Central Canada hosts wide variety of valuable mineral deposits

By Ellsworth Dickson

When most people think of Central Canada, they think of the vast fields of various grains grown in Manitoba and Saskatchewan.  However, beneath the fields of wheat, oats, barley, rye, flax and canola, there are also oil and gas deposits – even geothermal resources where Saskatoon-based Deep Earth Energy Production Corp. is advancing a base-load geothermal project in southern Saskatchewan where final field work and a bankable feasibility engineering study will be completed this year.

The Thompson Nickel Belt in north-central Manitoba is the host to over 18 nickel deposits and is estimated to have produced over 5 billion lbs of nickel since 1959. Vale SA [VALE-NYSE] operates an underground nickel mine, plus mill smelter and refinery in the Thompson area.

To the west at the Manitoba-Saskatchewan border lie the mining camps at Flin Flon and Lynn Lake.

HudBay Minerals Inc. [HBM-TSX, NYSE] plans to build a new camp near Snow Lake in the Flin Flon area to accommodate workers coming to the community to work on projects in the area, including the Lalor mine, Stall concentrator, New Britannia mill and other projects in development. HudBay operates the 777, Lalor and Constancia mines and has several development stage projects.

Lynn Lake is centrally located as a service hub for the region which hosts has proven nickel, copper, gold, and zinc reserves from previous mines. As such, exploration activity is underway by a number of junior and mid-tier companies in this resource-rich region.

Alamos Gold Inc. [AGI-TSX, NYSE] has completed a Feasibility Study for its Lynn Lake gold project with a construction decision expected in 2022.

Sixty km west of Flin Flon, Foran Mining Corp. [FOM-TSXV] is drilling its McIlvenna Bay copper-zinc-gold-silver-rich volcanogenic massive sulphide project.

There is lithium in Manitoba. New Age Metals Inc. [NAM-TSXV; NMTLF-OTC] has a 100% interest in seven pegmatite-hosted lithium and rare element projects in the Winnipeg River pegmatite field in southeast Manitoba where drilling is planned.

FAR Resources Ltd. [FAT-CSE] has the Zoro lithium project in the Snow Lake region of Manitoba.

Star Diamond Corp. [DIAM-TSX] has the advanced stage Star-Orion South diamond project 60 km east of Prince Albert, Saskatchewan where Rio Tinto has completed a 10-cutter-hole bulk sampling program.

Taiga Gold Corp.’s [TGC-CSE] partner SSR Mining Inc. [SSRM-TSX] identified continuous high-grade gold mineralization at the Mac North Zone at the Fisher Project 125 km east of LaRonge, Saskatchewan. The property is contiguous to the north, south and east with SSR’s Seabee Gold Operation.

CanaAlaska Uranium Ltd. [CVV-TSXV] is exploring for uranium 70 km north of Reindeer Lake, northwestern Manitoba and is preparing the drill its North Thompson Nickel Project.

CanAlaska is also one of the juniors exploring for uranium in the prolific Athabasca basin of northern Saskatchewan, home of the world’s highest grade uranium mines. Cameco Corp. [CCO-TSX; CCJ-NYSE] and the Orano Group are the senior players.

NexGen Energy Ltd. [NXE-TSX, NYSE] just released positive results from an independent Feasibility Study, Mineral Reserve and Mineral Resource update of the basement-hosted Arrow deposit, on the 100%-owned Rook I Project in the Athabasca Basin.

Denison Mines Corp. [DML-TSX; DNN-NYSE] recently closed a US$28.75 financing with proceeds anticipated to be used to finance evaluation and environmental assessment activities in support of the advancement of the proposed Phoenix in-situ recovery uranium mining operation on its uranium project in the basin. Denison is a partner with Orano and OURD Canada in the MacClean Lake uranium mine and mill and holds many uranium exploration projects.

Standard Uranium Ltd. [STND-TSXV; STTDF-OTCQB; 9SU-FSE] is exploring its Davidson River Project located in the southwest part of the prolific Athabasca Basin where there have been several uranium discoveries in recent years.

