Radisson to Acquire the New Alger Project and Partner with Renforth Resources Inc.

Radisson Mining Resources Inc. (TSX-V: RDS, OTC: RMRDF) (“Radisson“) and Renforth Resources Inc. (CSE – RFR, OTC US- RFHRF, WKN – A2H9TN) (“Renforth“) are pleased to announce that they have signed a binding agreement (the “Agreement“) pursuant to which Radisson will acquire a 100% interest in Renforth’s New Alger Gold Property (“New Alger“) and enter into a long-term strategic relationship through a 9.6% equity investment by Radisson in Renforth. The relationship aims to leverage regional synergies and unlock significant value for shareholders of both companies from one of the most prospective mining camps in the world.

The transaction will significantly expand Radisson’s claims in the Bousquet-Cadillac mining camp, which will create scale, and which Radisson believes will enhance its exploration potential and increase O’Brien’s appeal to investors and larger producers. In addition, the deal significantly bolsters Renforth’s balance sheet and allows for a significant expansion in planned exploration spending aimed at realizing the full potential of its attractive project portfolio that includes Parbec, Nixon Bartleman, Malartic West, Surimeau and Denain-Pershing. The transaction is expected to provide for significant benefits to both Renforth and Radisson and their respective shareholders.

Transaction highlights:

- Radisson will acquire a 100% interest in New Alger for the following consideration:

- 12 million class A common shares of Radisson will be issued to Renforth upon closing of the transaction;

- $0.5 million in cash upon closing of the transaction;

- a $1.5 million cash contingent payment, payable on the earlier of the announcement of commercial production at New Alger, a sale of New Alger for more than C$40 million or a change of control of Radisson.

- Renforth plans to complete a concurrent financing to raise approximately $3.24 million in cash proceeds, which will be backed by a 9.6% strategic investment by Radisson into Renforth.

- The financing is anticipated to be a charity flow-through financing, pursuant to which Renforth plans to issue 24 million flow-through shares at $0.135/share, which would represent a 145% premium to Renforth’s most recent financing

- The potential transaction value to Renforth (including contingent payments) is estimated at approximately $9.5 million, based on the three-day volume weighted average share price for Radisson.

Transaction funding:

Radisson anticipates that its strong cash position will be sufficient to both complete the transaction and to expand the ongoing drill program to include the newly acquired claims. As of July 31, 2020, the company estimates a total liquidity position of approximately $8.5 million including,

- a liquidity position of approximately $3.3 million, which includes proceeds from the recent sales of non-core securities and receivables

- anticipated liquidity of approximately $0.7 million from the exercise of in-the-money options and warrants by certain holders, including the Strategic Advisor, Chairman, CEO, President and Directors, who have indicated their intention to exercise such securities ; and

- funds reserved for exploration and evaluation of approximately $4.5 million, which should facilitate an expansion in the ongoing 60,000 m drill program to over 75,000 m, permitting additional drilling in 2021

“We are delighted to announce this partnership with Renforth and strongly believe this will prove to be a win-win situation for both companies. Considering our significant holdings in one of the most prolific gold mining camps, our interests are very much aligned, making this collaboration very significant. Nicole and her team have done a commendable job over the last several years. We look forward to building on her team’s work at New Alger while gaining exposure to the other assets in the Renforth portfolio, through our equity interest in Renforth,” commented Mario Bouchard, Chief Executive Officer of Radisson Mining Resources Inc.

“This transaction delivers to Renforth’s shareholders a significant return on our investment to date in New Alger. This re-positions Renforth as extremely well funded, with cash and securities, to allow us to continue exploration on several of our properties, including our Parbec open pit constrained gold resource. Renforth will not need to carry out any additional, dilutive, funding transactions for the foreseeable future. I believe getting out from under the need to repeatedly raise money, and dilute shareholders, is transformative for Renforth.” commented Nicole Brewster, President and Chief Executive Officer of Renforth Resources Inc.

Benefits to Renforth shareholders

- Attractive price realized for New Alger while retaining a 5.7% equity interest in Radisson post-transaction for continued exposure to upside from the combined O’Brien and New Alger properties.

- Exposure to the ongoing 60,000m drill program at O’Brien as well as the recently completed 1,782 m drill program at New Alger for which assays are pending.

- Additional exposure to any future exploration success by Radisson at the O’Brien and New Alger properties.

- A significant capital infusion at a significant premium to market which, when completed, will increase Renforth’s cash position to approximately $4.7 million proforma the transaction, which represents an 385% increase from pre-transaction levels.

- This does not include warrants and options that are in-the-money (based on the latest closing price), which, if exercised, could generate additional cash proceeds to Renforth of approximately $1.8 million in the future.

