Hot Chili Ltd hits the ground running

Copper explorer ticks all the boxes key for successful large-scale-mine development

After battling to get market recognition on the Australia Stock Exchange, Hot Chili Ltd. has just completed a $34 million TSX.V initial public offering (TSXV: HCH, OTC: HHLKF) that will garner North American eyes on this evolving copper story.

There’s lots to like about Hot Chili. The company, which once traded at a high of A$37.00 on the ASX (2011), has plenty of good reasons for its stock to begin migrating back up toward historical highs. They’ve just announced a resource estimate that renders the flagship Costa Fuego project one of the world’s top 10 largest copper inventories not controlled by a major mining company and will have a pre-feasibility study in hand by the end of 2022, a definitive feasibility in 2024 and be producing copper by 2026.

The good news starts with the new resource estimate upgrade just announced that makes Hot Chili a standout copper resource holder on the TSX.V. 927Mt grading 0.45% CuEq for 4.1Mt of copper equivalent metal (3.3Mt copper, 2.9Moz gold, 12Moz silver and 81kt molybdenum). Importantly, over 80% of Costa Fuego’s resource is classified as Indicated and over one third of the metal grades approximately 0.8%CuEq, and can be accessed by shallow open pit mining.

“The past year has been transformational in terms of reshaping the company. We’ve consolidated our capital structure and completed the exhaustive process of listing on the TSX.V and put ourselves amongst the senior copper developers in the world that have enjoyed significant appreciation with the copper prices going up,” says Christian Ervin Easterday, managing director and CEO of Hot Chili Ltd.

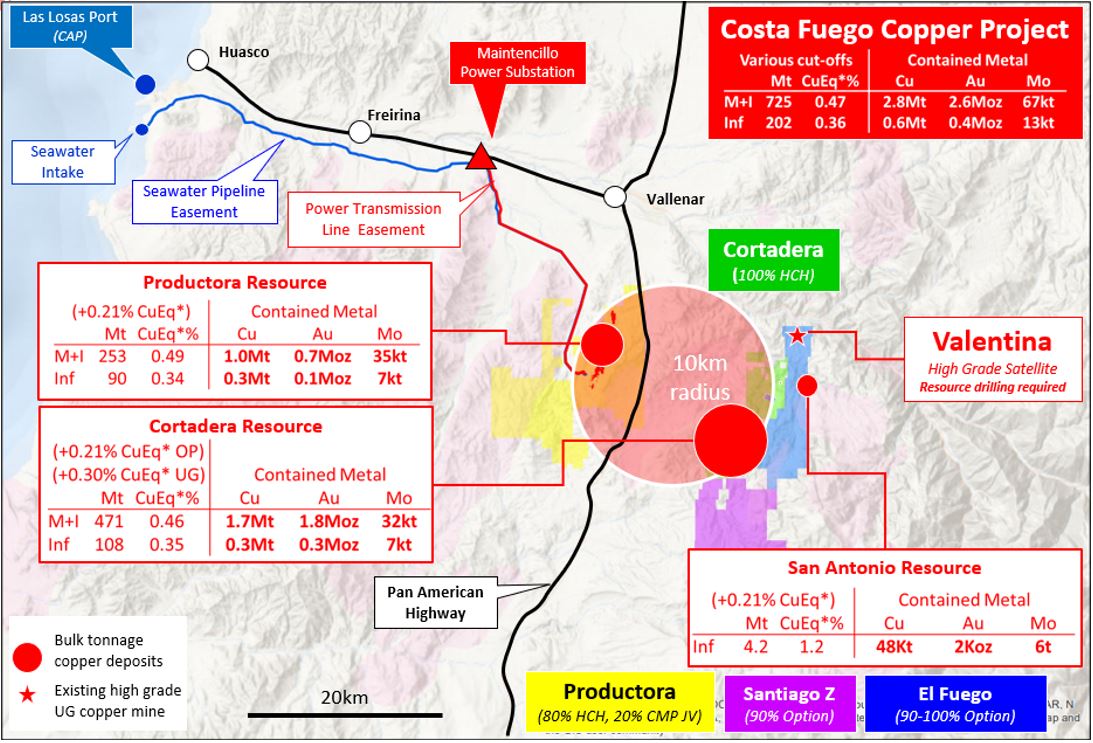

Hot Chili is developing the Costa Fuego project, a copper hub comprising two major deposits-the 100%-owned Cortadera porphyry deposit and neighbouring 80%-owned Productora porphyry-related breccia deposit. The most recent resource upgrade has also included the addition of the close-by, high grade, San Antonio deposit (4.2Mt grading 1.2% CuEq). While the company has been advancing Productora over the better part of the last decade (including a 2016 PFS), the resource potential took a step-change with the addition of the previously privately-owned Cortadera porphyry discovery in 2019.

