Sandstorm bullish on Turkish gold prospects

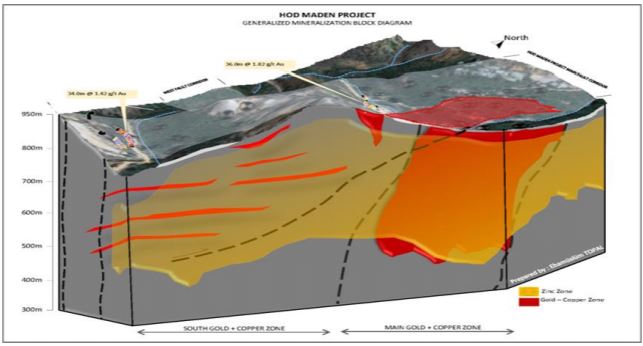

Generalised mineralization block diagram of the Hod Maden gold deposit in Turkey. Source: Sandstorm Gold Ltd.

Sandstorm Gold Ltd. [SSL-TSX, SAND-NYSE American] has released the results of a pre-feasibility study on its 30%-owned Hod Maden gold-copper project in northeastern Turkey.

The study is based on proven and probable mineral reserves of 2.61 million ounces of gold and 129,000 tonnes of copper. That material should sustain annual production of 266,000 gold equivalent ounces over a project life-span of 11 years, the study says.

Up front capital costs are estimated at US$272 million, with an all-in sustaining cost of US$374 per ounce. Gold was trading Wednesday at US$1,254.39/oz on the spot market.

“Hod Maden was discovered only three years ago and has since made remarkable progress towards production, at a pace that few projects in the mining industry could match and Sandstorm is pleased to be partnered with one of the best Turkish mining operators,” said Sandstorm President and CEO Nolan Watson in a June 26, 2018 press release.

Sandstorm shares have risen smartly on the news. After today’s $0.05 rise to $5.93, the stock is up from $5.78 on July 25, 2018. Aside from a 30% interest in Hod Maden, Sandstorm also holds a 2% net smelter royalty on the property.

Watson said the current financing plan is 65% debt financing, leaving Sandstorm’s capital contribution at less than $30 million.

The pre-feasibility study contemplates Hod Maden as an underground mine that will utilize mechanized methods, including traverse and longitudinal long hole open stoping with paste backfill.

The main area will be mined from the bottom up in primary and secondary stopes with expected production of 900,000 tonnes annually and a total of 9.1 million tonnes of ore produced during the life of the mine.

The mine will be built in nearby Salicor Valley to avoid contact with existing roads and housing. A tailings storage facility and waste dumps will be located on surface as will a main office, 120-person camp, laboratory, storage, and water treatment facilities.

Meanwhile, now that results of the pre-feasibility for Hod Maden have been released, the project can move towards the next stage of development. Majority operator Lidya Madencilik Sanayi ve Ticaret has commenced the permitting process and is currently working on a gap analysis and trade-off studies.

A feasibility study is expected to begin by the end of 2018, Sandstorm said.

Sandstorm is a royalty financing company that seeks to acquire gold and other metals purchase agreements and royalties from companies that have advanced stage projects or operating mines.

In return for making upfront payments to acquire a gold stream, Sandstorm receives the right to purchase, at a fixed price per ounce, or at a fixed percentage of the spot price, a percentage of the mine’s gold, silver and other commodity production for the life of the mine.

The company has a portfolio of over 185 royalties, producing cash flow from 20 producing mines. Other company assets include a $150 million credit facility.