- Renforth is expected to be well funded to undertake significant work programs at its other assets which should help Renforth materially enhance and upgrade its attractive project portfolio

- The opportunity to leverage its partnership with Radisson for increased institutional/retail exposure and an enhanced capital markets profile, which will enable Renforth to build on the positive momentum this year.

Benefits to Radisson shareholders

- Consolidates the adjacent O’Brien and New Alger projects in the Bousquet-Cadillac mining camp which will add scale and is expected to enhance the resource upside and significantly increase the attractiveness of Radisson’s high-grade O’Brien project. The transaction should,

- expand Radisson’s claims to cover 5,839 ha, representing a nine-fold increase from 637 ha prior to the transaction.

- expand Radisson’s prospective strike length along the Cadillac Break to approximately 6 km from 4.5 km prior to the transaction. This includes 3.2km to the east and 2.7km west of the historic O’Brien Mine (shaft no. 2), which has been the highest-grade producing gold mine in Quebec

- provide Radisson shareholders with exposure to upside from the Discovery Veins, located approximately 250 m south of the Cadillac Break and hosted in the Pontiac Sediments. The Discovery Veins have been traced by drilling for approximately 275 m along strike and to a depth of 120 m, within a sampled strike length of approximately 500m. Mineralization remains open for expansion to the east, west and at depth.

- allow Radisson to build on the technical work completed by Renforth (including 15,759 m of drilling to date) leading to the recent NI-43-101 resource update at New Alger (May 12, 2020).

- Radisson is expected to hold a 9.6% equity interest in Renforth, which will provide shareholders with upside exposure from Renforth’s other assets located in the same prospective district, including Parbec, Nixon Bartleman, Malartic West, Denain-Pershing and Surimeau

- Following the transaction, Renforth will be well funded to undertake significant work programs at its key assets.

- Radisson anticipates that its strong cash position will be sufficient to both complete the transaction and to meaningfully expand the ongoing drill program to include the newly acquired claims.

The New Alger Project

The New Alger Project is a highly prospective land package adjacent of Radisson’s O’Brien Project to the west and along strike; In June 2020, Renforth Resources published an Updated Mineral Resource Estimate and Technical Report.

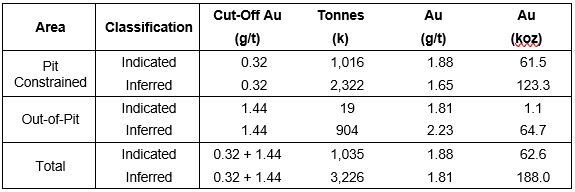

The New Alger gold deposit has a pit-constrained Indicated Resource of 61,500 ounces and Inferred Resource of 123,300 ounces. In addition, it has an out-of-pit Indicated Resource of 1,100 ounces and Inferred Resource of 64,700 ounces. The current resource covers a strike extent of approximately 1400 m and an average depth extent of approximately 300 m on the Cadillac Break. The deposit remains open at depth both on the Cadillac Break and the Discovery Veins, and along strike to the east and west on the Discovery Veins.

New Alger Current Resource Estimate

2. The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

3. The Mineral Resources in this report were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

4. Historically mined areas were depleted from the Mineral Resource model.

5. The pit constrained Au cut-off grade of 0.32 g/t Au was derived from US$1,450/oz Au price, 0.75 US$/C$ exchange rate, 95% process recovery, C$17/t process cost and C$2/t G&A cost. The constraining pit optimization parameters were C$2.50/t mineralized mining cost, $2/t waste mining cost, $1.50/t overburden mining cost and 50-degree pit slopes.

6. The out of pit Au cut-off grade of 1.44 g/t Au was derived from US$1,450/oz Au price, 0.75 US$/C$ exchange rate, 95% process recovery, C$66/t mining cost, C$17/t process cost and C$2/t G&A cost. The out of pit Mineral Resource grade blocks were quantified above the 1.44 g/t Au cut-off, below the constraining pit shell and within the constraining mineralized wireframes. Additionally, only groups of blocks that exhibited continuity and reasonable potential stope geometry were included. All orphaned blocks and narrow strings of blocks were excluded. The longhole stoping with backfill method was assumed for the out of pit Mineral Resource Estimate calculation.

Recent Results at New Alger

Recent results at New Alger include visible gold observed in several instances within the areas of the blasting work recently completed on the Discovery Veins.

Renforth blasted in four areas of the ~275m stripped portion of the Discovery Vein gold system. These areas were chosen based upon results obtained in each area via comprehensive surface channel and grab sampling carried out by Renforth between 2014 and 2019. Drilling at New Alger is complete for this program, with 3 infill holes completed on the Discovery Veins and 5 step out holes to the west, for a total step out of 300m west outside of the stripped area of the Discovery Veins. In addition, one hole was drilled in the mine area, on the Cadillac Break. The company is currently awaiting receipt of assays.