Another junior in the Athabasca basin is Skyharbour Resources Ltd. [SYH-TSXV; SYHBF-OTCQB] which holds interests in a number of uranium projects on its own and with partners Azincourt Energy Corp. [AAZ-TSXV; AZURF-OTC], Orano Canada Inc. and Valor Resources.

Other Athabasca companies include Fission 3.0 Corp. [FUU-TSXV] which holds about a dozen early stage uranium prospects in the basin and Fission Uranium Corp. [FCU-TSX] with its Triple R deposit.

Saskatchewan is also host to rare earths and gallium. Appia Energy Corp. [API-CSE; APAFF-OTCQB] has been exploring its 100%-owned Alces Lake Project where a program of ground geophysics and surveys followed by a stepped-up diamond drilling program to explore for additional subsurface high-grade Rare Earth Oxide occurrences is in the planning stage for this summer. Gallium also occurs in the monazite, host rock to the high-grade rare earths deposit.

The La Ronge Gold Belt of central Saskatchewan is home to past producers and more recent junior explorers such as MAS Gold Corp. [MAS-TSXV] which recently began drilling infill and step-out holes at the Greywacke North deposit.

Explorers and miners couldn’t ask for a more pro-mining and secure jurisdiction for their mineral projects. What is particularly interesting is the wide variety of mineral deposits in Central Canada – something for everyone.

Skyharbour Resources Ltd. [SYH-TSXV; SYHBF-OTCQB] offers investors exposure to a large property portfolio covering 250,000 hectares in northern Saskatchewan’s Athabasca Basin, home of the world’s richest uranium deposits.

Skyharbour Resources Ltd. [SYH-TSXV; SYHBF-OTCQB] offers investors exposure to a large property portfolio covering 250,000 hectares in northern Saskatchewan’s Athabasca Basin, home of the world’s richest uranium deposits.

It is a portfolio that puts the company in a position to benefit from the role that nuclear power and its uranium feedstock are expected to play in meeting rising demand for safe, reliable, carbon-free electricity as governments around the world strive to slow the pace of global warming.

On March 24, 2021, the shares were trading at $0.42 in a 52-week range of 50 cents and $0.085.

Skyharbour is led by an experienced management and is currently engaged in strategic partnerships with Denison Mines Corp. [DML-TSX, DNN-NYSE] and Orano Canada Inc., a unit of France’s largest uranium mining and nuclear fuel company.

Denison holds a large equity interest in Skyharbour, which is currently focused on expanding known zones of high-grade mineralization and finding new deposits on the 35,700-hectare Moore Lake Project.

Moore Lake is the company’s flagship property. It is located on the southeast side of the Athabasca Basin, approximately 15 kilometres east of Denison’s Wheeler River Uranium Project and 39 kilometres south of Cameco Corp.’s [CCO-TSX; CCJ-NYSE] McArthur River mine.

Moore Lake is an advanced stage exploration project which hosts high-grade uranium lenses at the Main Maverick and East Maverick Zones. Historical drill results include 6.0% U3O8 over 5.9 metres, including 20.8% U3O8 over 1.5 metres at a depth of 265 metres.

As Skyharbour leverages and monetizes the rest of its property portfolio using the prospect generator model, it can advance its flagship Moore Lake Project while partner companies fund exploration and development at other projects in its portfolio. It is a cost-effective structure that facilitates large exploration programs without substantial equity dilution.

For example, Skyharbour has JV agreements with Orano Canada Inc. and Azincourt Energy Corp. [AAZ-TSXV; AZURF-OTC] on the Preston and East Preston Projects, which collectively cover one of the largest tenure land positions in the Paterson Lake region.

The projects are located near NexGen Energy Ltd.‘s [NXE-TSX, NYSE] high-grade Arrow deposit, Fission Uranium Corp.’s [FCU-TSX] Triple R deposit and the Spitfire high-grade discovery on the Hook Lake Project, which is owned jointly by Cameco Corp., Orano Canada, and Purepoint Uranium Group Inc. [PTU-TSXV].

Azincourt has earned a 70% stake in 25,329-hectares of ground that is known as East Preston. To exercise the option, Azincourt was required to issue 9.5 million shares, spend $2.5 million on exploration and deliver $1 million of cash payments to Skyharbour and Dixie Gold.

