Suite of commodities to benefit from environmentally-driven market demand

By David Duval

Nuclear power provides about 10% of the world’s electricity from about 440 power reactors, most of which are fueled with uranium. One of the key attractions to nuclear energy is that it’s the world’s second largest source of low-carbon power, accounting for 29% of the total in 2018.

The closure of uranium mines in Canada and a reduction in production in Kazakhstan both helped push prices for the nuclear fuel to a four-year high of US$33.93/lb in May 2020. On June 10, it was US$31.60/lb. And the price appears to have room to move significantly higher in the mid to long term with about 50 more reactors under construction, equivalent to approximately 15% of existing capacity.

The uranium spot price has held firmly at around US$29/lb since September 2020 in the face of rampant global disruptions and production issues. Despite being US$21 short of the US$50 threshold often cited as the level that will incentivize projects, the U3O8 spot price was 37% higher from its January low to its 2020 May high.

Uranium is just one of the elements critical to the renewable energy revolution. The growing use of graphite in green technologies and the popularity of graphene are expected to provide attractive market opportunities for graphite manufacturers and investors over the next few years. As demand for battery-powered electric vehicles grows, graphite, an essential raw material used in EV batteries, is expected to be in high demand.

The most common EV Battery anode chemistry requires equal parts natural graphite and synthetic graphite; with the U.S. presently 100% import-dependent for natural graphite (US Geological Survey, 2021), absent significant acceleration of U.S.-based natural graphite projects and the advanced materials processing required to produce anode material, the United States will be sitting on the sideline when it comes to EV Battery manufacturing. Fortunately – see the analysis below – the U.S. has a major natural graphite project in Alaska, owned by a company laser-focused on developing a complete U.S.-based advanced graphite manufacturing supply chain.

The market for graphite is partially consolidated with the top five players of natural graphite and synthetic graphite accounting for a major share of the market in their respective fields. The Asia-Pacific region is the largest growth area for graphite.

Cobalt is an important raw material used in the production of lithium-ion battery materials, superalloys, high-temperature alloys, cutting tools, magnetic materials, petrochemical catalysts, pharmaceuticals, steels and glaze materials. Today, consumer electronics, Electric Vehicles (EVs) and Energy Storage Systems (ESS) are the dominant uses for lithium-ion batteries. Demand for cobalt is expected to escalate as EVs and Internal Combustion Engine (ICE) vehicles begin to achieve price parity over the next few years.

President Biden’s Clean Energy plan could accelerate EV demand and simultaneous renewable energy deployment/ESS rollout. Most cobalt (98%) is produced as a by-product of either nickel or copper mining and is thus incentivized by firmer nickel or copper prices rather than on its own merits. The Democratic Republic of the Congo (DRC) produces 71% of cobalt today.

Impacted by the Covid-19 pandemic and subsequent drop in global steel demand from the construction industry, demand for manganese is expected to grow as that industry recovers. Over the short term, the increasing demand for manganese in lithium-ion batteries production, owing to the rising demand for electric vehicles, is expected to drive the market’s growth. As one might expect, the Asia-Pacific region is expected to dominate the market and is also likely to witness the highest growth rates. The global construction industry is expected to reach US$8 trillion by 2030, primarily driven by countries such as India, China, and the United States.

Long known as a medicinal cure for depression, lithium’s price volatility has given investors the blues given the fact that global supplies have outstripped demand. “Lithium supply is growing far quicker than lithium demand and this can be said for all battery materials as the EV pick up rate is not expected to really start increasing until the early to mid-2020s,” said Marcel Goldenberg, manager for metals and derivatives at S&P Global Platts. However, Benchmark Mineral Intelligence forecasts improved market conditions for lithium in 2021, with the market unlikely to see the cutbacks and expansion delays it saw in 2020. Higher contract prices are expected in 2021 which could be a prelude to a sustainable spot market recovery.

