Uranium: a carbon-free solution for base load power

By Ellsworth Dickson

The ability of uranium to generate a great deal of electric power is remarkable. For example, a typical pellet of uranium weighs about 7 grams (0.24 ounces) and can generate as much energy as 3.5 barrels of oil, 17,000 cubic feet of natural gas, or 1,780 pounds of coal.

Canada, Australia, Kazakhstan, Niger, Russia and Namibia are the world’s leading producers, accounting for approximately 84% of global mine production. In 2019, world production of uranium was 54,752 tonnes which was only 81% of global demand.

According to a report by the World Nuclear Association, over two-thirds of the world’s production of uranium from mines is from Kazakhstan, Canada and Australia. The WNA report stated that mining methods have been changing. In 1990, 55% of world production came from underground mines, but this shrank dramatically to 33% by 1999. In situ leach (ISL, also called in situ recovery, ISR) mining has been steadily increasing its share of the total, mainly due to Kazakhstan, and in 2019 accounted for over half of production.

In an interview, Stephen G. Roman, Chairman, President and CEO of Global Atomic Corporation, said that the uranium sector is currently flirting at the edges of a bull market. “The uranium price has moved up from recent lows of US$18 to about US$30 a pound. I believe the bull market will start when the uranium price starts to move higher; however, uranium company shares have begun to move higher in anticipation of rising uranium prices.”

The uranium price is determined by supply and demand. “Nuclear power utilities drive the price since they require the uranium to power their nuclear reactors to generate electricity,” noted Roman. “Typically, they would have contracts signed for a term supply of 10 years. When they need to top up their supply, they sign new contracts. Uranium has a market with a spot price and a term price. Utilities try to blend their supply with both spot and term market uranium to achieve the best value and not get caught short of fuel, since reactors need to be fed on a steady basis. For the past number of years, much of their buying has been out of the spot market.”

Term prices are negotiated between a utility and a miner for a fixed price over a specific length of time, typically 10 years, with the ability to negotiate prices depending on market conditions.

“Some uranium miners that have curtailed or reduced production due to the COVID-19 pandemic will need higher prices to incentivize production increases,” Roman said. “Most of the new projects being developed will require uranium prices higher than US$50 a pound to make production decisions.”

He speculated that big companies such as Cameco and Kazatomprom that can produce uranium at reasonable prices, say below US$40 a pound, would be able to turn on some of that production.

Roman expects the big driver in the next market will be new reactor construction. “There are currently 55 reactors in the world being built and another 30 to 40 reactors expected to be built before the end of the decade,” he commented. “These new reactors are adding to the fleet of reactors that are already in service. They will need to find reliable fuel supplies as well. The big issue is the high cost to produce new uranium. The price needs to move up significantly before you would see much new production coming on stream.”

“I believe the new reactors coming on line over the next decade will prolong the deficit. A great deal of the world’s previous surplus has dried up,” said Roman. He is of the view that nuclear power will play a major part in the planet’s carbon-free plans. Nuclear provides a base load of reliable electricity that is carbon-free which would be augmented with wind and solar power.

“To have reliable power not dependent on the weather or daylight, you need to have a nuclear component,” Roman said. “Reactor design over the last 40 years has advanced tremendously. They are safe, clean and the risk of another Fukushima has been drastically reduced.”

He said the other major reactor advancement coming to the market are small, modular reactors – the SMRs. “Many countries, including Canada, are studying them and will have prototypes running this decade. These small reactors can power towns and villages anywhere, safely and efficiently without stringing power lines across the country. There is a great deal of development happening in the nuclear sector now as part of the world vision to achieve the goal of net carbon zero by 2050.”

Blue Sky Uranium Corp. has made a major uranium discovery with vanadium credits in Argentina where the company has completed a positive PEA; this, in a country with three nuclear reactors but no uranium production.

Skyharbour Resources Ltd. is active with six uranium projects in northern Saskatchewan’s Athabasca basin – host to the world’s highest grade uranium mines.