The Skyharbour portfolio includes a 100% interest in the South Falcon Uranium Project on the eastern perimeter of the Athabasca basin. The project contains an NI 43-101 inferred resource of 7.0 million pounds of U3O8 at 0.03%, and 5.3 million pounds of ThO2 (Thorium) at 0.023%.

Recently, Skyharbour signed a definitive agreement with Australian company Valor Resources on its North Falcon uranium project. Under the agreement, Valor can earn-in to 80% of the project by spending $3.5 million on exploration and delivering $475,000 in cash payments over three years as well as issuing 233,333,333 shares of the company.

Skyharbour President and CEO Jordan Trimble, said the agreement gives his company the opportunity to work with new partners while maintaining a 100% stake in the Frasers Lakes uranium and thorium deposits at the South Falcon Point Project.

Appia Energy Corp. [API-CSE; APAAF-OTCQB; Germany: A0I.F; A0I.MU; A0I.BE] is set to change its name in order to better reflect the company’s focus on its rare earth element and uranium projects in Saskatchewan and Ontario.

Appia Energy Corp. [API-CSE; APAAF-OTCQB; Germany: A0I.F; A0I.MU; A0I.BE] is set to change its name in order to better reflect the company’s focus on its rare earth element and uranium projects in Saskatchewan and Ontario.

Assuming that its shareholders vote to accept the change of name to Appia Rare Earths & Uranium Corp., Appia will continue to operate with a basket of properties that include a uranium and rare earth elements project near Elliot Lake, Ontario, and three uranium projects (Loranger, Eastside and North Wollaston) in Saskatchewan’s Athabasca Basin.

However, its primary focus will be the development of its 17,577-hectare (35,420 acre) 100%-owned Alces Lake Project, also in Saskatchewan located north of the Athabasca Basin approximately 34 kilometres east of Uranium City.

Appia’s goal is to become a major producer of high-grade critical rare earths in North America. It’s a strategy that looks well timed. Appia’s Alces Lake Project will benefit from the Saskatchewan Research Council’s (SRC) new rare earth processing facility now being built in Saskatoon, Saskatchewan.

Rare earth elements are a group of 17 elements with tongue-twisting names like Neodymium, Terbium and Dysprosium, and which are vital to green technology and high-tech applications. They fall into two sub-groups: light and heavy with the heavies being more scarce.

Appia is laying out its strategy amid growing awareness that the supply chain of critical rare earth elements (CREE) remains largely under Chinese control. Concern about the situation has resulted in international interest in potential production outside of China. It’s a scenario that spells opportunity for Appia which believes its shareholders will benefit from increasing demand for critical materials for new technologies such as those found in electric vehicles, wind turbines,  etc.

