Japan Gold arranges placement of up to $10 million

Japan Gold Corp. [JG-TSXV, JGLDF-OTCQB] said Wednesday it has arranged a non-brokered private placement that is expected to raise up to $10 million.

Proceeds will be used for drill programs, drill targeting, advancing the prospect pipeline from the company’s large portfolio of exploration projects.

The private placement will consist of up to 50 million shares priced at 20 cents each, the company said in a press release.

On April 25, 2023, Japan Gold shares closed unchanged at 23.5 cents. The shares currently trade in a 52-week range of 30.5 cents and 20 cents.

Japan Gold is a Canadian mineral exploration company with a focus on Japan’s three largest islands: Hokkaido, Honshu, and Kyushu. The portfolio of 34 gold projects cover areas with known gold occurrences and a history of mining. These projects are prospective for high-grade epithermal gold mineralization.

The company has a country-wide alliance with Barrick Gold Corp. [ABX-TSX, GOLD-NYSE] to jointly explore, develop and mine certain gold mineral properties and mining projects.

The Barrick Alliance has completed a successful two-and-a-half-year country-wide screening program of 29 projects and has selected six with the potential to host Tier 1 and Tier 2 gold ore bodies for further advancement, and two more recently acquired projects and three project extensions for initial evaluation.

Japan Gold was the first foreign company to be granted mineral exploration licenses in Japan since World War 11.

In 1943, at the height of the war, Japan placed a moratorium on gold mining, directing all of its companies to the war effort. It meant that mining engineers could be redirected to base metal mines in support of the war effort. Following the war, very few of the mines resumed production, resulting in a hiatus in exploration.

But that was before the Global economic crisis in 2008 and the March 2011 Fukushima nuclear power plant disaster created the need for economic stimulus and a change in the law in 2012, when foreign companies were permitted to operate independently in Japan.

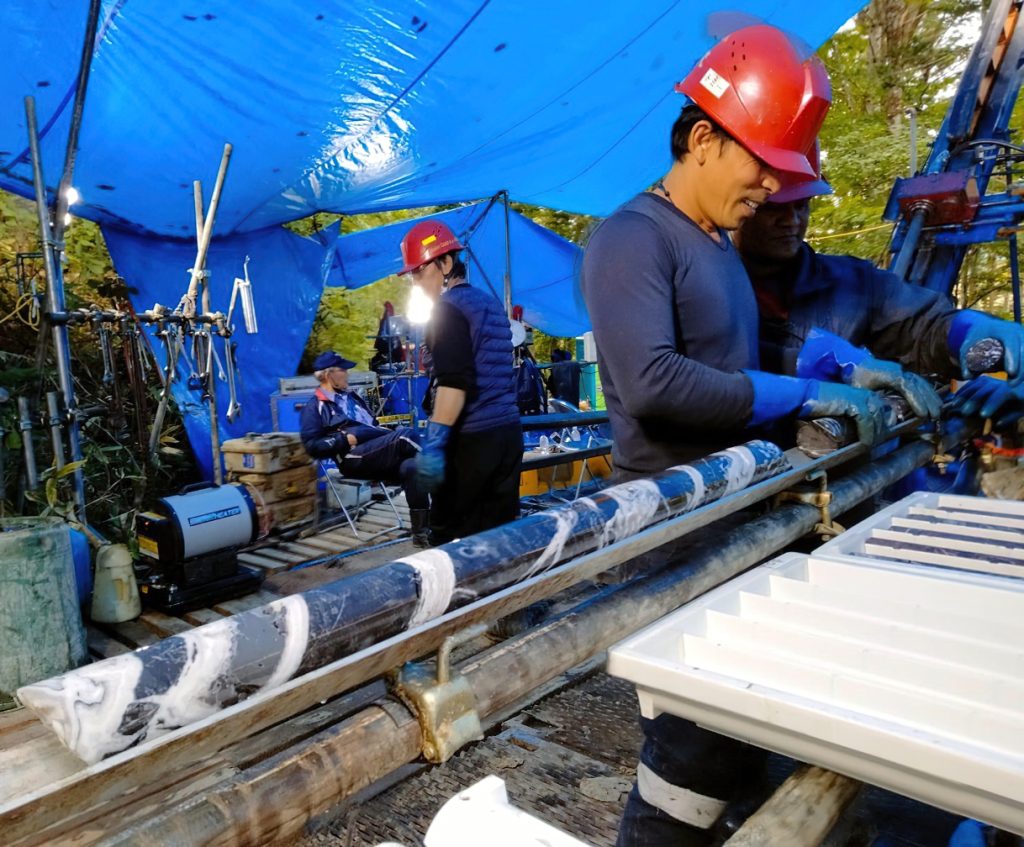

In a press release on March 16, 2023, Japan Gold announced the commencement of drilling at the Barrick Alliance Mizobe project in southern Kyushu. Mizobe is one of six projects selected by Barrick to advance to the second evaluation phase under the strategic alliance agreement.

The Mizobe Project lies within the Hokusatsu Region of southern Kyushu, along the western edge of the Kagoshima Grqaben in a similar geological setting as the Hishikari gold mine, located 23 kilometres to the north. Hishikari is one of the highest grade Tier 1 gold mines in the world and has produced in excess of 8.3 million ounces of gold since 1985.

An initial reconnaissance phase of the three widely spaced 500-metre deep drill holes are planned at Mizobe, targeting the concealed extensions of gold-bearing antimony-rich hydrothermal breccias for gold-rich feeder veins.