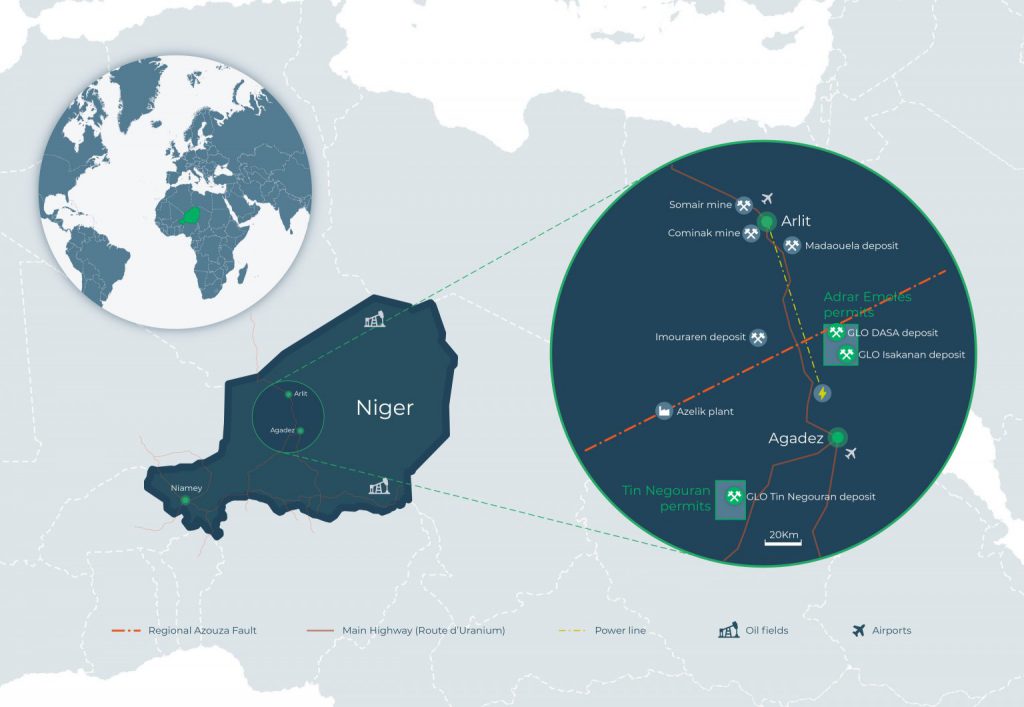

Global Atomic Corporation recently acquired a mining permit for its flagship Dasa Uranium Project, located in the West African Republic of Niger, the world’s fourth largest producer, and a country with 4% of world uranium resources (276,800 tonnes).

The combination of an ongoing global uranium deficit, increasing demand by additional reactors coming on line and a climate action drive for a carbon-free future will lend impetus to increasing uranium prices and more exploration.

Skyharbour Resources Ltd. [SYH-TSXV; SYHBF-OTCQB] offers investors exposure to a large property portfolio of six projects covering over 240,000 hectares (590,000 acres) in northern Saskatchewan’s Athabasca Basin, home of the world’s richest uranium deposits.

Skyharbour Resources Ltd. [SYH-TSXV; SYHBF-OTCQB] offers investors exposure to a large property portfolio of six projects covering over 240,000 hectares (590,000 acres) in northern Saskatchewan’s Athabasca Basin, home of the world’s richest uranium deposits.

It is a portfolio that puts the company in a position to benefit from the feedstock role that uranium plays while catering to the rising global demand for nuclear power. Nuclear Energy creates safe, reliable, carbon-free electricity that is being increasingly utilized by governments around the world to decarbonize their power grids.

On January 8, 2021, the shares were trading at 30 cents in a 52-week range of 32.5 cents and $0.08.

Skyharbour is led by an experienced management team and is currently engaged in strategic partnerships with Denison Mines Corp. [DML-TSX, DNN-NYSE] and Orano Canada Inc., a unit of France’s largest uranium mining and nuclear fuel company.

Denison holds a large equity interest in Skyharbour, which is currently focused on expanding known zones of high-grade uranium mineralization and finding new deposits on the 35,700-hectare Moore Uranium project.

The Moore Uranium Project is the company’s flagship property. It is located on the southeast side of the Athabasca Basin, approximately 15 kilometres east of Denison’s Wheeler River Uranium Project and 39 kilometres south of Cameco Corp.’s [CCO-TSX; CCJ-NYSE] McArthur River mine.

The Moore Uranium Project is the company’s flagship property. It is located on the southeast side of the Athabasca Basin, approximately 15 kilometres east of Denison’s Wheeler River Uranium Project and 39 kilometres south of Cameco Corp.’s [CCO-TSX; CCJ-NYSE] McArthur River mine.

Moore Uranium is an advanced stage exploration project which hosts several high-grade uranium pods called along the Maverick Conductive Corridor. Historical drill results include 6.0% U3O8 over 5.9 metres, including 20.8% U3O8 over 1.5 metres at a depth of 265 metres.

