Santacruz to acquire Bolivian silver mines for US$110 million

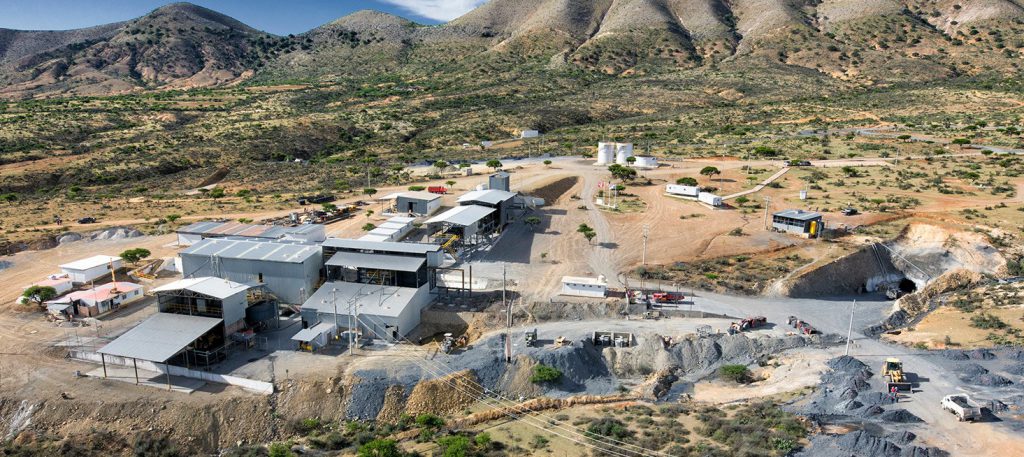

Santacruz Silver Mining Ltd. [SCZ-TSXV; 1SZ-FSE] has signed a definitive share purchase agreement with Glencore PLC [GLEN-LSE; GLN-Jo’burg; GLCNF-OTC] to acquire a portfolio of Bolivian silver assets from Glencore, including a 45% interest in the producing Bolivar and Porco mining operations held through an unincorporated joint venture with Corporacion Minera de Bolivia (COMIBOL), a Bolivian state-owned entity, a 100% interest in the Sinchi Wayra business which includes the producing Caballo Blanco mining complex, the Sorocaya project located in Bolivia and the San Lucas ore sourcing and trading business and certain related properties and assets.

Under the agreement, Santacruz will pay initial upfront consideration of US$20 million (subject to customary working capital adjustments), and an additional US$90 million is payable in equal instalments over four years from the closing of the transaction, subject to certain conditions and adjustments. In addition, Glencore will also be granted a 1.5% net smelter returns royalty on the assets.

Transaction highlights include creation of a significant Americas-focused silver producer approaching senior status, with additional significant leverage to the zinc market. It diversifies production across a robust portfolio of producing mines and creates a platform for future growth. Assets include five producing mines, two exploration projects, three milling facilities, one trading company and two power plants (thermo and hydroelectric) among the most relevant;

For the nine months ended September 30, 2021, the assets produced 6.4 million ounces silver equivalent (100% basis); immediately accretive to cash flow and all key metrics. The majority of consideration is deferred and to be financed by cash flows resulting in limited upfront dilution compared to an all-share transaction.

Arturo Prestamo Elizondo, executive chairman and interim CFO of Santacruz, said, “This is a transformational acquisition that creates a leading mid-tier silver producer in the Americas. The transaction represents a unique opportunity to significantly enhance our portfolio of operations – it is highly accretive on all key metrics and the transaction structure allows the company to finance the majority of the acquisition via the cash flow generated by these assets.”

“Santacruz shareholders will participate in a larger, more diverse silver producer with strong production growth and enhanced cash flow profile. We look forward to operating in Bolivia and partnering with COMIBOL to generate value for all stakeholders,” added Prestamo.

Carlos Silva, CEO, commented, “We are very pleased to team up with a great group of professionals in Bolivia. Glencore has performed extraordinary work on these assets while achieving very high standards in terms of responsible mining practices and its commitment to responsible business and community relations. We will ensure that this excellent legacy continues as we operate the projects in the coming years.”

It is anticipated that the closing of the transaction will take place during Q4 2021.

Maxit Capital LP is acting as financial advisor to Santacruz with DuMoulin Black LLP acting as the Company’s legal counsel. In connection with the transaction, the company has entered into a consulting services agreement with Big Buck Capital, S.C. whereby the company has agreed to pay to BBC a fee equal to US$1,320,000, being 1.2% of the transaction value.

Santacruz is a Mexican focused silver company with one producing silver project (Zimapan) and two exploration properties, the La Pechuga property and Santa Gorgonia prospect.