In 2020 the platinum market was in deficit by 932,000 oz – the largest annual deficit on record. While the Covid-19 pandemic played a role in this deficit, production outages at the Anglo American Converter Plant (ACP) Phase B unit and reduced recycling far outweighed the pandemic-driven fall in demand from the automotive, jewelry and industrial sector. Investment demand also picked up, exacerbating the deficit.

According to CME Group, overlaying the price dynamic for platinum is its relationship with other platinum group metals (PGMs), especially palladium. PGMs are interlinked with regard to supply as well as demand, being co-products or by-products in the majority of their mining locations. They are usually recovered together as well as being recycled from many end-of-use products and substitutes for each other in several applications. CME Group is predicting a supply deficit in 2021, although not as severe as 2020.

Analysts at Metals Focus see palladium prices rising to $3,000 an ounce in 2021. On June 10, palladium was US$2,814.00/oz. Palladium is a key ingredient in gasoline engine autocatalysts which lower emissions. Automotive demand is forecast to hit a record high this year driven by strong growth in China, which represents one-third of global automotive production. In addition, the roll-out of more stringent emission legislation around the world is expected to support domestic demand, as will President Biden’s green agenda, Metals Focus says.

Rhodium prices tripled last year which must be a record for any industrial commodity. It’s known as the rarest of the platinum group metals and is mostly used in automobile catalytic converters but also as an electrical contact material and as a catalyst in making nitric acid. Spot prices for the metal touched a record high on March 23 of $29,800 an ounce based on data from John Matthey. On June 10, rhodium was priced at US$21,850.00/oz.

Rhodium saw a supply deficit of 84,000 ounces in 2020, just about doubling its deficit from 2019, as tight supplies “greatly exceeded” declines in autocatalyst and industrial demand, according to Johnson Matthey. Zaner Precious Metals sees rhodium climbing to $30,000 as a “real possibility” by year-end – and higher if the infrastructure bill passes in the U.S.

Origen Resources Inc. [ORGN-CSE; 4VX-FSE] is a mineral exploration company with a focus on project generation and exploration of key assets that span a variety of commodities and jurisdictions in Canada, including British Columbia and Newfoundland.

Origen Resources Inc. [ORGN-CSE; 4VX-FSE] is a mineral exploration company with a focus on project generation and exploration of key assets that span a variety of commodities and jurisdictions in Canada, including British Columbia and Newfoundland.

One of the world’s leading lithium suppliers – China’s Ganfeng Lithium Corp. – holds a 4.7% equity stake in Origen which recently acquired over 29,000 hectares of ground in a newly identified prospective lithium belt in Newfoundland.

The company has an attractive share structure with only 30 million shares outstanding (35 million fully diluted), and is led by a highly experienced management team. CEO Gary Schellenberg has been a director and officer of numerous publicly traded companies, including Kodiak Copper Corp. [KDK-TSXV], and International Lithium Corp. [ILC-TSXV].

Blake Morgan has 15 years of mining industry experience including 10 years dedicated to the mining and natural resource sector in Australia with Rio Tinto Plc [RIO-NYSE], BMA Metals (a subsidiary of BHP Billiton Ltd. [BHP-NYSE, BHPLF-OTCPK]) and Santos Ltd. [STO-ASX].

Returning to historically active areas to capitalize on the benefits of new technology, updated deposit models and fresh ideas is a proven strategy used by Origen’s exploration team.

Returning to historically active areas to capitalize on the benefits of new technology, updated deposit models and fresh ideas is a proven strategy used by Origen’s exploration team.