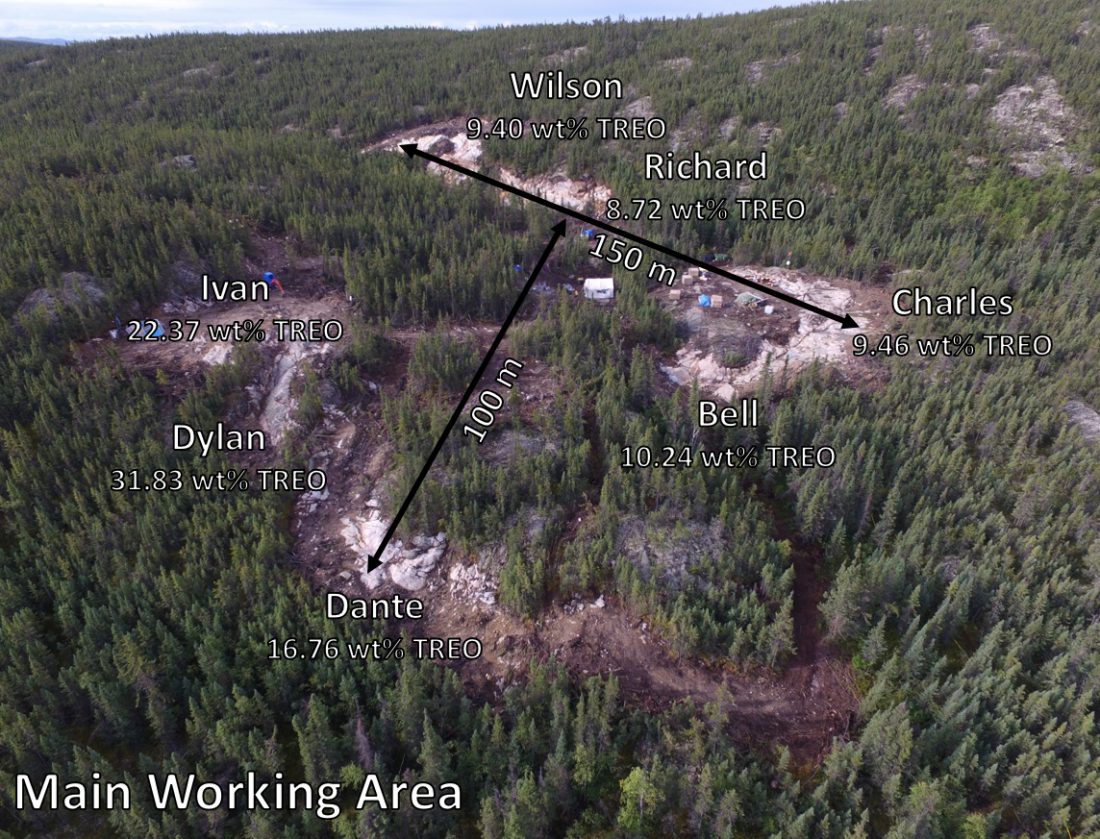

The Alces Lake Project hosts some of the highest-grade total and critical rare earth elements (CREE) and gallium mineralization in the world, material that is exposed at surface.

Average zone high grades range from 4.209 to 31.83 wt% total rare earth oxide (TREO).

To date, Appia has discovered a total of 74 REE and uranium-bearing surface zones and occurrences over 45 kilometres of the system on the Alces Lake Project. Less than 1% of the property has been explored with diamond drilling.

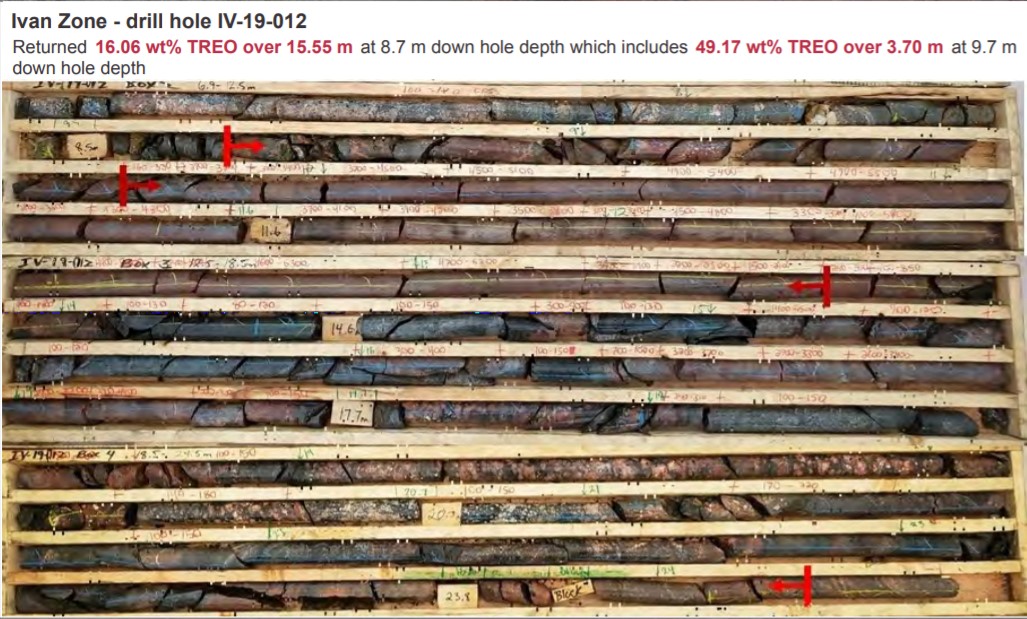

Drilling has discovered numerous surface and shallow REE zones, less than 15 metres from surface. For example, hole IV-19-012 returned 15.55 metres grading 16.06 wt% TREO, including 3.7 metres of 49.17 wt% TREO.