“We have consolidated our copper deposits to form the Costa Fuego Copper Project – a major copper mining hub located on the Chilean coastal range. The centerpiece of our Chilean copper mining portfolio is the Cortadera porphyry deposit, regarded as one of the most significant copper-gold discoveries of the past decade in Chile,” says Christian Ervin Easterday, managing director of Hot Chili Ltd.

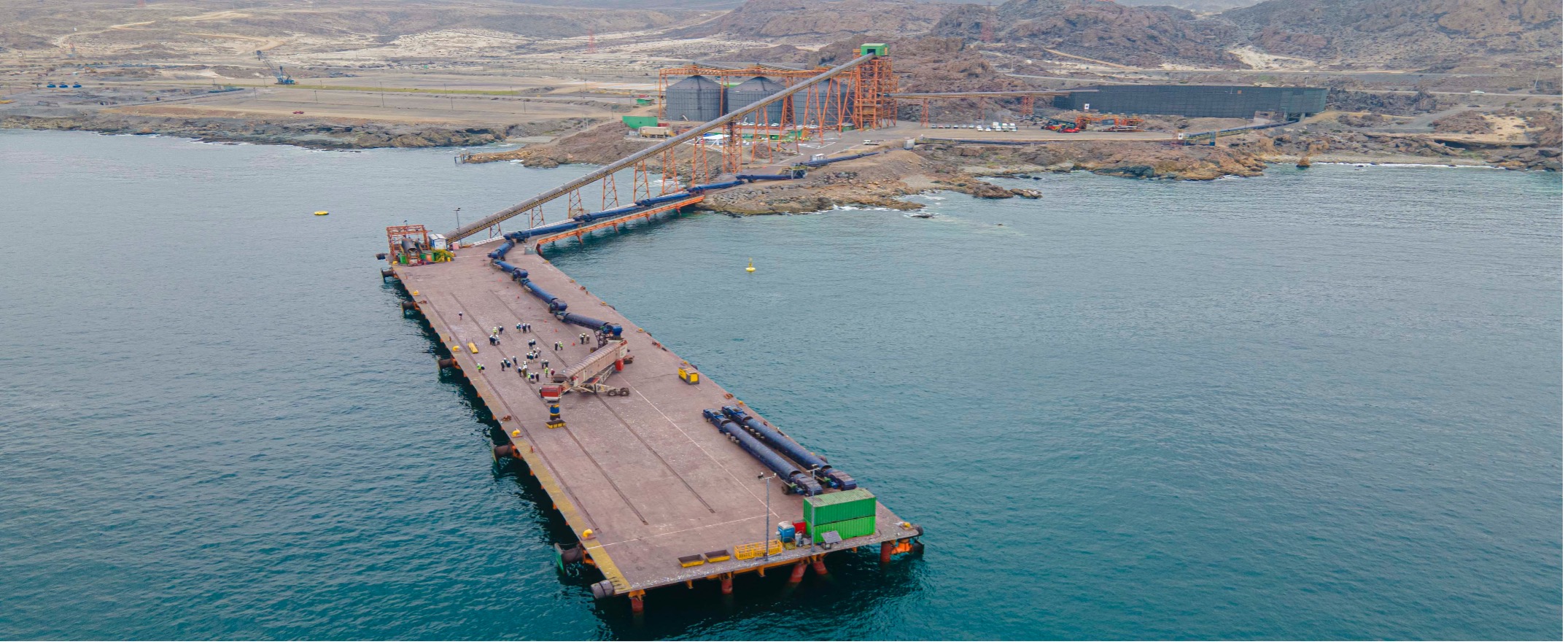

The Company’s profile is further bolstered by the location of the Costa Fuego project at low elevations (less than 1,000m elevation) in Chile’s coastal range, unique amongst senior copper developers in the America’s which are more used to high altitude locations – typically above 3,000m elevation in the high Andes. Costa Fuego is situated almost 600 kilometres north of Santiago, next to the Pan American highway, with access to the power grid and 50 kilometres from the port of Las Losas.  Additionally, Hot Chili has surface rights and easements to establish a sea water pipeline and power transmission lines. Also unique is that Hot Chili has a maritime concession, water license, which was approved in December 2020 – a critical element of any project development in the world, not least of all in Chile’s Atacama region.

Global copper demand on the rise

Without new capital investments, Commodities Research Unit (CRU) predicts global copper mined production will drop from 20 million tonnes to below 12 million tonnes by 2034, leading to a supply shortfall of more than 15 million tonnes. Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

Some of the largest copper mines are seeing their reserves dwindle; have to dramatically slow production due to major capital-intensive projects to move operations from open pit to underground. Examples include the world’s two largest copper mines, Escondida in Chile and Grasberg in Indonesia, along with Chuquicamata, the biggest open pit mine on Earth.