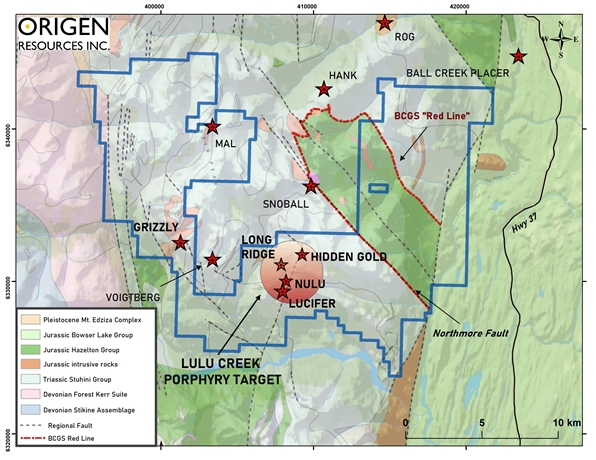

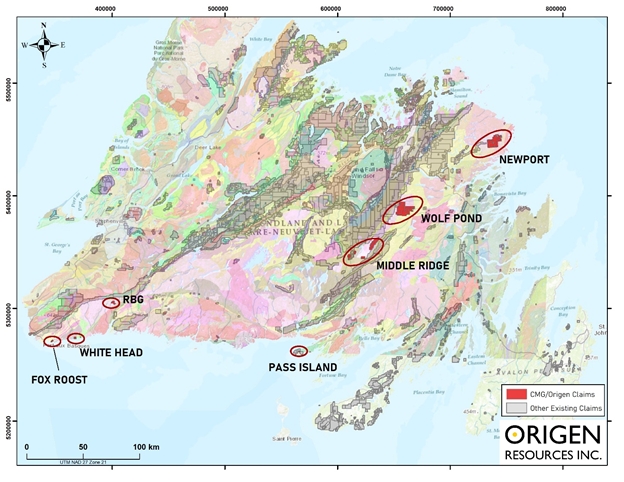

The company’s flagship assets are made up of a dominant 30,742-hectare land package in British Columbia’s mineral-endowed Golden Triangle and the Middle Ridge property in the prolific Exploits subzone gold belt in Newfoundland, home to New Found Gold Corp.’s [NFG-TSXV] Keats Zone discovery at its Queensway project.

Origen’s equity portfolio includes 3.7 million common shares of Exploits Discovery Corp. [NFLD-CSE] (market value $2,500,000) which holds a strategic land position that predates the New Found Gold discovery. It has two projects known as Mt. Peyton and Jonathan’s Pond, which are located two and 25 kilometres west and northeast respectively of New Found Gold’s Queensway discovery.

Origen recently said it has been granted drill permits for its Wishbone property in the heart of the Golden Triangle. Exploration at Wishbone is focused on a large gold-rich cirque area called the Rat, where numerous high grade gold values from rock and talus were obtained during the 2020 drilling season, and the Windy showing in the northeast, where multiple high-grade gold and silver veins occur.

Origen recently said it has been granted drill permits for its Wishbone property in the heart of the Golden Triangle. Exploration at Wishbone is focused on a large gold-rich cirque area called the Rat, where numerous high grade gold values from rock and talus were obtained during the 2020 drilling season, and the Windy showing in the northeast, where multiple high-grade gold and silver veins occur.

Work this year will include an airborne high resolution EM survey over the property that is scheduled to start in the late spring. The airborne survey will be followed by further geological mapping, sampling, and a detailed IP survey to refine drill targets ahead of a mid-season inaugural drill program consisting of a minimum of 1,500 metres.

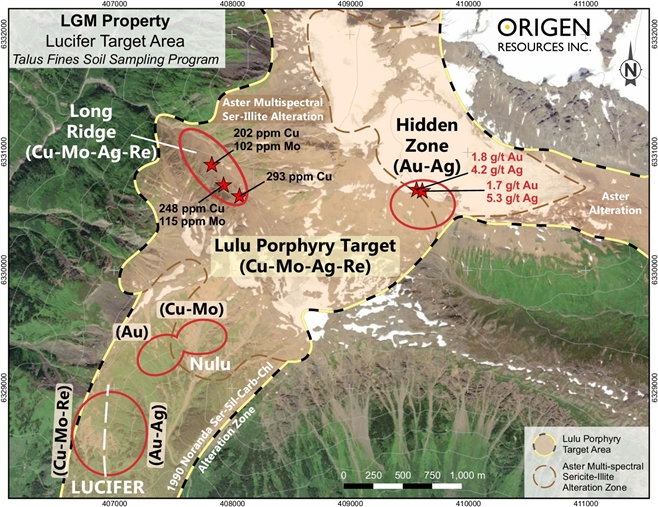

In the Golden Triangle, the portfolio includes the wholly-owned LGM Project, which covers 26,771 hectares, bordering Evergold Corp.’s [EVER-TSXV] Snoball Project, which hosts a new high-grade gold-silver epithermal vein discovery which was achieved by the company last year.

