Capella Acquires Advanced-Stage Hessjøgruva Copper-Zinc-Cobalt Project, Kjøli District, Norway

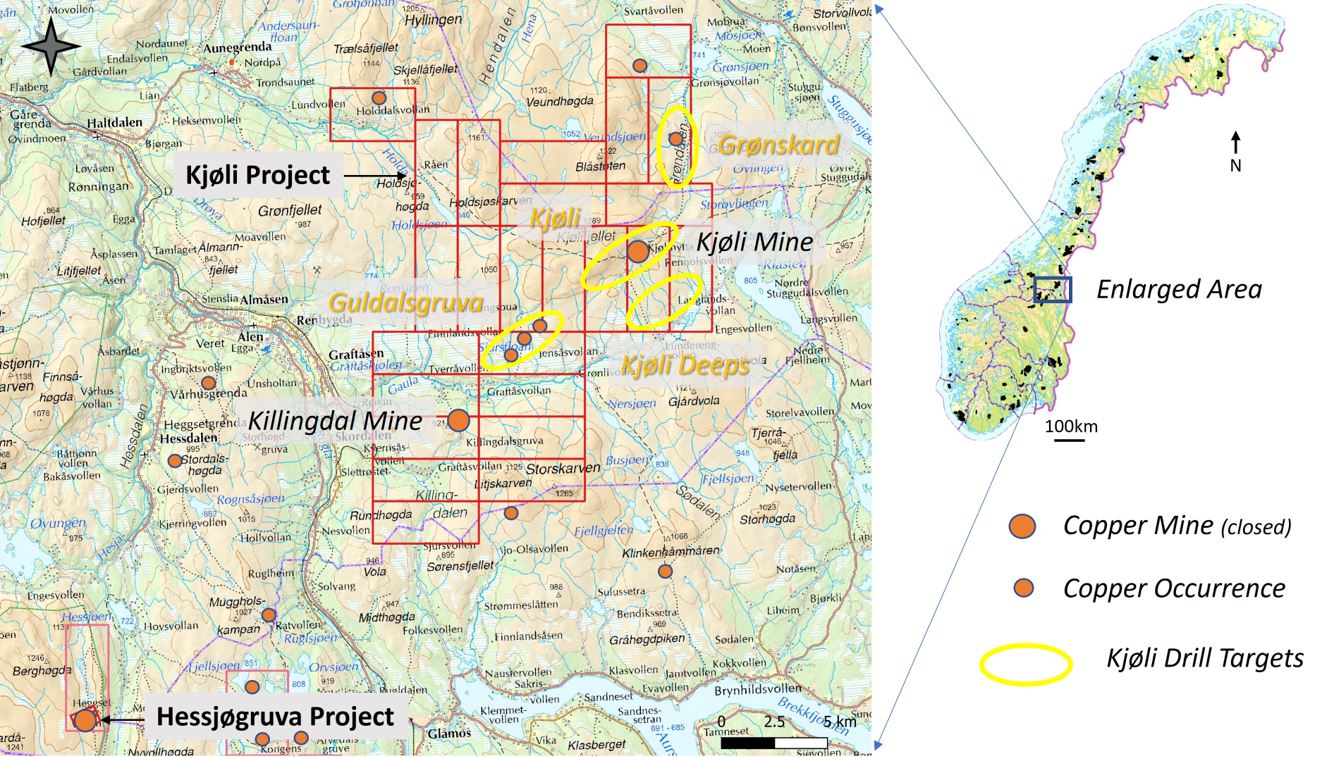

Capella Minerals Ltd. (TSXV: CMIL; OTCQB: CMILF; FRA: N7D2)(the “Company” or “Capella”) is pleased to announce that it has signed an Exploration and Exploitation Agreement (“EEA”) with Hessjøgruva AS for the acquisition of a 100% interest in the advanced exploration-stage Hessjøgruva Copper-Zinc-Cobalt (“Cu-Zn-Co”) project in central Norway. The Hessjøgruva project is located approximately 20km SW of the Company’s 100%-owned Kjøli Cu-Zn-Co project (Figure 1) and has a current mineral inventory (non-Canadian National Instrument NI 43-101 compliant mineral resource) of 3MT @ 1.7% Cu + 1.4% Zn1,2 (or 2.2% Cu equivalent3) based on a total of 12,139m / 68 holes of historical diamond drilling.

