Positive outlook for gold as low interest rates could last years

By David Duval

As recently seen on the charts, price volatility for gold ranks among the highest in the metals sector because it’s a tradable commodity and a medium of exchange. The price downturn since mid-2020 is hardly anything new or surprising and pales in comparison to some of the recent pullbacks in bitcoin which often drops over 10% in a week.

Unlike Bitcoin, gold’s losses are generally not restricted to the unit of exchange itself. There’s always plenty of collateral damage to producers and junior explorers which we are seeing in the latest pullback. Yet gold producers reported record high margins last year and 2021 also looks good. More often than not, gold equities outperform the metal and a repeat of this scenario is likely in store for gold stocks before year end.

Nonetheless, gold was one of the best performing major assets of 2020, driven by, among other things, a combination of financial and geopolitical uncertainty, low interest rates and positive price momentum – especially during late spring and summer when it reached a record of US$2,058.40 per ounce.

Why was gold bid up to this level and will the metal achieve that lofty performance again? The answer is more than likely “yes” as its main price drivers are beginning to awaken after a half year slumber.

Gold has always been seen as a safe haven in times of crisis and uncertainty. And heaven knows, there’s plenty of that around these days. For one thing, markets appear to be heavily overbought and the global financial system is precarious at best following the economic downturn that resulted from the Covid-19 pandemic whose economic consequences will be felt for generations.

Since the 1930s, the U.S. dollar has lost 99% of its value against gold while other reserve currencies such as the British pound and Japanese yen did even worse.

One of the most important things impacting gold is the bond market as the spike in yields have worked against the value of gold as it’s much easier to simply clip coupons in the bond market than it is to pay for storage of gold. Investors generally see gold as a good inflation hedge and the metal has proved to be relatively stable over the long haul and not easily depreciated by outside factors or other currencies.

As a rule, when the value of the dollar increases relative to other currencies around the world, the price of gold tends to fall in U.S. dollar terms. The reason for this is because gold becomes more expensive in other currencies. As the price of any commodity moves higher there tend to be fewer buyers, reducing demand for the metal. Conversely, as the value of the U.S. dollar moves lower, gold tends to appreciate as it becomes cheaper in other currencies, increasing demand at the lower prices.

The U.S. Federal Reserve has kept interest rates near zero to keep financial markets stable and make borrowing costs as low as possible to shore up the economy. It also decided to buy hundreds of billions of dollars in bonds which brought yields down, making gold and its lack of yield more attractive to investors.

The gold market suffered a major sell-off that began late last year and only began to reverse itself in mid-March of 2021 after gold futures ended below the US$1,700 mark when the U.S. dollar index touched its highest level in over three months. Treasury yields briefly topped 1.6% as the U.S. employment report showed larger-than-expected job gains in February. Higher government bond yields and a stronger dollar can make gold less attractive to investors seeking a safe-haven.

Jason Teed, co-portfolio manager of the Gold Bullion Strategy Fund QGLDX, recently told MarketWatch that gold has been pressured by “a continued increase in interest rates, making the metal a less attractive store of value relative to bonds,” adding that “interest rate pressure is likely a larger and nearer-term factor than the positive pressure of expected inflation.” As a caveat, he believes that should interest rates continue to move up on positive U.S. economic news, gold may continue to come under some selling pressure but that pressure may “abate somewhat if yield movements take a breather.”

One of the most important things investors need to pay attention to is the bond market as the spike in yields have worked against the value of gold as it is much easier to simply clip coupons in the bond market than it is to pay for storage of gold.

As the global economic recovery gathers momentum, analysts expect the U.S. dollar to weaken which will serve to increase safe haven demand for gold. Investors should remember that real interest rates are much more important for the gold market than changes in nominal interest rates, including the federal funds rate. Generally, real interest rates are negatively correlated with the price of gold (i.e. rising real rates adversely impact the yellow metal).

Recent statements from U.S. Federal Reserve Chairman Jerome Powell indicated that any interest rate hike is unlikely through 2023. The U.S. economy remains fragile and the post-pandemic recovery will be gradual at best, meaning a low-rate environment and an elevated gold price environment is here to stay at least for the next few years!

