Are junior critical minerals companies the missing link in global supply chain?

By Peter Kennedy

Investors should pay close attention to the role that critical minerals can play in the development of a future clean energy system, International Energy Agency (IEA) officials have said.

A handful of junior exploration companies have already heeded the call by snapping up properties that are prospective for critical minerals such as lithium and cobalt.

They include companies like Coloured Ties Capital Inc. [TIE-TSXV, APEOF-OTC PINK, 97A0-FSE], and FE Battery Metals Corp [FE-CSE, FEMFF-OTCQB], which have acquired highly prospective properties in Arizona, Ontario, and Quebec.

Already holding shares in a basket of lithium exploration juniors, including Patriot Battery Metals Inc. [PMET-CSE, PMETF-OTCQB, R9GA-FSE] and Winsome Resources Ltd. [WR1-ASX], Coloured Ties has moved to monetize its property assets by spinning them off into two affiliated companies, Hertz Lithium Inc. [HZ-CSE] and Quebec Pegmatite Corp.

Hertz Lithium, which holds assets in the Arizona Pegmatite Belt, recently raised $1.6 million from an initial public offering of units priced at 12.5 cents each, a move that is expected to be followed soon by Quebec Pegmatite. Hertz shares began trading on the CSE on April 10, 2022, hitting a high of C$0.27 on 1.365 million shares in volume and closing the week at $0.22.

The proposed Quebec Pegmatite RTO could offer investors a window on exploration in the Cadillac-Pontiac region of Quebec and proximity to lithium projects held by Patriot Battery Metals and Winsome Resources.

The opportunity that these companies see has been outlined by Tim Gould, Head of Division for Energy Supply Outlooks and Investment at IEA.

As governments try to meet the climate goals of the Paris Agreement by reducing greenhouse gas emissions, huge supplies of critical minerals will be required to transform the global energy sector, the IEA says.

Gould said an energy system powered by clean energy technologies needs significantly more minerals, notably lithium, nickel, cobalt, manganese and graphite for batteries, rare earth elements for wind turbines and electric vehicle motors. Copper and aluminum are needed for electricity networks.

“The key question is how fast could demand for these minerals rise,” Gould said.

The short answer is that a concerted effort to reach the global climate goals of The Paris Agreement will require at least a quadrupling of overall mineral requirements for clean energy technologies by 2040.

An even faster transition to hit net zero emissions globally by 2050 requires six times more mineral inputs in 2040 than today.

The main factor behind those projected increases is explosive growth in demand for electric vehicles and battery storage, closely followed by the mineral needed for expanding electricity networks, and then the growth of low carbon power generation.

“When you start to look into the details you see that growth for some minerals is much faster than four to six times,’’ Gould said. In a scenario compatible with the Paris Agreement, demand for lithium is more than 40 times higher than today by 2040, Gould said.

It is why critical minerals represent a “generational” economic opportunity for Canada, said Jonathan Wilkinson, Canada’s Minister of Natural Resources during the recent Prospectors & Developers Association of Canada (PDAC) convention in Toronto.

“Effectively, there is no energy transition without significantly augmented supplies of critical minerals,’’ he said.

Seeing the opportunity, Quebec is aiming to become a leader in the production, transformation, and recycling of critical and strategic metals.

It recently took a step in that direction when Sayona Quebec, a joint venture involving Australian companies Sayona Mining Ltd. [SYA-ASX, SYAXF-OTCQB] and Piedmont Lithium [PLL-NASDAQ, ASX] resumed production at the North American Lithium (NAL) mine, in Abitibi, Que. Sayona is aiming to supply key battery and electric vehicle manufacturers, including Tesla Motors Ltd. [TSLA-NASDAQ] and Korean chemical company LG Chem Ltd.

The implications for mining companies looking to supply the energy sector are expected to be dramatic.

Revenue from coal production is currently ten times larger than revenue from energy transition minerals. But there is a rapid reversal of fortunes in a scenario that meets climate goals.