The Hessjøgruva project provides Capella with a potential near-term development asset which complements the Company’s ongoing exploration activities at the adjacent Kjøli project. Both Hessjøgruva AS and local government / communities will benefit directly from the successful advancement and development of the Hessjøgruva project, with copper and cobalt also being key metals required for zero-carbon energy transmission and for battery/energy storage.

Highlights

- Capella to acquire a 100% interest in the advanced-stage Hessjøgruva Cu-Zn-Co project.

- Hessjøgruva’s current mineral inventory (non-Canadian National Instrument NI 43-101 compliant mineral resource) is 3MT @ 1.7% Cu + 1.4% Zn1,2 (or2% Cu equivalent3), based on 12,139m / 68 holes of diamond drilling completed by previous operators in the 1970’s. Historical assaying was focused principally on copper and zinc (but not cobalt).

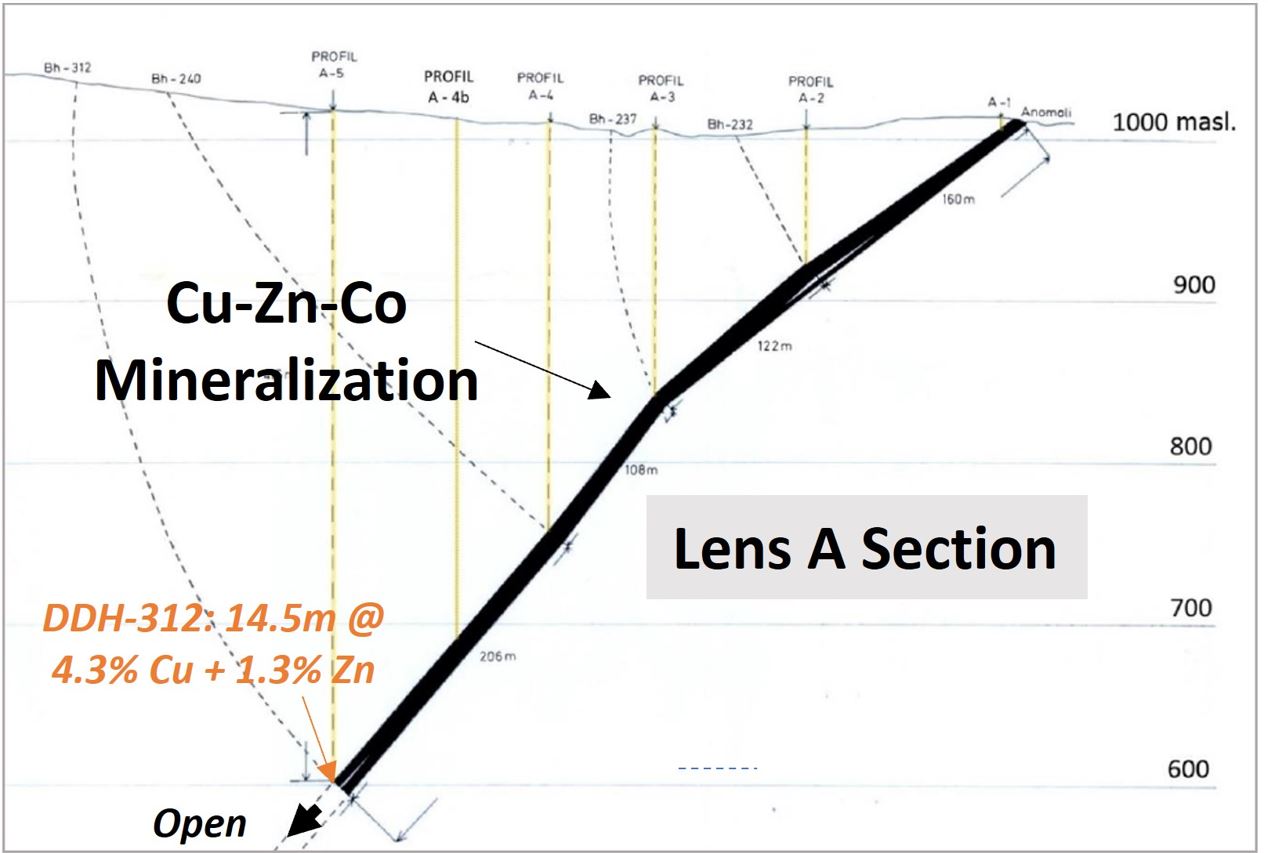

- The Cu-Zn-Co mineralization at Hessjøgruva is massive-sulfide (“VMS”)-type, identical to the mineralization type being targeted at Kjøli. The Hessjøgruva mineralization occurs primarily in three lenses (A-C, with Lens A hosting most of the high-grade mineralization; Figures 2-4), all of which extend from surface to >400m vertically below surface and all remain open down-dip. Mineralization is dominated by chalcopyrite, pyrite/pyrrhotite, and sphalerite, with Cu content observed to increase with depth in the deposit.

- The average thickness of the highest-grade Lens A is approximately 10m1, with the thickest and highest-grade intercept reported from the historical drilling being 5m @ 4.35% Cu + 1.3% Zn (or 4.8% Cu equivalent2) (approximate true thickness) from 455.5m to 470m downhole in DDH-312. This Cu-Zn-Co mineralization remains open down dip.

- As part of a due-diligence process, the Company completed a systematic resampling program of the Hessjøgruva drill core stored at the NGU storage facility in Løkken. A total of 113 quarter core samples were taken for analysis and confirmed: i) the reliability of copper and zinc grades reported from historical drilling, and ii) the existence of elevated cobalt concentrations (ranging from below detection limit to 0.1% Co) within the re-assayed core intervals.