The World Gold Council believes that investment demand will remain well supported while gold consumption should benefit from the nascent economic recovery, especially in emerging markets. The WGC also sees gold investors navigating potential portfolio risks including: ballooning budget deficits, inflationary pressures and market corrections amid already high equity valuations.

Scottie Resources Corp. [SCOT-TSXV; SCTSF-OTC] is an exploration stage company engaged in the acquisition, exploration and evaluation of gold and silver properties located in the Golden Triangle, an area of northwestern British Columbia that ranks among the world’s most heavily mineralized districts.

Scottie Resources Corp. [SCOT-TSXV; SCTSF-OTC] is an exploration stage company engaged in the acquisition, exploration and evaluation of gold and silver properties located in the Golden Triangle, an area of northwestern British Columbia that ranks among the world’s most heavily mineralized districts.

The 100%-owned Scottie Gold Mine is the flagship project of the company. It is road accessible with excellent existing infrastructure, and is located 40 kilometres north of Stewart, B.C. and 20 kilometres north of Ascot Resources Ltd.’s [AOT-TSX; AOTVF-OTCQX] Premier mill along the Granduc haul road.

The Golden Triangle area is host to past and current mining operations, including Johnny Mountain, Red Mountain, Snip Mine, Eskay Creek, Premier Mine, Golden Bear and Valley of Kings. Scottie’s portfolio of properties covers more than 25,000 hectares and all are located in the Golden Triangle.

The Scottie Gold Mine Project consists of the Scottie Gold Mine, Bow, Summit Lake and Stock claim groups. The project includes the past-producing Scottie Gold Mine, which operated from 1981 to 1985, producing 95,426 ounces of gold from 183,147 tonnes of mineralization. The Scottie Mine ultimately shut down due to a drop in the gold price combined with high interest rates.

Scottie owns a 100% interest in the high-grade, past-producing Scottie Gold Mine, Bow, and Stock properties and has the option to purchase a 100% interest in Summit Lake claims which are contiguous with the Scottie Gold Mine property. Scottie also owns 100% interest in the Cambria Project properties and the Sulu property.

While 13 distinct gold-bearing vein zones have been identified on the Scottie Gold Mine project, mine production was primarily from one vein.

The company said there are over 20 gold and/or silver-bearing mineralized zones within the project area, and prior to the 2020 field season, only five had been drill tested.

The majority of historical drilling was done from underground, and therefore consisted of short holes with single targets – with very restricted drill pad locations. Recent exploration by Scottie has used the benefits of drilling from surface to target areas that were inaccessible with underground drill locations, and where possible to test multiple targets with individual holes.

The company is currently focused on expanding the known mineralization around the mine while advancing near mine-grade gold targets, with the purpose of delivering a potential resource.

Scottie CEO Bradley Rourke said drilling last year at the Scottie Gold Mine Project continues to deliver strong results that indicate that the gold mineralization is more extensive than previously tested. Past mining practices used a historical cut-off grade of 10 g/t gold, and with current market conditions the opportunity to expand the mineralization is considered excellent as recent results have indicated.

“During 2021, the company will continue expanding the drill program and advancing towards delivering a potential resource,” Rourke said.

The company completed 7,040 metres of drilling in 46 holes during 2020 and took 921 surface samples on its Scottie Gold Mine area projects. High-grade drill results from the O-Zone, the Domino Zone, the Blueberry Zone and the M-Zone demonstrate the company’s success in advancing multiple high-grade areas within its claims in and around the Scottie Gold Mine.

In a December 8, 2020, press release the company said new assay results for the Blueberry Zone included the discovery of a new mineralized trend that runs oblique to the historic Blueberry Vein target. It said the intersection of multiple high-grade intervals along strike (including 22.3 g/t gold over 6.1 metres) has defined an intensely mineralized gold trend oriented north-south. The new target remains open along strike and depth, with numerous high-grade grab samples delineating a zone that exceeds 800 metres in strike length.

A total of 1,609 metres in 11 holes were drilled into the Blueberry Zone during 2020. Future drill campaigns will increasingly step out along strike and at depth to further define the extent and grade of the zone.

The Blueberry Zone is a near surface target located on the Granduc Road, 2 kilometres northeast of the former Scottie Mine. “The grades and widths of these recent results get us extremely excited about the economic potential of the area,” Rourke said.