As coal goes into structural decline and energy transition minerals gain a tailwind from growing demand and upward pressure on prices, combined revenue from energy transition minerals overtakes those from coal well before 2040, Gould said.

This highlights a strategic opportunity for companies, which some are already taking to position themselves in growing sectors at the expense of declining ones.

Industry officials say demand for battery minerals is likely to be the largest driver of consolidation in the mining sector in 2023.

Canada, meanwhile, is reviewing its regulatory process for clean energy projects, including critical minerals, as permitting is one of the biggest hurdles faced by juniors today.

“The urgency of the climate crisis means it simply cannot take us 12 to 15 years to permit a new mine in this country,’’ said Wilkinson. “The work to establish new mines must be efficient if we are to affect the transition to a net zero future.’’

Some companies are urging governments to go further. Northern Graphite Corp. [NGC-TSXV; NGPHF-OTCQB] says it has been unable to secure needed financing for its Bissett Creek graphite deposit in northern Ontario, even though it is recognized as the leading undeveloped graphite project outside China. The company said it needs $150 million to kickstart the project and will seek financial support from the Federal Government.

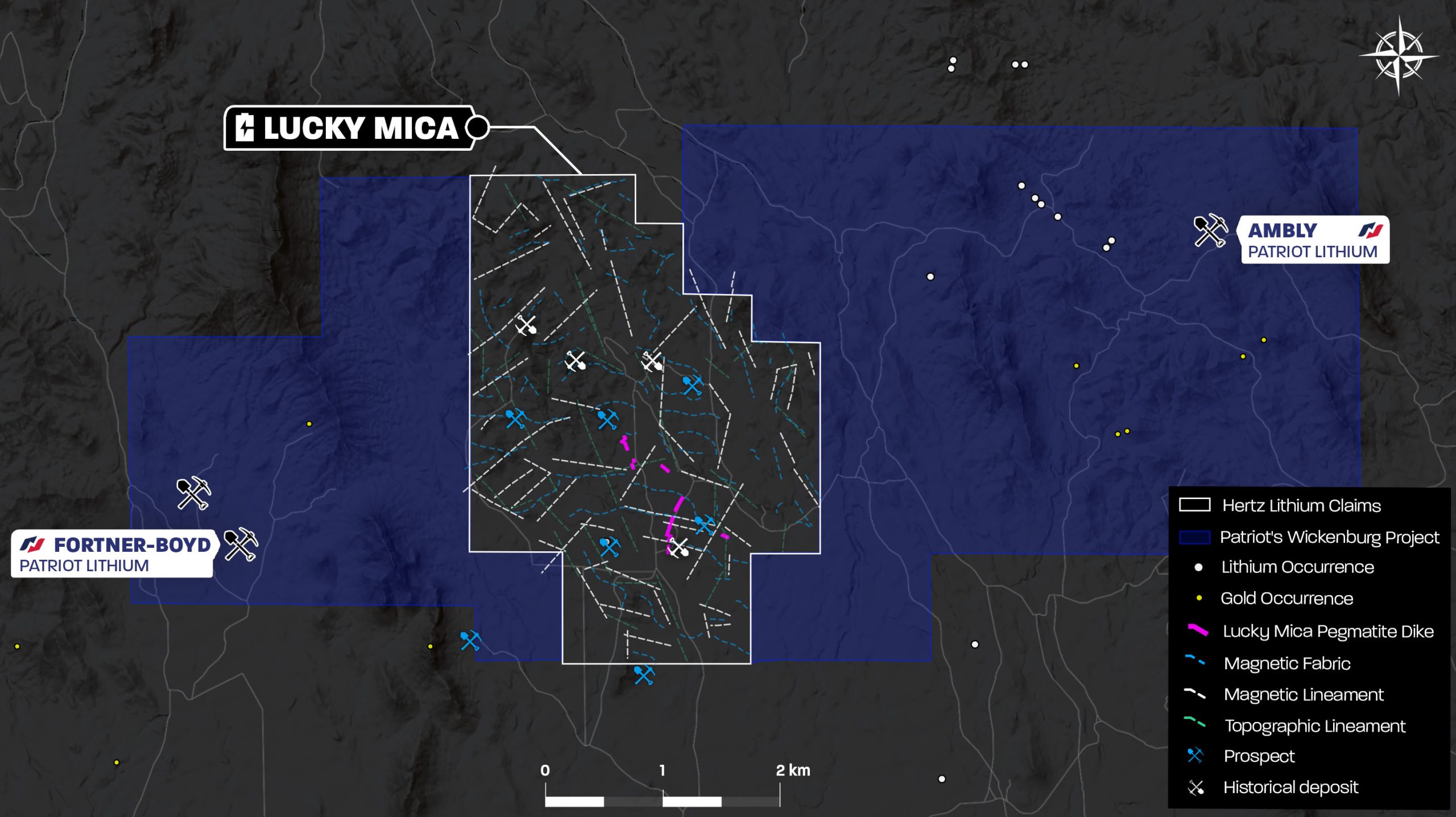

Hertz Lithium Inc.’s [HZ-CSE] Lucky Mica property is well positioned in the Arizona pegmatite belt, an emerging high-grade hard rock lithium district with known lithium deposits.

A member of the Coloured Ties Capital Inc. [TIE-TSXV, APEOF-OTC PINK, 97A0-FSE] group, Hertz has earmarked proceeds from a recent IPO to fund exploration at the Lucky Mica project, which is located in Maricopa County, Arizona, about 10 kilometres southwest of the city of Wickenburg (population 6,300).

The project is road accessible and at an early stage of exploration. It consists of 114 contiguous lode mining claims covering 939 hectares and lies within a prospective geological and structural setting for lithium and rare metal pegmatite mineralization.