These cuts are significant to the global copper market because Chile is the world’s biggest copper-producing nation – supplying 30% of the world’s red metal. Adding insult to injury, copper grades have declined about 25% in Chile over the last decade, bringing less ore to market.

By 2020, the international industry’s head grade was 30% lower than in 2001, and the capital cost per tonne of annual production had surged four-fold during that time – both classic signs of depletion. According to the Goehring & Rozencwajg model, the industry is “approaching the lower limits of cut-off grades,” and brownfield expansions for many of the major copper miners are no longer a viable solution.

“Projects of the scale of Costa Fuego are hard to find. But they’re even harder to find at low altitude, sitting in the middle of infrastructure in one of the top three mining countries of the world. I think what most people don’t know is that over the past two decades head grades for copper have dropped to about half a percent from 1.6 percent copper and now it’s all about economy of scale and that’s the space we are in,” says Ervin Easterday.

Lower grades and increased demand shine a light on the importance of making new discoveries in establishing a sustainable copper supply chain. Over the past 10 years, greenfield additions to copper reserves have slowed dramatically, with tonnage from new discoveries falling by 80% since 2010-something that can’t be changed overnight.

Some of the world’s largest copper companies are doing everything they can to expand existing mines and acquire prospective new deposits, as they seek to replace their rapidly depleting copper reserves and resources.

But it takes many years to bring a copper deposit into production, even for the majors moving from open pit to underground. According to Bloomberg Intelligence, the average lead time from first discovery to first metal has increased by four years from previous cycles, to almost 14 years. In places like the United States and Canada, where miners face strict permitting regulations that can cause significant delays, it’s not unusual for a copper mine to take 20 years to develop.

“I guess you could say we are ahead of the crowd being 12 years into our journey already. There are few copper developers of our scale that have the near-term timelines to production we do,” says ErvinEasterday, who credits the recent Glencore investment on the Company’s advanced exploration and development, project scale and clean concentrate potential (no arsenic).

Vote of confidence from Glencore

Glencore became Hot Chili’s largest shareholder after a series of investments in 2021 where Glencore took a 9.96 percent stake. It also won a seat at the board in the form of Mark Jamieson and further management in the form of participation on the technical steering committee, positions it can hold onto as long as Glencore keeps a minimum 7.5 per cent stake in the company. The investment was backed up recently when Glencore agreed to an eight year off-take agreement to purchase 60 percent of the copper concentrate from Hot Chili’s Costa Fuego copper-gold project in Chile.

“We ensured project financing flexibility with 40 percent of our first eight years of concentrate production remaining uncommitted ahead of initiating project financing discussions in 2022, following completion of the Costa Fuego Pre-Feasibility Study. Glencore’s expertise and support is welcomed and is an important part of our strategy to transform the company into a material copper-gold producer. It is unique to have one of the world’s largest miners as a major shareholder and off-take partner in advance of a PFS” says Ervin Easterday.

Boosting its international capability even further, Hot Chili recently appointed Dr Nicole Adshead-Bell as the company’s independent, non-executive chairman, after she joined the board in January. Residing in Canada, Dr Adshead-Bell has 25 years of technical and investment banking experience across the capital markets and resource sectors and sits on the boards of Toronto-listed Altius Minerals and ASX-listed Matador Mining.

Lots of exploration upside

Fresh with a world-class resource estimate, which is fast approaching 1 billion tonnes, and pre-feasibility in the works, there are no signs of Hot Chili resting on their laurels.

“Now that we have a strong treasury of $30 to $40 million, this year is also about growing our resources from within. We are moving with a series of drill holes on some of the larger scale un-drilled targets on the property,” says Ervin Easterday.

The last word

“I know there is some frustration with retail investors wondering just like myself, how a company holding an asset of the size, quality, location, infrastructure advantage and attracting the attention of one of the top three miners in the world would have a market capitalization at about a fifth of what it probably should be. That frustration is well understood, but we have not shied away from making important decisions. What we are doing her is putting together a 20-to-30-year mine plan on something that has the potential to produce upwards of $US1 billion in revenue annually on long-term copper prices. In addition, we are de-risking our project, and as we hit our catalysts and milestones over the next year, I’m sure the market will look after itself – value will always eventually rise to the top” says Ervin Easterday.

Hot Chili is determined to commission the Cortadera copper gold project by 2026, a time frame that would be the envy of most mining majors. Now with a locked in offtake agreement with Glencore and the further upside to its resource base, it appears Hot Chili will hit the ground running this year.