“The results from the 2020 exploration season gave Origen and our shareholders, an exceptional opportunity for discovery in 2021,” said Morgan. “With drill permits in hand we are taking the LGM property to the next stage of development this year, drilling high-grade gold and kilometre-scale copper porphyry targets,” he said. Plans include drill testing four high priority targets with a minimum of 2,000 metres and conducting IP surveys over the Lulu Porphyry target areas.

“The results from the 2020 exploration season gave Origen and our shareholders, an exceptional opportunity for discovery in 2021,” said Morgan. “With drill permits in hand we are taking the LGM property to the next stage of development this year, drilling high-grade gold and kilometre-scale copper porphyry targets,” he said. Plans include drill testing four high priority targets with a minimum of 2,000 metres and conducting IP surveys over the Lulu Porphyry target areas.

In Southern British Columbia, the portfolio includes a 100% interest in three high-grade precious and base metals projects. Of the three, Broken Handle has been optioned by Hawthorn Resources Ltd. [HAW-ASX]. Bonanza Mountain is currently optioned to Tearlach Resources. A fourth project, known as Silver Dollar is being spun out into Forty Pillars Mining Corp. (a unit of Origen), which is aiming to list its shares on the Canadian Securities Exchange.

In Newfoundland, Origen has an option to acquire a 100% interest in the 7,875-hectare Middle Ridge property located in the prolific subzone gold belt, which hosts New Found Gold’s Keats Zone gold discovery at the Queensway Project.

Much of the historical work by Noranda in the 1970s focused on base metal (volcanogenic massive sulphide) targets. Two Noranda drill holes were collared on the property and contained a number of rich quartz veins that were never assayed.

Much of the historical work by Noranda in the 1970s focused on base metal (volcanogenic massive sulphide) targets. Two Noranda drill holes were collared on the property and contained a number of rich quartz veins that were never assayed.

Origen is planning on completing an airborne VTEM survey in early 2021 over the entire claim block to aid in target generation to provide a better geological understanding.

Meanwhile, Origen secured 10 target areas with geological characteristics similar lithium pegmatite belts found in Ireland, Nova Scotia and North Carolina, Origen said it is planning to rapidly advance its newly acquired prospects to a drill stage later this season.

One of the world’s leading lithium suppliers – China’s Ganfeng Lithium Corp. – holds a 4.7% equity stake in Origen.

On July 5, 2021, the shares were trading at $0.29 cents in a 52-week range of 55 cents and 12 cents, leaving the company with a market cap of $9.35 million with 32,248,657 shares outstanding.

Graphite One Inc. [GPH-TSXV; GPHOF-OTCQX] is working to capitalize on the growing demand for high-grade coated spherical graphite from manufacturers of lithium-ion batteries that power Electric Vehicles, energy storage systems and consumer electronics applications – plus advanced graphite for 5G networks, semiconductors and a wide array of technology manufacturing.

Graphite One Inc. [GPH-TSXV; GPHOF-OTCQX] is working to capitalize on the growing demand for high-grade coated spherical graphite from manufacturers of lithium-ion batteries that power Electric Vehicles, energy storage systems and consumer electronics applications – plus advanced graphite for 5G networks, semiconductors and a wide array of technology manufacturing.

With the new IEA (International Energy Agency) Report projecting global graphite demand will rise by a factor of 25 between 2020 and 2040, there’s a world of opportunity waiting for Graphite One’s advanced graphite materials.