Hertz acquired the Lucky Mica project in April 2022, to follow up on historical work with recent surface sampling exploration. In order to advance the project, the company said a work budget of $1.05 million is estimated for further phases of exploration. It struck a deal to acquire the initial 112 claims with Utah Mineral Resources LLC and Bullrun Capital Inc. a company founded by Coloured Ties CEO and director Kal Malhi. The company subsequently agreed to buy two additional claims (known as the Montecinos claims), which form part of the project.

Aside from the project, another key asset is a partnership with Penn State University to secure patents for the development of new technology related to the extraction of lithium from spodumene. Their commercial application of utilizing microwave roasting with sodium hydroxide can improve lithium recovery from spodumene by up to 90%.

The mineralization of economic interest at Lucky Mica is found in spodumene-bearing pegmatite dike complexes, which can vary from a few metres to 100 metres in length with the same variation in widths. Spodumene is a lithium-bearing mineral, which contains 8% lithium oxide (Li2O) when pure. Spodumene also contains minor amounts of niobium and tantalum.

Lithium mineralization was first reported on the property in the 1950s. In 1957, a work report described a mine consisting of a main pegmatite vein or dike, 2,000 feet long and 12 feet wide in granitic rocks and schist, plus several pegmatites.

From early work completed on the property, data shows that spodumene bearing pegmatites have grades comparable to the average grade of other pegmatite projects where studies have been completed indicating positive economics, including Patriot Lithium (PAT), North American Lithium (NAL), Nemaska Lithium, with one grab sample (from spodumene rich pegmatite) returning a grade of 7.5% Li2O.

The Lucky Mica Dike is considered the most significant known occurrence with reported lithium grades of 3.0% to 5.0% in spodumene minerals.

However, the company has said further field work and drilling will help better define the mineralogical zoning of the Lucky Mica dike and the regional chemical zonation of the different pegmatite bodies observed on the project.

A NI 43-101-compliant analysis has defined a potential resource for the Lucky Mica dike alone (not the entire project) of between 330,000 and 551,000 tonnes at grades of between 0.3% and 2.5% Li2O. The project, as identified by SGS Canada, comprises seven (7) other outcropping dikes, which according to a technical report could add significant volume to the spodumene bearing pegmatites and increase the tonnage range to 330,000 to 3.0 million tonnes.