The transaction remains subject to customary conditions including the entry into a definitive agreement, completion of satisfactory due diligence and receipt of TSXV approval. The acquisition is expected to close before the end of Q3 2020, after which the proposed Renforth financing is expected to close.

Qualified Person

Richard Nieminen, P. Geo, Exploration Manager, is a Qualified Person as defined in National Instrument 43-101 and has reviewed and approved the technical information in this press release relating to Radisson.

Brian H. Newton P.Geo, is a Qualified Person as defined in National Instrument 43-101 and has reviewed and approved the technical information in this press release relating to Renforth.

About Radisson Mining Resources Inc.

Radisson is a gold exploration company focused on its 100% owned O’Brien project, located in the Bousquet-Cadillac mining camp along the world-renowned Larder-Lake-Cadillac Break in Abitibi, Québec. The Bousquet-Cadillac mining camp has produced over 21,000,000 ounces of gold over the last 100 years. The project hosts the former O’Brien Mine, considered to have been the Abitibi Greenstone Belt’s highest-grade gold producer during its production period (1,197,147 metric tons at 15.25 g/t Au for 587,121 ounces of gold from 1926 to 1957; 3D Geo-solution, July 2019).

About Renforth Resources Inc.

Renforth Resources Inc. is a Toronto-based gold exploration company with six wholly owned surface gold bearing properties located in the Provinces of Quebec and Ontario, Canada.

In Quebec Renforth holds the New Alger and Parbec Properties, in the Cadillac and Malartic gold camps respectively, with gold present at surface and to some depth, located on the Cadillac Break. Renforth also holds Malartic West, contiguous to the western boundary of the Canadian Malartic Mine Property, located in the Pontiac Sediments, this property is gold bearing and was the recent site of a copper discovery. Renforth has acquired the Surimeau property, also contiguous to Canadian Malartic and the southern border of the Malartic West property. In addition to this Renforth has optioned the wholly owned Denain-Pershing gold bearing property, located near Louvicourt, Quebec, to O3 Mining Inc.

In Ontario, Renforth holds the Nixon-Bartleman surface gold occurrence west of Timmins, Ontario, drilled, channeled and sampled over 500m – this historic property also requires additional exploration to define the extent of the mineralization.

On behalf of Radisson

Mario Bouchard

CEO and Director

For more information on Radisson, visit our website at www.radissonmining.com or contact:

Hubert Parent-Bouchard

Director, Corporate Development

819-763-9969

hpbouchard@radissonmining.com

On behalf of Renforth

Nicole Brewster

President and Chief Executive Officer

T:416-818-1393

E: nicole@renforthresources.com

#269 – 1099 Kingston Road, Pickering ON L1V 1B5

Certain information contained in the press release are subject to receipt of all regulatory approvals. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. No securities regulatory authority has approved or disapproved of the contents of this news release.

Forward-Looking Statements

All statements, other than statements of historical fact, contained in this press release including, but not limited to, those relating to the acquisition, its intended effects, timing of completion of the acquisition of New Alger and the Renforth financing, Radisson liquidity, the development of the O’Brien project, anticipated exploration activities and generally, the above “About Radisson Mining Resources Inc.” and “About Renforth Resources Inc.” paragraphs which essentially describes the Corporation’s outlook, constitute “forward-looking information” or “forward-looking statements” within the meaning of applicable securities laws, and are based on expectations, estimates and projections as of the time of this press release. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Radisson and Renforth as of the time of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. These estimates and assumptions, including regarding the timing and completion of the proposed acquisition and financing, may prove to be incorrect. Many of these uncertainties and contingencies can directly or indirectly affect, and could cause, actual results to differ materially from those expressed or implied in any forward-looking statements and future events, could differ materially from those anticipated in such statements. A description of assumptions used to develop such forward-looking information and a description of risk factors that may cause actual results to differ materially from forward looking information can be found in disclosure documents issued by Radisson and Renforth on the SEDAR website at www.sedar.com.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that estimates, forecasts, projections and other forward-looking statements will not be achieved or that assumptions do not reflect future experience. Forward-looking statements are provided for the purpose of providing information about management’s endeavors and, more generally, its expectations and plans relating to the future. Readers are cautioned not to place undue reliance on these forward-looking statements as a number of important risk factors and future events could cause the actual outcomes to differ materially from the beliefs, plans, objectives, expectations, anticipations, estimates, assumptions and intentions expressed in such forward-looking statements. All of the forward-looking statements made in this press release are qualified by these cautionary statements and those made in our other filings with the securities regulators of Canada. The Corporation disclaims any intention or obligation to update or revise any forward-looking statements or to explain any material difference between subsequent actual events and such forward-looking statements, except to the extent required by applicable law.