Newcrest acquiring Pretivm for C$18.50 in cash and shares

Pretium Resources Inc. [PVG-TSX, NYSE] has entered into a binding agreement for Newcrest Mining Limited [NCM-ASX, TSX] to acquire all of the outstanding shares of Pretivm that it does not already own.

Under the transaction, Pretivm shareholders will have the option to elect to receive C$18.50 per Pretivm share in cash or 0.8084 Newcrest shares per Pretivm share, representing share consideration of C$18.50 based on the Canadian dollar equivalent of the 5-day volume-weighted-average-price (VWAP) of Newcrest shares on the ASX ending on November 8, 2021, subject to proration to ensure aggregate cash and Newcrest share consideration each represent 50% of total transaction consideration. Pretivm shareholders who do not elect cash or Newcrest shares (subject to proration) will receive default consideration of C$9.25 per Pretivm share in cash and 0.4042 Newcrest shares per Pretivm share.

The transaction price represents a premium of 23% and 29% to the closing price and the 20-day VWAP, respectively, of Pretivm’s shares on the TSX as of November 8, 2021. The total equity value pursuant to the transaction is approximately C$3.5 billion on a fully diluted basis. Newcrest currently owns approximately 4.8% of Pretivm’s shares. If consummated, the transaction would result in Pretivm shareholders owning approximately 8% of Newcrest, on a fully diluted basis.

Jacques Perron, President and CEO of Pretivm, stated: “The acquisition of Pretivm by Newcrest is an outstanding opportunity for the company and its shareholders, employees, First Nations partners and the local communities in northwest British Columbia. The transaction delivers an immediate and compelling premium for Pretivm shareholders that reflects the excellent work of our employees and contractors in developing and operating the Brucejack gold mine, while also offering an opportunity to benefit from potential upside as Newcrest shareholders.”

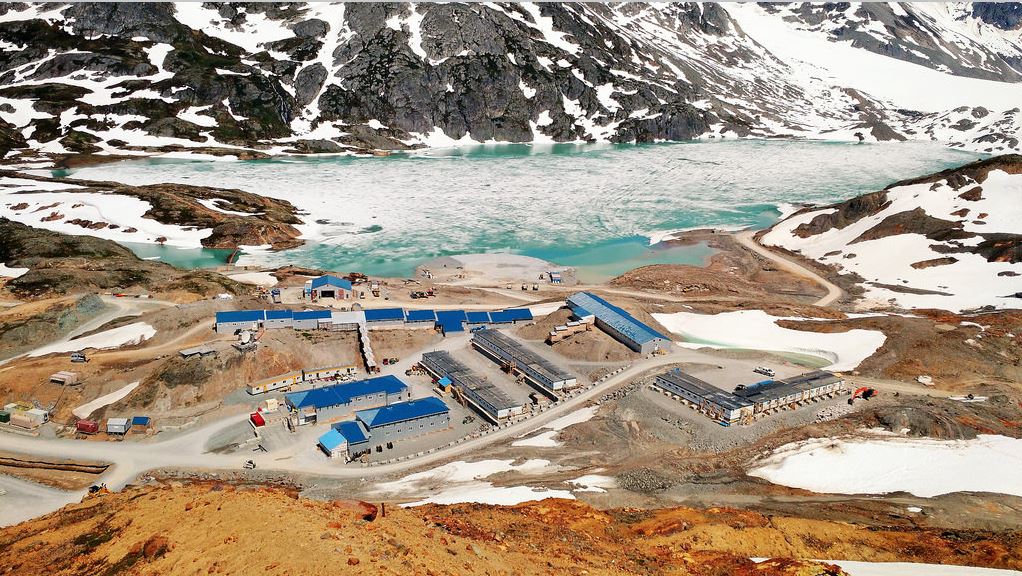

“With this acquisition, Brucejack will join Newcrest’s portfolio of tier one assets, mitigating the inherent risks associated with ownership of a single-asset mining company. Moreover, Newcrest has the financial means and the intention of maximizing the long-term potential of the Brucejack Mine and the district scale opportunities in the surrounding Brucejack property. Newcrest and Pretivm have complementary corporate cultures and values, with a focus on safety, employee development and ESG. We believe our employees, First Nations partners and community partners will be very well-positioned to succeed and develop under Newcrest’s world-class stewardship,” Perron added.

The transaction, which is not subject to a financing condition, will be implemented by way of a court-approved plan of arrangement and will require the approval of 66 2/3% of the votes cast by the holders of Pretivm’s common shares and holders of options to acquire shares of Pretivm, voting together as a single class, at a special meeting of Pretivm securityholders to be held to consider the transaction. Expected to be completed in the first quarter of 2022, the transaction is also subject to the receipt of court approval, regulatory approvals and other customary closing conditions.

Pretivm is an intermediate gold producer with the 100%-owned, high-grade gold underground Brucejack Mine located in northwestern BC.