Bolstered by the high-grade grab samples from 2020, drilling in 2021 will see the company aggressively stepping out along this new trend to establish the full extent of what it described as a “remarkably large and high-grade system.”

On April 6, 2021, Scottie shares were trading at $0.19 in a 52-week range of 53 cents and 14.5 cents, leaving the company with a market cap of $22.88 million based on 120.4 million shares outstanding.

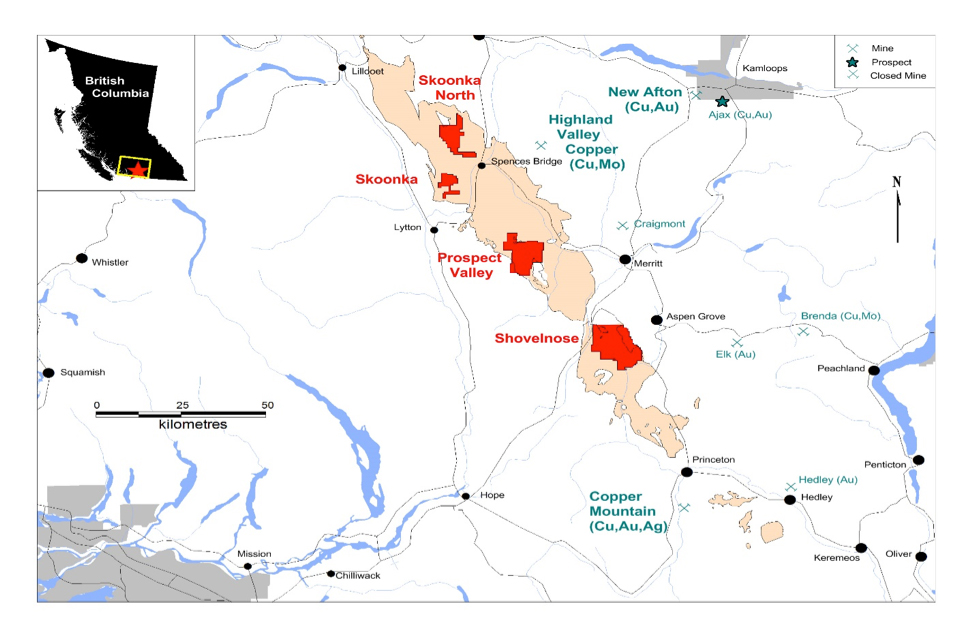

Westhaven Gold Corp. [WHN-TSXV; WTHVF-OTC] is a gold-focused exploration company advancing a high-grade discovery on the Shovelnose project in Canada’s newest gold district, the Spences Bridge Gold Belt (SBGB) near Merritt, British Columbia.

Westhaven Gold Corp. [WHN-TSXV; WTHVF-OTC] is a gold-focused exploration company advancing a high-grade discovery on the Shovelnose project in Canada’s newest gold district, the Spences Bridge Gold Belt (SBGB) near Merritt, British Columbia.

Westhaven Chairman Grenville Thomas is a former Welsh coal miner who is best known for his role in discovering one of Canada’s richest diamond deposits in the Northwest Territories. At the time of the Diavik diamond discovery in 1992, Thomas was running Aber Resources Ltd. Peter Fischl, B.Sc., P.Geo. and Manager of Exploration for Westhaven Gold was the recipient of the 2019 H.H. “Spud” Huestis Discovery of the Year Award 2019 (AME BC) for Westhaven’s Shovelnose discovery late 2018. Peter had previously spent 12 years (2003-2015) in the Russian Far East conducting brownfields exploration for low sulphidation epithermal gold deposits at Kupol and Dvoinoye with Bema Gold, B2Gold and Kinross Gold.

Westhaven holds a 100% interest in over 37,000 hectares of ground on four gold properties within the Spences Bridge Gold Belt, an area that the company believes is highly prospective for epithermal type gold mineralization.

All of the four properties are located to the west of Teck Resources Ltd.’s [TECK.B-TSX; TECK.A-TSX; TECK-NYSE] Highland Valley Copper Mine and New Gold Inc.’s [NGD-TSX, NYSE American) New Afton Mine.