Having completed 2,506.9 metres of diamond drilling in 18 holes last year, the company says it is fully funded and committed to completing the largest exploration and diamond drilling program to date. During the summer of 2021, in excess of 5,000 metres is expected to be drilled at Alces Lake.

Prior to the anticipated start of the summer program, the company has commenced bench-scale metallurgical testing at the Saskatchewan Research Council (SRC) facilities using rock samples from the WRCB zone to achieve the following:

- To test physical separation of monazite from the host rock.

- Produce a mixed REE-carbonate and to eventually produce Nd and Pr oxides.

- Separate and produce isolated uranium oxide (U3O8).

A microprobe study performed at SRC confirmed that the mineralogical host for the high-grade gallium observed within the Alces Lake rocks occurs within the monazite and therefore gallium oxide extraction will also be investigated at SRC during the bench-scale metallurgical test.

Meanwhile the company is re-analysing ground geophysical and geological data in a bid to better locate and target high-grade mineralization. Planned summer field activities include a property-wide airborne magnetic and radiometric geophysical survey, as well as ground geophysical surveys and an aggressive drilling program to explore the property for additional sub-surface high-grade REO occurrences. Appia also plans to continue exploring the three Saskatchewan uranium projects.

Aside from the Saskatchewan assets, Appia has a 100% interest in the Elliot Lake property which covers approximately 13,008 hectares (32,143 acres) and is adjacent to Denison Mines Corp. and Rio Algom Ltd.’s past producing uranium and REE mines.

The Elliot Lake camp produced over 300 million pounds of U3O8 and is the only mining camp in Canada with significant historical commercial and rare earth element production (yttrium) which was recovered through bioleaching and conventional milling.

The Elliot Lake property hosts a NI 43-101 mineral resource of 8.0 million pounds U3O8 and 47.5 million pounds of TREE in the indicated category in the Teasdale Zone. On top of that is an inferred resource of 20.1 million pounds of U3O8 and 133.2 million pounds TREE in the inferred category. The Banana Lake Zone is estimated to contain an inferred resource of 27.6 million pounds of U3O8. The company sees significant potential to increase the size of the current resources as they are largely unconstrained along strike and at depth.

On March 24, 2021, Appia shares were trading at 60 cents in a 52-week range of 84 cents to 13 cents.

Standard Uranium Ltd. [STND-TSXV; STTDF-OTCQB; 9SU-FSE] is a relatively new uranium exploration company that began trading May 4, 2020 having completed a $4.5 million prospectus offering followed by a $3.4 million offering in October 2020.

Standard Uranium Ltd. [STND-TSXV; STTDF-OTCQB; 9SU-FSE] is a relatively new uranium exploration company that began trading May 4, 2020 having completed a $4.5 million prospectus offering followed by a $3.4 million offering in October 2020.

The company’s flagship project is the +25,886-hectare Davidson River Project located in the southwest part of the prolific Athabasca Basin of northern Saskatchewan, site of the highest-grade uranium mines in the world.

The southwest Athabasca Basin has seen several uranium discoveries totaling over 400 million pounds in recent years including Fission Uranium’s Triple R deposit, NexGen Energy’s Arrow deposit and Purepoint/Cameco/Orano’s Spitfire Zone.

These are significant uranium discoveries. For example, NexGen’s Arrow deposit hosts indicated resources of 256.6 million lbs of 4.03% U3O8. The Arrow deposit compares to the well-known Cigar Lake and McArthur mines, in terms of size and grade, but NexGen Energy is projecting it to be a lower-cost operation due to its favourable geological setting in the basement rocks beneath the un-stable sands of the Athabasca Basin.

