Pan American suspends operations at Mexico silver mine

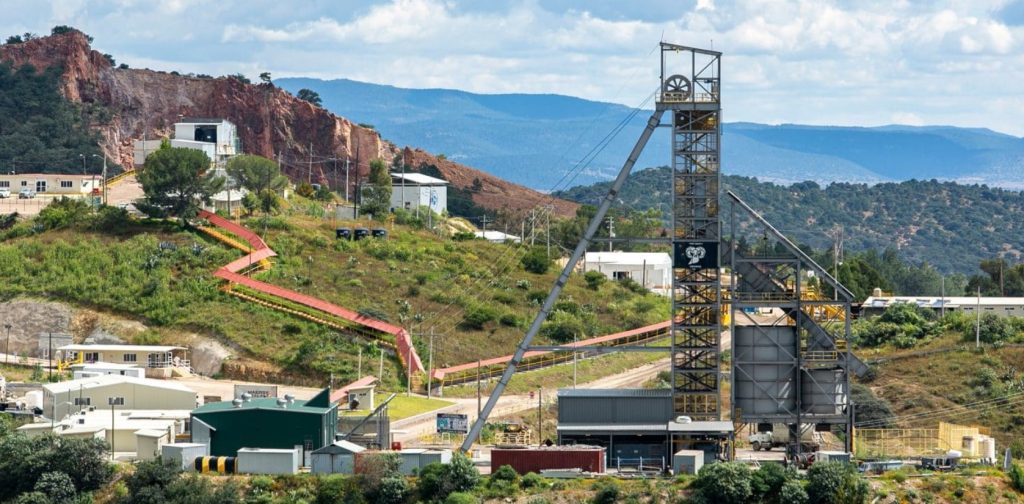

Pan American Silver Corp. [PAAS-TSX, NASDAQ] has announced the temporary suspension of all operating activities at its La Colorada mine in Zacatecas, Mexico, due to security concerns at the mine site and the surrounding area.

The company noted that the operation experienced an armed robbery of two trailers of concentrate in the early hours of October 5, 2023. No employees at the site were harmed. The site is currently secure and Pan American has activated care and maintenance activities while it works with state and federal authorities regarding this incident.

The suspension is expected to continue until Pan American determines that it is appropriate to resume operations. La Colorada accounts for 3.6% of Pan America’s net asset value and is expected to produce 5.5-5.9 million ounces (with 2.56 million ounces already produced in the first half of 2023), representing 26% of the company’s total silver production of 21-23 million ounces in 2023.

La Colorada hosts a polymetallic deposit that is estimated to contain 94.4 million ounces of silver based on the indicated mineral resource estimate of 95.9 million tonnes and 132.9 million ounces of silver, based on the inferred resource estimate of 147.8 million tonnes, plus a large volume of zinc and lead.

Pan American eased 2.0% or 38 cents to $18.56 on the news. The shares are currently trading in a 52-week range of $26.54 and $18.14.

Pan American was recently in the news when it and Agnico Eagle Mines Ltd. (AEM-TSX, AEM-NYSE) acquired Yamana Gold, a move that ensured that Canada’s largest gold mine – The Canadian Malartic – remained under Canadian ownership.

Yamana was a Canadian precious metals producer with significant gold and silver production, development stage properties and exploration properties in the Americas, including Brazil, Argentina, Chile, Mexico and Canada.

Its key asset was a 50% interest in the Canadian Malartic mine, a Quebec operation which ranked as Canada’s largest gold mine and Yamana’s biggest producer. The mine was held jointly by Agnico-Eagle and Yamana.

Under the arrangement deal, Pan American acquired all the issued and outstanding shares of Yamana, which then sold certain subsidiaries and partnerships holding Yamana’s interests in its Canadian assets to Agnico. That included a 50% interest in the Canadian Malartic mine.

The Yamana acquisition established Pan American as a major precious metals producer in Latin America. The combined portfolio consisted of 12 operations concentrated in Latin America. The deal also gave Agnico-Eagle operational control of the Canadian Malartic mine during the remaining development of the Odyssey project at Canadian Malartic and future projects nearby.

Pan American recently released an update on previously announced non-core asset sales that were expected to yield cash proceeds of US$593 million.

The company said it has completed the previously announced divestment of its 56.2% stake in the Mara project in Argentina and its 92.3% interest in the Morococha mine in Peru.