Hertz’s exploration plan is to identify all the pegmatite bodies located on the property and to explore multiple zones of lithium mineralization to assemble an economic resource tonnage and grade.

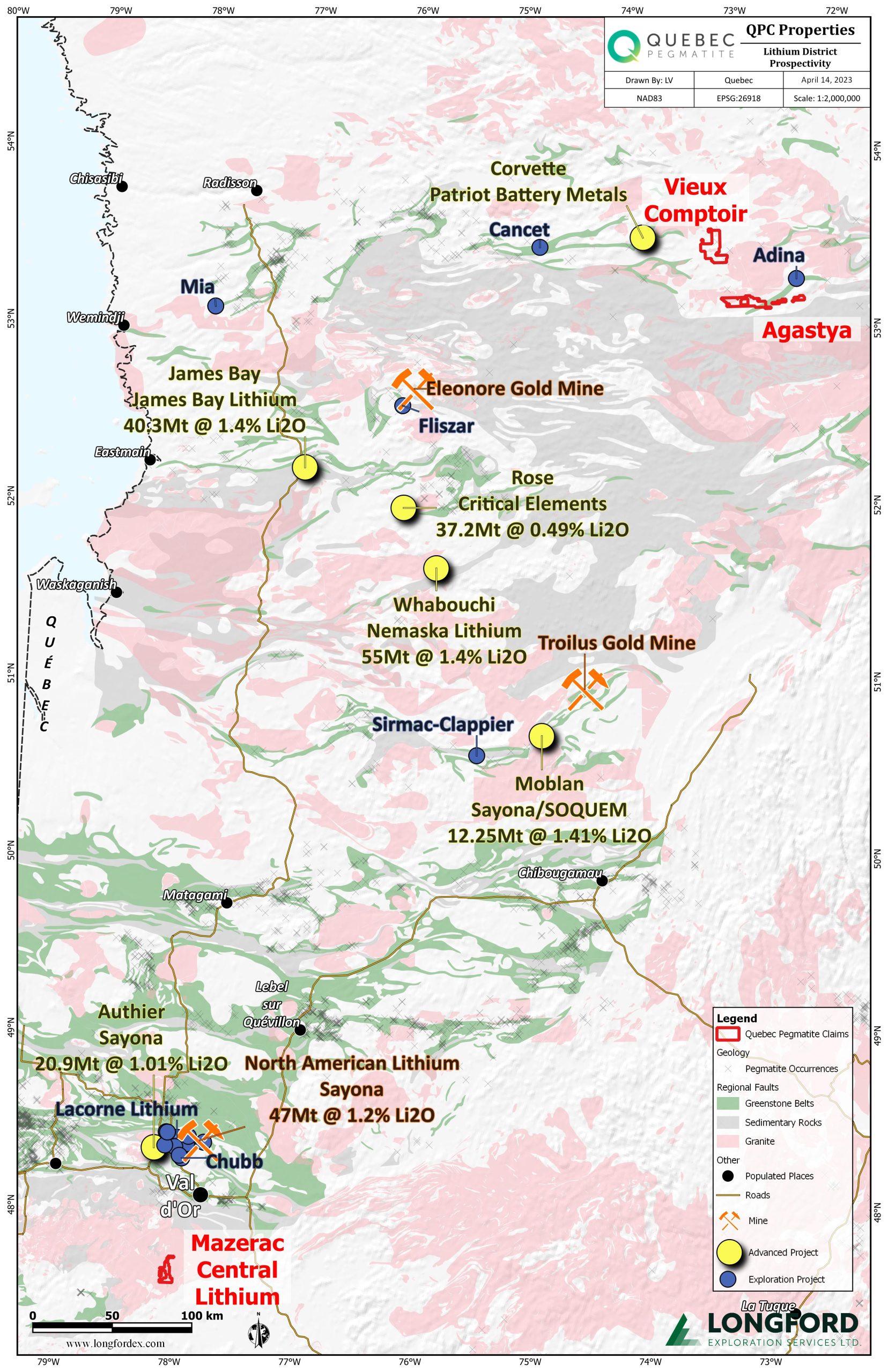