Graphite One’s aim is to become a vertically integrated American supplier, mining graphite from its flagship Graphite Creek Property in Alaska, the largest natural graphite in North America, producing concentrates at the mine site and shipping that material to a U.S.-based manufacturing facility.

Situated in western Alaska, about 50 kilometres north of Nome, Graphite Creek was recently designated a high-priority infrastructure project by the U.S. Government. The Biden Administration’s new supply chain report features graphite prominently essential to 21st Century technologies and the renewable energy transition.

Alaska Governor Mike Dunleavy, who nominated Graphite One for high-priority status, said the designation sends a strong signal that the U.S. intends to end the days of its 100% import-dependency for this increasingly critical mineral.

As noted in the introduction, U.S. graphite production is presently zero, with China the world’s leading provider. So if electric vehicle manufacturers like Tesla Motors Ltd. [TSLA-NASDAQ], Ford Motor [F-NYSE] and Volkswagen succeed in meeting just a fraction of their widely publicized sales targets, more graphite mines will be needed to support the required lithium-ion battery production.

As noted in the introduction, U.S. graphite production is presently zero, with China the world’s leading provider. So if electric vehicle manufacturers like Tesla Motors Ltd. [TSLA-NASDAQ], Ford Motor [F-NYSE] and Volkswagen succeed in meeting just a fraction of their widely publicized sales targets, more graphite mines will be needed to support the required lithium-ion battery production.

Graphite One President and CEO Anthony Huston has said at least five new mines may be required to meet future demand. What sets Graphite One apart is the company’s plan to build a complete U.S.-based supply chain from mine to advanced material.

Graphite One aims to emerge as a dominant producer in North America by exploiting the unique properties of material that could be mined from his company’s Graphite Creek project. It already ranks as America’s highest grade and largest know flake graphite deposit.

Having already seen intermittent production since the early 1900s, Graphite Creek hosts a NI 43-101 compliant measured and indicated resource of 10.95 million tonnes of grade 8.0% graphitic carbon (Cg) or 850,534 tonnes of contained graphite. On top of that is an inferred resource of 91.89 million tonnes at 8.0% Gg or 7.34 million tonnes of contained graphite. G1 is projecting a 20-year mine life – based on exploration of just 20% of the drill strike.

In addition to the deposit’s grade and size, Graphite Creek hosts material of an unusual morphology:Â semi-spheroidal – potato-shaped – graphite that will make spheroidization for Li-Ion Battery applications more efficient and less process-intensive.

Based on those conclusions, the company moved to trademark the term STAX, an acronym for material that is in its natural state Spheroidal, Thin, Aggregate, and expanded.

A 2017 preliminary economic analysis concluded that 44 million tonnes of graphite mineralization would be available for mining at Graphite Creek, enough material to support producing 50,000 tonnes per year of graphite concentrate. At full production, the manufacturing plant is expected to convert those concentrates into more than 40,000 tonnes per year of CSG and nearly 10,000 tonnes per year of purified graphite powders.

A 2017 preliminary economic analysis concluded that 44 million tonnes of graphite mineralization would be available for mining at Graphite Creek, enough material to support producing 50,000 tonnes per year of graphite concentrate. At full production, the manufacturing plant is expected to convert those concentrates into more than 40,000 tonnes per year of CSG and nearly 10,000 tonnes per year of purified graphite powders.

Having recently raised $10 million from two private placement offerings, Graphite One is working to complete its preliminary Feasibility Study in fourth quarter 2021. While the PFS analysis requires no additional drilling, Graphite One is working to accelerate its development as the company plans to execute a 3,000-metre HQ core drilling program at Graphite Creek in a bid to expand the measured and indicated resources at the site, with the work scheduled to begin in July 2021.

Graphite One’s potential is catching the eye of the graphite sector’s top talent.

