i-80 Gold closes Lone Tree, Buffalo Mountain acquisitions, Nevada

i-80 Gold Corp. [IAU-TSX; IAUCF-OTCQX], together with its wholly owned subsidiaries Goldcorp Dee LLC and Au-Reka Gold LLC, has completed the transactions contemplated by the previously announced asset exchange agreement with Nevada Gold Mines LLC (NGM). Under the exchange agreement, i-80 Gold acquired from NGM, by way of an asset exchange, the Lone Tree and Buffalo Mountain gold deposits and certain processing infrastructure, including an autoclave (collectively, the NGM properties), in consideration for Goldcorp Dee’s 40% ownership in the South Arturo property; assignment of Au-Reka’s option to acquire the adjacent Rodeo Creek exploration property; contingent consideration of up to $50-million based on production from the Lone Tree property; and arrangement of substitute bonding (and release of NGM bonds) in respect of the Lone Tree and Buffalo Mountain reclamation obligations at closing (collectively, the asset exchange).

In addition, at closing of the asset exchange, NGM reimbursed i-80 approximately $7.3-million for amounts previously advanced by i-80 for the autonomous truck haulage test work completed at South Arturo and for funds advanced by i-80 that were not used for reclamation activities.

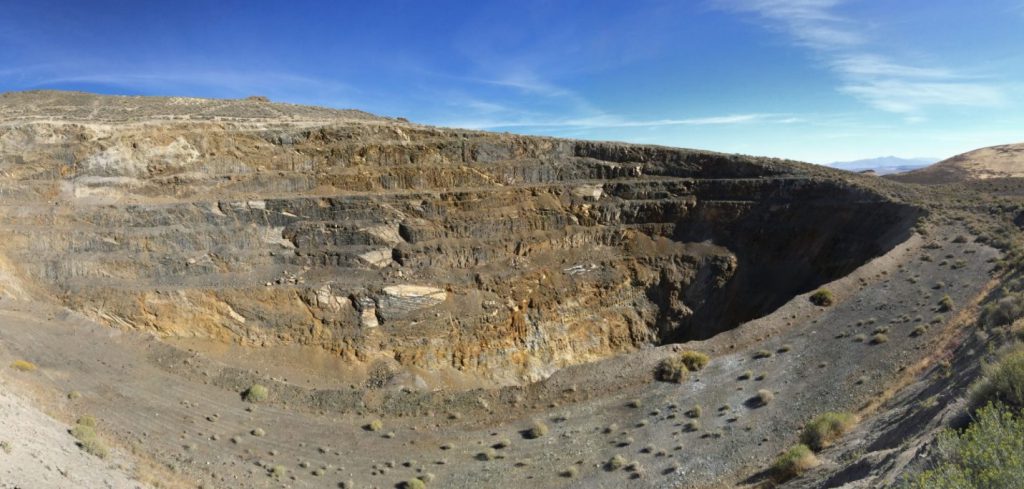

“With the closing of this transaction, we now embark on our aggressive growth plan to achieve our goal of building a prominent mid-tier gold producer,” stated Matthew Gollat, executive vice-president of business and corporate development of i-80 Gold. “Becoming one of only three companies in Nevada with infrastructure to process refractory mineralization, i-80 has gained a strategic advantage for long-term mine development. Furthermore, the toll processing agreement is a key component to this transaction, by providing the ability to process ore from Granite Creek, McCoy-Cove and Ruby Hill as they are developed while we are retrofitting the Lone Tree autoclave.”

i-80 Gold has closed a concurrent non-brokered private placement under which it sold an aggregate of 39,041,515 common shares of the company at a price of $2.62 per common share (the issue price), which represents the five-day volume-weighted average trading price of the common shares on the TSX ending on September 2, 2021, being the last trading date prior to the date of execution of the exchange agreement, for aggregate gross proceeds of approximately $102,288,769.

In connection with the asset exchange, NGM subscribed for 22,757,393 common shares under the private placement at the issue price. Following completion of the private placement, NGM owns approximately 9.90% of the issued and outstanding common shares of i-80 Gold on a non-diluted basis.

Certain directors, officers and other insiders of the company also subscribed for an aggregate of 615,802 common shares under the private placement on the same terms as arm’s-length investors. The private placement is subject to the final approval of the TSX.

The company intends to use the net proceeds of the private placement, together with other available funds, to finance the acquisition of the Ruby Hill mine, the exploration and development of its Nevada mineral projects, including the Ruby Hill mine, the NGM properties and the McCoy Cove property, and for general corporate purposes.