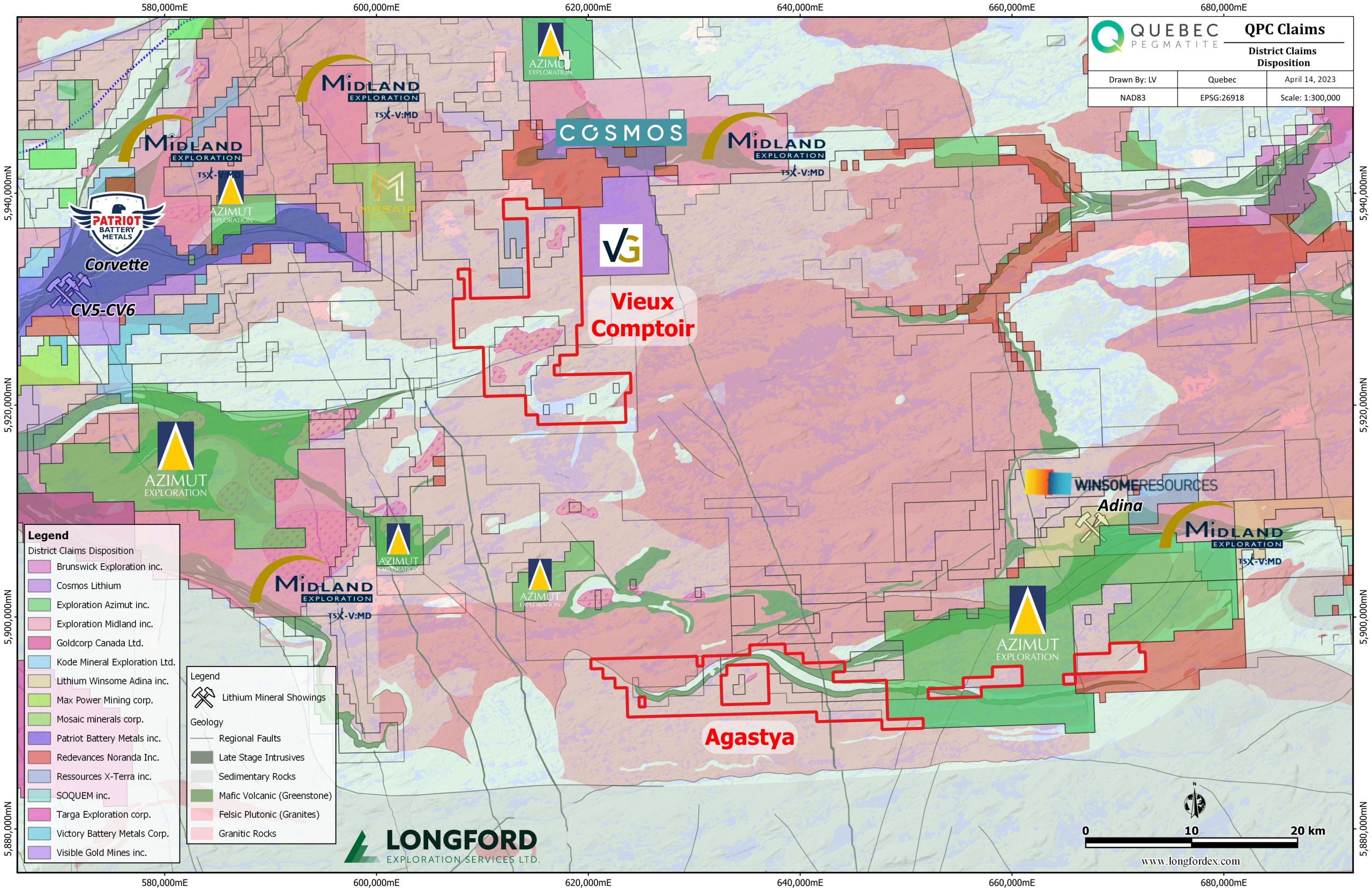

Quebec Pegmatite Corp. a privately owned subsidiary of Coloured Ties Capital Inc. [TIE-TSXV, APEOF-OTC PINK, 97A0-FSE] is focused on two highly sought after lithium exploration regions in the Cadillac-Pontiac lithium belt in Quebec.