The SBGB is a 110-kilometre northwest-trending belt of intermediate to felsic volcanic rocks dominated by the Cretaceous Spences Bridge Group. Talisker Resources Ltd. [CSE-TSX; TSKFF-OTCQB] and Westhaven have a combined control of 86% of the SBGB [225,000 hectares]. Westhaven has a 2.5% NSR covering approximately 70,000 hectares of claims that were staked by Talisker Resources in late 2018Â on the Spences Bridge Gold Belt.

In addition, Westhaven has a 30-day right of first refusal for a three-year period for any properties outside this 5-kilometre radius.

The 17,542-hectare Shovelnose property is located near the southern end of the SBGB and borders a major B.C. highway known as the Coquihalla. The proximity to highway infrastructure permits year-round exploration at the property.

The location of its properties in southwestern British Columbia means they are easily accessible by road (2.5 hours from Vancouver) and amenable to low-cost exploration.

Westhaven is fully funded for exploration this year after raising $15 million from a bought deal public offering of 21.3 million units priced at 70 cents per unit. Each unit consisted of one common share and one half of a common share purchase warrant. Each warrant entitles the holder to acquire one common share of Westhaven at an exercise price of $1 per share for up to two years after the closing date

On April 6, Westhaven shares were trading at 56 cents in a 52-week range of $1.25 and $0.435 cents, leaving the company with a market cap of $70.67 million, based on 126.2 million shares outstanding.

Net proceeds are earmarked for exploration and development of the company’s early stage properties in British Columbia. Aside from Shovelnose, they also include the Prospect Valley (PV), Skoonka Creek and Skoonka North properties which are also located on the SBGB.

Drilling at the Shovelnose property in the latter part of 2020 has been primarily focused on testing vein continuity along the 4.0-kilometre strike length of Vein Zone 1, the most significant mineralized structure defined to date on the Shovelnose gold project.

Vein Zone 1 will continue to be the focus for the coming year, including step-out and infill drilling on the South Zone. Other targets tested last year, such as the Romeo target, where drilling encountered significant gold pathfinders, remain to be tested further.

Prospecting and mapping in 2020 has also drawn attention to several targets within 2.0 kilometres southwest of the Vein Zone 1, proximal to the Brookmere showing.

The goal of the 2020 drill program was to find new gold vein zones outside of the high-grade South Zone discovery. Exploration highlights included the discovery of a brand-new quartz outcrop (Franz Zone), one kilometre northwest of the FMN target.

Westhaven has said the Franz outcrop is the most significant surface vein occurrence yet witnessed at Shovelnose and is being prioritized for drilling. Drill results from the first hole at the newly discovered Franz Zone were (18.36 – 26.14m) 7.78 metres of 14.84 g/t gold and 39.40 g/t silver as well as (41.12 – 57.44m) 16.32 metres of 2.37 g/t gold and 31.15 g/t silver.

The newly discovered Franz Zone is located approximately 2.8 kilometres along strike from the high-grade gold discovery at the South Zone. Over half of this strike length has not been drill tested.

Objectives for 2021 are to find more gold-silver zones on the Shovelnose property, complete a maiden resource at the South Zone, and extend the high-grade gold mineralization at the newly discovered FMN and Franz Zones.

The company expects to complete approximately 40,000 metres of diamond drilling this year, with the majority focused on exploration targets. It means that investors can look forward to a steady flow of news. Any positive news would likely impact the share price.

Drilling will also carry on-trend towards the Franz Zone where 7.79 metres of 14.84 g/t gold and 39.40 g/t silver was encountered last fall.

Benchmark Metals Inc. [BNCH-TSXV; BNCHF-OTCQX; A2JM2X-WKN] is a mineral exploration company with a focus on developing the substantial resource potential of the road accessible Lawyers Gold and Silver Project, located in the prolific Golden Horseshoe area of northern British Columbia.

Benchmark Metals Inc. [BNCH-TSXV; BNCHF-OTCQX; A2JM2X-WKN] is a mineral exploration company with a focus on developing the substantial resource potential of the road accessible Lawyers Gold and Silver Project, located in the prolific Golden Horseshoe area of northern British Columbia.