- The combined Hessjøgruva and Kjøli projects provide Capella with both a potential near-term development project as well as significant exploration upside within the past producing Røros Mining District of central Norway.

1 Geological Survey of Norway Report 2007.023; The Hersjø ore deposit, evaluation of ore potential.

2 Reader is also referred to “Disclosure Relating to Historical Estimate” section.

3 Copper equivalent grades have been calculated using 2022 Year-to-Date average copper and zinc prices of USD 9,900/T and USD 3,700/T, respectively, with no adjustment having been made for metallurgical recovery as these are unknown at this time (metal price data: London Metal Exchange, www.lme.com).

Eric Roth, Capella’s President and CEO, commented: “The acquisition of the advanced-stage Hessjøgruva copper-zinc-cobalt project provides Capella with a potential near-term growth platform in the broader Kjøli district.  The advancement of Hessjøgruva will also bring significant tangible benefits to both Hessjøgruva AS and local communities / government, all of which have been strongly supportive of our exploration activities at Kjøli. Our partnership with Hessjøgruva AS will also provide Capella with significant local knowledge and operating “know how”‘.

Our strict compliance to ESG (Environmental, Social and Governance) principles will also ensure that we continue to work with net zero-carbon emission standards and with maximum respect towards both local communities and the environment.

We expect our first priority to be the completion of an NI 43-101 compliant mineral resource for the project, which is expected to also lead to further infill and step-out drilling. Subsequently, we expect to initiate some of the development-related studies (such as metallurgical testwork) that a scoping-level mining study would require. I look forward to keeping all stakeholders updated as the Hessjøgruva project moves forward.”

Figure 1. Location map of the Hessjøgruva and Kjøli Projects, central Norway.

Figure 2. Overview of the Hessjøgruva project area – view looking North.