Holding three 100%-owned properties James Bay and Mazerac, Quebec Pegmatite offers an exploration window in a province that hosts an established hard rock lithium endowment, with numerous spodumene showings and defined resources in four deposits.

Its Vieux Comptoir Lithium Project, covering 381 claims and spanning 195 square kilometres, is located approximately 45 kilometres east of Patriot Battery Metals Inc.’s [PMET-CSE, PMETF-OTCQB, R9GA-FSE] Corvette Property, where numerous spodumene-bearing pegmatites have been discovered, and recent drilling has returned intersections up to 1.25% Li2O and 194 ppm Ta205 over 58.1 metres.

The property is also approximately 45 kilometres west of ASX-listed Winsome Resources’ Adina project where early- stage exploration has identified outcropping pegmatites across the property with intercepts including 1.34% Li2O over a whopping 107.6m from 2.3m downhole including several high-grade intercepts such as 2.21% Li2O over 30m (AD 22-005).

Winsome has said it is working towards being able to announce a resource for Adina, while simultaneously advancing other existing projects in the region.

Quebec Pegmatite has entered into an option agreement with Superior Mining International Corp. [SUI-TSXV, SUIFF-OTC], whereby Superior has the option to earn a 100% interest in the Vieux Comptoir property. In a press release on April 11, 2023, Coloured Ties said the agreement has been approved by the TSX Venture Exchange.

Superior can exercise the option by issuing 7.0 million shares. Another 3.5 million Superior shares are payable on the first-year anniversary of option deal. The final batch of 3.5 million shares is payable on the 18-month anniversary of the option deal.

If Superior exercises the option in full and acquires the property, it will grant QPC a 3.0% net smelter return royalty which may be reduced to 1.5% once Superior has made a cash payment of $3.0 million to QPC.

With the TSX Venture approval, Superior Mining will fund and proceed with its planned phase 1 and 2 exploration programs over the remainder of the spring and summer.

Another key asset is the Mazarec Central lithium project, which covers 108 claims (6,262 hectares) and is located about 50 kilometres southwest of Val d’Or, Que., in the midst of several other well-funded public company lithium projects that are being aggressively explored.

The claims are immediately adjacent to claims currently held by Winsome Resources and Vision Lithium Inc. [VLI-TSXV, ABEPF-OTCQB, 1AJ2-FSE].

The Mazerac claims are accessible by a dense network of trails and other logging roads. The area is also accessible through boat or seaplane within the watershed hosting the Rapid-7 hydroelectric dam of Decelles. The proximity to Val d’Or, means the project is close to comprehensive mining centre, as well as a processing facility with a feed rate of 1.5 million tonnes annually.

The general area has recently attracted many lithium prospecting and exploration companies such as Brunswick Exploration, [BRW-TSXV], High Tide Resources [HTRC-CSE], Medaro Mining Corp. [MEDA-CSE, MEDA-OTC, 1ZY-FSE], Neo Terrex Corp. (private), Renforth Resources Inc. [RFR-CSE, RFHRF-OTC Pink, A2H9TN-Frankfurt], Sayona Mining, Vision Lithium and Winsome Resources.

The current claim block provides for a sizeable lithium exploration target within the watershed of the Decelles Reservoir that the company will seek to monetize via a joint venture or option deal. Coloured Ties acquired 100% interest in the claims for cash subject to a 2.0% NSR that can be reduced to 1.0% with a $1 million payment at any time in the future.

Quebec Pegmatite believes the project has a favourable geological setting for lithium, cesium and tantalum pegmatite-style deposits, and merits further exploration. Depending on the field exploration success of a two-phase program being conducted over the remainder of the spring and summer, the company may proceed with preliminary diamond drilling before the end of 2023.