Benchmark is part of the Metals Group of Companies and sees future potential to outline over 5.0 million gold equivalent ounces (AuEq) at its flagship Lawyers Project.

Benchmark is part of the Metals Group led by a dynamic group of resource sector professionals who have a strong record of success in evaluating and advancing mining projects from exploration through to production, attracting capital to deliver exceptional shareholder value. The highly experienced management team is led by CEO and Chairman John Williamson who has held senior executive and board positions at more than 20-listed companies in Canada and Australia. Benchmark President Jim Greig was involved in the advancement of the 5.0 million-ounce-Esaase Gold Project in West Africa as a member of the development team at Keegan Resources.

Backed by an investor group that includes numerous institutions, high profile shareholders including Eric Sprott, Benchmark is working towards the announcement of a maiden bulk-tonnage mineral resource estimate and a preliminary economic study for the Lawyers Project. Those key milestones are anticipated during April of this year.

The company is planning to complete a fully funded drill program, at a cost of up to approximately $25 million this year, to move the project towards the feasibility study stage. That includes drilling on the newly discovered Marmot Zone, which yielded a 101.00-metre core length of 0.82 g/t AuEq with four separate high-grade intersects with the best assaying a 2.00-metre core length of 14.52 g/t AuEq.  Benchmark’s $35 million in cash enables drilling of new discovery targets from widespread gold and silver soil anomalies and a2021 main zones resource expansion program that expansion potential at depth and on strike.

Benchmark has the support with signed agreements from the Tsay Keh Dene Nation, Kwadacha Nation, and Takla Nation and Tahltan Nation(the Partner Nations) to advance its flagship gold-silver project. The Partner Nations and Benchmark are committed to working together in the spirit of partnership and collaboration in building a positive, respectful, mutually beneficial, and harmonious relationship with respect to the Lawyer’s Gold-Silver Project.

The Lawyers property is located in the Toodoggone region of B.C. and consists of 140km2 of land that encompasses the Lawyers group of prospects, including the former Lawyers underground gold-silver mine. The property is situated 45 kilometres northwest of Centerra Gold Inc.’s Kemess Copper-Gold mine, where underground development program is under way.

Previous exploration in the area identified numerous showings, prospects and deposits that led to the development of the Lawyers gold-silver mine (1989-1992) that produced 171,200 ounces of gold and 3.6 million ounces of silver.

However, the deposit was never fully mined, and the surrounding area was never thoroughly explored for gold-silver mineralization. An estimated $50 million in infrastructure remains in place, including year-round road access.

Five underground developments remain in place, in addition to historical resources and new targets.

Benchmark said the Lawyers Project exhibits geological similarities to world-class low sulphidation epithermal gold-silver mines located in the Patagonia region of Argentina.

The structurally controlled Cliff Creek, Dukes Ridge, Phoenix and AGB zones are located within a 5.0-kilometre by 8.0-kilometre radiometric anomaly that is coincident with a potassic alteration, associated with a low-sulphidation epithermal system.

Limited historical underground production at the AGB and Cliff Creek zones targeted the high-grade veins associated with this epithermal system. However, the company has said recently acquired data, geological compilation, and reinterpretation has revealed that the potential exists to add gold and silver ounces within these zones and across the entire mineralizing system.

In a March, 2020 press release, the company said a number of widespread gold and silver soil anomalies have delineated new regional exploration targets across a strike length of 16 kilometres. Benchmark said it has defined 20+ new areas for follow-up exploration including drill testing beyond the heart of the property that hosts the three main mineralized zones (Cliff Creek, AGB, and Dukes Ridge).

The company is advancing the Lawyers Project after being granted a five-year work permit by the Government of British Columbia for exploration and drilling. The permit, granted in in July, 2019, encompasses an expanded scope and scale to explore existing and new targets across the project area.

The company provided an Exploration Target at the Cliff Creek zone that ranged between 1.7 million and 1.9 million ounces of gold equivalent. The Exploration Target was based on all drilling to 2019 and did not include the massive amount of drilling completed during 2020. In addition, two other large zones (AGB zone and Dukes Ridge zone) will form part of the global resource estimate to be published in April, 2021.

On April 6, Benchmark Metals shares were trading at $1.44 in a 52-week range of $1.64 and $0.24.