Zhengli (Andrew) Tan was recently named Director, Graphite Product Manufacturing at Graphite One. He will focus on the company’s plan to manufacture high grade Coated Spherical Graphite. Since 2013, Tan has been an independent consultant to the carbon and graphite materials industry, advising companies on graphite materials manufacturing.

On July 5, 2021, Graphite One shares were trading at $1.03 in a 52-week range of $2.40 and 35.5 cents, putting the company’s market cap at $67.8 million, based on 65.2 million shares outstanding.

South Star Battery Metals Corp. [STS-TSXV; STSBF-OTCQB], formerly South Star Mining, is planning to place the first new graphite mine in continuous commercial production in the Americas in over a decade, with operations scheduled to begin in 2022. The Santa Cruz Graphite Project is located in the State of Bahia, Brazil, one of the most prospective graphite belts in the country, and has an estimated Proven and Probable Reserve of 12.3 Mt at 2.40% Cg and a Measured and Indicated Resource of 14.9 Mt at 2.29% Cg (as of 2020 PFS).

South Star Battery Metals Corp. [STS-TSXV; STSBF-OTCQB], formerly South Star Mining, is planning to place the first new graphite mine in continuous commercial production in the Americas in over a decade, with operations scheduled to begin in 2022. The Santa Cruz Graphite Project is located in the State of Bahia, Brazil, one of the most prospective graphite belts in the country, and has an estimated Proven and Probable Reserve of 12.3 Mt at 2.40% Cg and a Measured and Indicated Resource of 14.9 Mt at 2.29% Cg (as of 2020 PFS).

The project consists of 13 approved exploration licenses covering 13,000 ha. There is a large geologic upside with only 5% of the total land package explored to date and 10-15 drill-ready targets. Key advantages include at-surface mineralization, low-strip ratios in friable, oxide materials, which require no drilling and blasting. The orebody is a world-class jumbo and large flake deposit with approx. 64% of the volume greater than 80 mesh.

The plan is to develop the project in two phases. The first is a 5,000 tonne-per-year pilot plant operation that is expected to require a capital expenditure of US$8 million in the first two years, followed by a larger 25,000 tpy Phase 2 operation requiring a CAPEX of US$27 million.

South Star has all the required Phase 1 permits and licenses, and construction and commissioning are expected to take approximately 12 months. Phase 2 licensing and permitting are underway too.

South Star has all the required Phase 1 permits and licenses, and construction and commissioning are expected to take approximately 12 months. Phase 2 licensing and permitting are underway too.

The project has many advantages including first quartile operational costs, extremely low capital intensity, excellent infrastructure, and experienced workforce.

Santa Cruz presents South Star with a rare opportunity to become a leading supplier of graphite, a mineral that has long been associated with industrial uses, but is also a key ingredient in the production of electric vehicles as the principal anode material in a lithium-ion battery and its single largest component by weight. There are no substitutes, and almost all of it currently comes from China.

Benchmark Minerals Intelligence estimates global EV sales to reach 25-30 million by 2030 and on average contain 85-115 kg of flake graphite per vehicle. The global demand for concentrate is expected to grow over 340% by 2030.

“Once our Phase 1 plant is operational, we can add further capabilities downstream of the concentration facilities and produce a broad array of products in high-demand sectors. The growth potential is enormous with prices ranging from $3,000 to $18,000 per tonne. The Phase 2 plant can then be sized, and construction based on real commercial relationships and market demand,” said CEO Richard Pearce.

The management team consists of extremely experienced mine builders, operators and financiers with decades of taking projects from discovery to profitable operations. South Star is committed to a corporate culture, project execution plan and safe operations that embrace the highest standards of ESG principles.

The management team consists of extremely experienced mine builders, operators and financiers with decades of taking projects from discovery to profitable operations. South Star is committed to a corporate culture, project execution plan and safe operations that embrace the highest standards of ESG principles.

A perfect storm is forming for battery metals, and graphite is the best positioned mineral to take advantage of the EV revolution. The current market dynamics and timing enable South Star Battery Metals to capitalize on that.