FE Battery Metals Corp [FE-CSE, FEMFF-OTCQB] is focusing on identifying and exploring early-stage lithium pegmatite projects in Canada.

FE Battery Metals Corp [FE-CSE, FEMFF-OTCQB] is focusing on identifying and exploring early-stage lithium pegmatite projects in Canada.

The company currently holds highly prospective areas for spodumene pegmatite exploration in two of the world’s top-tier mining jurisdictions, Ontario and Quebec.

The Quebec projects, including the flagship Augustus property, are located within an emerging lithium district located near the mining hub of Val d’Or.

Sayona Mining Ltd.’s [SYA-ASX, SYAXF-OTCQB] North American Lithium Mine (NAL) and Authier property are two notable projects in the area that highlight the potential of the Augustus Lithium property.

Total lithium resources for both NAL and Authier currently stand at 87.8 million tonnes of grade 1.05 Li20% measured and indicated and 31.2 million tonnes of 1.07 Li20% inferred category.

As part of a plan to create a lithium mining hub in the Abitibi region, Sayona has restarted NAL and plans to integrate it with its Authier project, which has already reached the feasibility stage and will provide supplementary ore feed to NAL.

FE recently raised $1.5 million from a private placement 3.0 million common shares priced at 50 cents each, with proceeds earmarked for exploration work at the Augustus property.

The Augustus project has several clusters of spodumene-bearing pegmatites that occur within the same geological setting as those of the NAL mine, located just six kilometres from the property. Pegmatite bodies include the Beluga, Augustus and NAL showings.

The Augustus project has several clusters of spodumene-bearing pegmatites that occur within the same geological setting as those of the NAL mine, located just six kilometres from the property. Pegmatite bodies include the Beluga, Augustus and NAL showings.

The Augustus property covers 700 mining claims spanning over 27,000 hectares. The property benefits from excellent local infrastructure with road network, railway, electricity, and trained manpower available locally.

FE Battery shares rallied on April 10, 2023, after the company released new drill results from Augustus.

The company said drill hole LC23-50 from the 2023 program intersected multiple sections of lithium mineralization, including a 17.45-metre-wide section of 1.19% lithium oxide (Li20) at 82.4 metres drilled. The new drill hole was cored to test the eastward extension of LC21-16, which previously yielded 1.17% Li20 over 19 metres at a depth of 126 metres. “The results of LC23-50 better allow us to understand the geometry of the main higher-grade lithium zone,’’ the company said, adding that it is planning both follow-up drilling and 3D modelling of the lithium-bearing rock.

To date, more than 50 drill holes with cumulative core drilling of over 9,500 metres have been completed. Metallurgical test work has been initiated to develop a preliminary process to treat the spodumene-bearing lithium mineralized rock to conceptualize a flowsheet, produce lithium oxide concentrate and generate a high-purity lithium carbonate product.

To date, more than 50 drill holes with cumulative core drilling of over 9,500 metres have been completed. Metallurgical test work has been initiated to develop a preliminary process to treat the spodumene-bearing lithium mineralized rock to conceptualize a flowsheet, produce lithium oxide concentrate and generate a high-purity lithium carbonate product.

FE Battery’s other lithium projects are in Ontario. They include the 100%-owned Falcon Lake lithium property which covers 48 mining claims over 960 hectares in the Thunder Bay Mining Division. The first reported work on the property was completed in 1956 when diamond drilling outlined four pegmatite zones to a depth of approximately 37 vertical metres.

The company’s North Spirit Lithium property is located about 175 kilometres north of Red Lake, and covers 2,480 hectares in two claim blocks, both of which are adjacent to Frontier Lithium Inc.’s [FL-TSXV] PAK lithium project.

On April 25, 2023, FE Battery Metals shares closed at 70 cents in a 52-week range of $1.34 and 20 cents, leaving the company with a market cap of $31.64 million, based on 45.2 million shares outstanding.