Figure 3. Plan view of diamond drill-holes in high-grade Cu-Zn-Co mineralization in Lens A, with the surface projection of mineralization shown in Figure 4 also indicated (source: Geometric and Qualimetric Modeling of the Hessjø deposit; Nørsett, S.J. 2016; NTNU M.Sc. Thesis).

Figure 4. Section showing high-grade Cu-Zn-Co mineralization in Lens A (source: Geometric and Qualimetric Modeling of the Hessjø deposit; Nørsett, S.J. 2016; NTNU M.Sc. Thesis).

2022 and Beyond Work Program at Hessjøgruva

The Company’s expected work plans for the Hessjøgruva project commencing immediately are:

- The completion of a Canadian National Instrument 43-101 (“NI 43-101”) compliant Mineral Resource Estimate (“MRE”). In addition to producing a formal MRE, this study would identify those areas where infill drilling is required (in order to potentially upgrade the category of the existing mineral inventory) in addition to determining where step-out drilling would have the highest probability of extending known mineralization.

- Subsequent to the completion of the MRE and further recommended drilling, Capella would initiate a Preliminary Economic Assessment in order to evaluate potential mining, mineral processing, and infrastructure requirements of the project.

Terms of the Hessjøgruva Acquisition

Capella may acquire a 100% interest in the Hessjøgruva Cu-Zn-Co project in return for:

- Capella managing and funding exploration / development activities on the project.

- Capella paying Hessjøgruva AS a one-time amount of Euro 500,000 upon completion of a positive Bankable Feasibility Study.

- Capella providing Hessjøgruva AS with a 2.5% Net Smelter Royalty (“NSR”) on all future metal production from the project, retaining an option to buy-back 0.5% of this NSR at any time prior to the commencement of commercial production for Euro 1,000,000.

- Capella to cover the cost of annual property payments and basic administration costs.

Quality Assurance / Quality Control (QA/QC)

Capella utilizes industry-standard exploration sampling methodologies and techniques. All soil, stream, and rock (including drill core) samples are collected under the supervision of the Company’s geologists and in accordance with best industry practices. Drill core samples taken as part of the Hessjøgruva due diligence were quarter core and were cut from half core stored at the NGU’s covered core storage facility at Løkken. All samples were sent to ALS Laboratory’s (“ALS”) sample preparation facility in MalÃ¥, Sweden (ALS code PREP-31Y), and subsequently dispatched to ALS’s analytical facilities in Loughrea, Ireland, for multi-element geochemical analysis (ALS codes ME-MS61 and PGM-ICP23). All geochemical assays are subject to quality assurance / quality control programs using a combination of internationally recognized standards, duplicates, and blanks, as provided by both ALS and the Company.

Disclosure Relating to Historical Estimate

In accordance with Section 2.4 of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), an issuer may disclose an historical estimate, using the original terminology, if the disclosure identifies the following:

Source and date of the historical estimate, including any existing technical reports

- Information relating to this historical estimate is summarized from a 2007 technical report prepared for the Geological Survey of Norway (“NGU”) by Terje BjerkgÃ¥rd (“Report 2007.023: The Hersjø ore deposit, evaluation of ore potential”).

Relevance and reliability of the historical estimate:

- The historical estimate for Hessjøgruva was derived from drilling undertaken by three mining companies – Røros Kobberverk AS, AS Sydvaranger, and Killingdal Grubelskap AS – up until 1977. Whilst Capella does not consider the historical estimate to have been completed in accordance with current NI 43-101 standards, it is considered relevant to reporting on the project.

Key assumptions, parameters and methods used to prepare the historical estimate:

- Original (pre-1977) technical reports relating to the calculation of the historical estimate and outlining the assumptions / parameters used have not been sighted by Capella.

Resource category used:

- As the historical estimate is not believed to have been completed in accordance with current NI 43-101 standards, Capella utilizes the terminology “mineral inventory” rather than either mineral resources or mineral reserves to classify the known mineralization.