A significant large-scale geological feature of the southwest Athabasca Basin is the Clearwater Domain, which has been theorized to be a potential source of the uranium and/or a contributing factor of the hydrothermal fluid system related to the uranium deposits. Exploration corridors east of the Clearwater Domain, namely the Patterson Lake Corridor, host the recently discovered Triple R and Arrow deposits.

Before going public, in 2018 and 2019, the company conducted VTEM, ZTEM, and magnetic geophysical surveys on their flagship Davidson River Property that showed similar signatures to those associated with the Triple R and Arrow deposits. The Davidson River Property is located on the west side of the Clearwater Domain. Four main exploration corridors were defined on the Property, the Saint, Warrior, Bronco and Thunderbird trends which have a combined strike-length of greater than 37 kilometres. To put this into perspective, there is 12 kilometres between the Triple R deposit, Arrow deposit and the Spitfire Zone on the Patterson Lake Corridor.

Last summer, Standard Uranium conducted an inaugural Phase I drilling program on the property, totalling 5,600 metres in 13 holes. The work was focused on the Warrior trend, one of the corridors that have been interpreted as an extension of the Patterson Lake Corridor on the east side of the Clearwater Domain. Using technical data gleaned from Phase I, a Phase II drilling program is underway. The Phase II drilling program will follow up on the highest priority areas on the Warrior trend, as well as begin testing the Saint trend to the east.

The program is fully permitted and funded, with the first segment of work of drilling sites that are ground-accessible in the winter. The second segment will comprise a summer fly-in program to drill test the Bronco corridor, which has not yet been drill-tested.

The geological setting of the Davidson River Property is favourable for high-grade, basement-hosted, unconformity related uranium mineralization, and the drilling campaign has many premier targets that have the earmark of some of the recent discoveries in the region. Standard has a large land-package, with many targets to test on several parallel trends. With the momentum in the uranium-space, the company is definitely one to watch out for.

It won’t be necessary to build an exploration camp as the company is using the Big Bear Lodge on Grygar Lake as its base camp for the duration of the exploration program. The camp is owned and staffed by locals from the nearby community of La Loche.

Standard Uranium also holds the 100%-owned Sun Dog prospect located in the northwest part of the Athabasca Basin near Uranium City. A site visit last year confirmed historical surface uranium showings. The Skye, Java, and Haven surface outcrop and boulder grab samples returned 3.58%, 1.7% and 0.7% U3O8, respectively. For 2021 and 2022, the company is planning community engagement, as well as follow-up mapping, a ground gravity survey to identify potential areas of alteration, and diamond drilling. Despite being in the shadows of Canada’s first uranium mining camp, the company is after a different type of deposit compared to the historically mined Beaverlodge-style deposits. Beaverlodge-style deposits went out of favour when the superior unconformity-related deposits were discovered in the 1970s, which have made the Athabasca Basin so renowned. Standard has defined several high-grade, basement-hosted unconformity-related uranium exploration targets.

At the north eastern side of the oval-shaped Athabasca Basin, the company has three 100%-owned uranium prospects covering 13,216 hectares – the Atlantic, Canary, and Ascent projects. These projects contain several shallow exploration targets along conductive corridors, locally coincident with anomalous uranium and other pathfinder elements. The projects have little-to no drill testing so far, despite favourable exploration targets. IsoEnergy’s nearby Hurricane Zone returned excellent recent results of 33.9% U3O8 over 8.5 metres. The northeastern Athabasca region is expected to get more attention in the next few years as IsoEnergy develops their project.

Jon Bey is President, CEO and Chair of Standard Uranium and heads a team with extensive uranium exploration experience in the Athabasca Basin. This team is led by VP of Exploration Neil McCallum and includes: Garrett Ainsworth, Galen McNamara and Sean Hillacre all recently from NexGen Energy The company has 92.7 million shares outstanding. Significant shareholders include Sachem Cove, L2 Capital, Tribeca Investment Partners..

With outstanding project locations in the uranium-rich Athabasca Basin and solid geological evidence of mineralization, Standard Uranium is in an excellent position for making significant high-grade uranium discoveries.

We seek safe harbor.