for responsible mining in the country by incorporating and setting new precedents for international best practices in partnership with local communities, local contractors and suppliers, all levels of government and NGOs can lead to dramatic benefits for all stakeholders.

Warintza benefits from being located in a naturally low-cost mining district with excellent access to infrastructure, including a highway that connects to Pacific ports and national power grid that supplies inexpensive and emission-free hydroelectric power, and at low elevation with abundant fresh water and low cost labour.

The project builds upon the existing, high-grade, pit-optimized Inferred Mineral Resource estimate for Warintza Central of 124Mt grading 0.70% CuEq that incorporates a small amount of shallow discovery drilling completed over 20 years ago and covers a portion of the outcrop exposure of the zone.

Over the course of the last year, Solaris has completed intensive drilling with a large number of rigs to expand the size and confidence of this resource, with drilling consistently returning long intervals of high-grade copper mineralization, with the highest grades starting at or near surface and extending to greater than 1km-depths with grades up to 1% CuEq. The large size, high overall grade and favourable grade distribution are key differentiators versus copper discoveries made globally in the last two decades.

Over the course of the last year, Solaris has completed intensive drilling with a large number of rigs to expand the size and confidence of this resource, with drilling consistently returning long intervals of high-grade copper mineralization, with the highest grades starting at or near surface and extending to greater than 1km-depths with grades up to 1% CuEq. The large size, high overall grade and favourable grade distribution are key differentiators versus copper discoveries made globally in the last two decades.

Warintza Central is one of five porphyry occurrences exposed at surface within the 7km x 5km Warintza porphyry cluster, all of which have very similar signatures expressed at surface in geochemistry and in the subsurface with geophysics. Solaris has redirected its 12-rig drilling fleet toward aggressive step-out growth and discovery-oriented drilling over the balance of the year and into 2022.

The Company has a remarkable 100%-success rate in drilling on the property to date, without a single hole failing to intersect significant mineralization. The first-ever drilling at Warintza West earlier this year resulted in a major new discovery and, more recently, the same in the first-ever drilling at Warintza East, marking the second and third discoveries on the property, all within close proximity to Warintza Central.

Recent drilling indicates that mineralization from Warintza Central and Warintza East overlap as the Warintza Central footprint continues to extend to the east to a 1,350m strike length and remaining open.

“With this latest discovery at Warintza East and the growing footprint of Warintza Central to the north and east returning some of the strongest intervals reported to date, the conceptual pit shell is expected to be extended to the north and east showing the potential to ultimately become one multi-kilometre “superpit” joining the two areas. Drilling is focused on further extensional and step-out drilling, including establishing the potential link between Warintza East and Warintza Central, and discovery drilling at the other well-defined targets.” said Jorge Fiero, Solaris’ VP Exploration.

The Company just commenced the first-ever drilling program at its voluminous Warintza South target, with the goal of making the fourth major discovery on the project. According to the Company, the Warintza South high conductivity anomaly has dimensions more than twice the size of Warintza Central, and a similar geochemical signature where exposed at surface. If the Company’s track record is any indication of future results, Warintza South could prove to be the next major discovery on this project.

More importantly, insider buying has increased over the last month with an additional $5.5M invested in on-the-market buying bringing the total insider investment to over $128M within the 15 months – the most invested by any materials sector company. Insiders remain bullish as Warintza is a world-class, strategically important asset with scale and potential for low capital and operating costs that would attract any major mining company at a time when the global copper development pipeline is depleted.