More recent estimates or data available to the issuer:

- No more recent estimates are currently available to the issuer. A study completed during 2016 (Geometric and Qualimetric Modeling of the Hessjø deposit; Nørsett, S.J.; NTNU M.Sc. Thesis) confirmed most aspects of the geometry of the Cu-Zn-Co mineralization and distribution of Cu-Zn-Co grades as utilized in the historical estimate.

Work needed to be done to upgrade or verify the historical estimate as current mineral resources or mineral reserves:

- An independent Qualified Person (“QP”) has not yet done sufficient work to review the historical data and historical estimate to determine what further work would be required to prepare a technical report in accordance with NI 43-101. Capella is in the process of engaging a QP with suitable experience in the deposit style being evaluated in order to prepare a technical report in accordance with NI 43-101.

Capella is not treating the historical estimate as current mineral resources or reserves. At this time, a Qualified Person has not done sufficient work on behalf of Capella to classify this historical estimate as current mineral resources or reserves. Investors should not rely on the historical estimate as a current mineral resource estimate until it has been verified and supported in a technical report in accordance with NI 43-101.

Qualified Persons and Disclosure Statement

The technical information in this news release relating to the Hessjøgruva copper project has been prepared in accordance with Canadian regulatory requirements set out in NI 43-101, and approved by Eric Roth, the Company’s President & CEO, a Director, and a Qualified Person under NI 43-101. Mr. Roth holds a Ph.D. in Economic Geology from the University of Western Australia, is a Fellow of the Australian Institute of Mining and Metallurgy (AusIMM) and is a Fellow of the Society of Economic Geologists (SEG). Mr. Roth has 30 years of experience in international minerals exploration and mining project evaluation.

On Behalf of the Board of Capella Minerals Ltd.

“Eric Roth”

___________________________

Eric Roth, Ph.D., FAusIMM

President & CEO

About Capella Minerals Ltd

Capella is engaged in the acquisition, exploration, and development of quality mineral resource properties in favourable jurisdictions with a focus on high-grade gold and copper(-zinc-cobalt) deposits. The Company also holds 1,000,000 common shares (on a post-consolidation basis) in Prospector Metals Corp. (formally Ethos Gold Corp.), providing Capella shareholders with indirect exposure to exploration success at both the Savant Lake JV Project and elsewhere within Prospector’s extensive Canadian project portfolio.

The Company’s copper(-zinc-cobalt) focus is currently on the discovery of high-grade VMS-type deposits within 100%-owned, district-scale land positions around the past-producing Løkken, Kjøli, and now Hessjøgruva copper mines in central Norway. The Company’s precious metals focus is on the discovery of high-grade gold deposits on its recently acquired Finnish properties (Katajavaara, Aakenus), the 100%-owned Southern Gold Line Project in Sweden, and its active Canadian Joint Ventures with Prospector Metals Corp (TSXV: PPP) at Savant Lake (Ontario) and Yamana Gold Inc. at Domain (Manitoba). The Company also retains a residual interest (subject to an option to purchase agreement with Austral Gold Ltd) in the Sierra Blanca gold-silver divestiture in Santa Cruz, Argentina.

Capella Contacts

Eric Roth

Email: info@capellaminerals.com

Karen Davies, +1.604.314.2662

Cautionary Notes and Forward-looking Statements

This news release contains forward-looking information within the meaning of applicable securities legislation. Forward-looking information is typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. Such statements include, without limitation, statements regarding the future results of operations, performance and achievements of Capella, including the timing, completion of and results from the exploration and drill programs described in this release.  Although the Company believes that such statements are reasonable, it can give no assurances that such expectations will prove to be correct.  All such forward-looking information is based on certain assumptions and analyses made by Capella in light of their experience and perception of historical trends, current conditions and expected future developments, as well as other factors management believes are appropriate in the circumstances. This information, however, is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Important factors that could cause actual results to differ from this forward-looking information include those described under the heading “Risks and Uncertainties” in Capella’s most recently filed MD&A. Capella does not intend, and expressly disclaims any obligation to, update or revise the forward-looking information contained in this news release, except as required by law. Readers are cautioned not to place undue reliance on forward-looking information.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.