After drill results were recently announced at Moore, Skyharbour President and CEO Jordan Trimble stated: “We are very pleased with the results from this most recent drill program at our flagship Moore Project as we continue to discover new high-grade uranium mineralization at the Maverick Corridor in relatively wide intercepts of continuous mineralization. We will be commencing a winter drill program to follow up on these results and test more extensively the highly prospective potential feeder zones in the basement rock at the Maverick Corridor. Skyharbour is very well positioned to benefit from the accelerating uranium market recovery with strong discovery potential and upcoming news flow from its continued drilling at Moore.

As Skyharbour leverages and monetizes its property portfolio using the prospect generator model, it can advance Moore Uranium while partner companies fund exploration and development at other projects it owns. It is a cost-effective model that facilitates large exploration programs without substantial equity dilution.

For example, Skyharbour has option agreements with Orano Canada Inc. and Azincourt Energy Corp. [AAZ-TSXV; AZURF-OTC] on the Preston and East Preston Projects respectively, which collectively cover one of the largest land positions in the Paterson Lake region (4,965 hectares).

It is located near NexGen Energy Ltd.’s [NXE-TSX, NYSE] high-grade Arrow deposit, Fission Uranium Corp.’s [FCU-TSX] Triple R deposit and the Spitfire high-grade discovery on the Hook Lake Project, which is owned jointly by Cameco Corp., Orano Canada, and Purepoint Uranium Group Inc. [PTU-TSXV].

Orano can earn up to a 70% interest in the 49,645-hectare Preston Project by spending $8 million over six years. They are currently about halfway through that earn-in having completed several exploration programs over the last several years.

Meanwhile, Azincourt can earn a 70% stake in the 25,329-hectare East Preston Project. To exercise the option, Azincourt was required to issue 4.5 million shares, spend $2.5 million on exploration, and deliver $1 million of cash payments to Skyharbour and Dixie Gold. If carried to completion, another tripartite joint venture would be formed with Azincourt holding 70% and Skyharbour and Dixie Gold sharing the remaining 30%.

The Skyharbour portfolio also includes a 100% interest in the South Falcon Uranium Project on the eastern perimeter of the Athabasca Basim. The project contains an NI 43-101 inferred resource of 7.0 million pounds of U3O8 at 0.03%, and 5.3 million pounds of ThO2 at 0.023%.

Recently, Skyharbour signed a definitive agreement with Australian company Pitchblende Energy Pty Ltd., (currently being acquired by ASX-listed Valor Resources) on its North Falcon Point Uranium Project. Under the agreement, Pitchblende can earn-in 80% of the project by spending $3.5 million on exploration and delivering $475,000 in cash payments over three years as well as 233 million shares of Valor.

Skyharbour President and CEO Jordan Trimble recently stated: “We are excited to have the opportunity to work with new partners in Pitchblende and Valor led by experienced management and technical teams at our North Falcon Point Project while maintaining a 100% interest at the Fraser Lakes Uranium and Thorium deposit at the South Falcon Point Project. Skyharbour continues to execute on its business model by adding value to its project base in the Athabasca Basin through strategic partnerships and focused mineral exploration.”

Blue Sky Uranium Corp. [BSK-TSXV; BKUCF-OTCQB; MAL2-FSE] is a leader in the field of uranium exploration. It is also a company that offers investors a window on vanadium, a strategic metal in the United States that has applications in both steel and battery production.

Blue Sky Uranium Corp. [BSK-TSXV; BKUCF-OTCQB; MAL2-FSE] is a leader in the field of uranium exploration. It is also a company that offers investors a window on vanadium, a strategic metal in the United States that has applications in both steel and battery production.

One of the company’s key goals is to produce uranium in Argentina, a South American country that currently lacks the domestic production to support the expansion of its nuclear energy sector.

Any sign of progress on either fronts would likely be positive for Blue Sky shares which were trading on January 8, 2020 at 16.5 cents, leaving the company with a market cap of just under $20 million, based on roughly 120 million shares outstanding.

Blue Sky’s exploration and development strategy is led by a highly experienced management team that includes President and founder Joe Grosso, who has been active in Argentina since the country opened its mining sector to foreign investment in 1993.

Using his experience and connections, Blue Sky discovered a new uranium district in Rio Negro Province in the Patagonia region of southern Argentina. The 100%-owned Amarillo Grande Project (AGP) covers 300,000 hectares, and contains the Ivana near-surface deposit, which hosts the largest NI 43-101 compliant uranium resource in the country.

Using his experience and connections, Blue Sky discovered a new uranium district in Rio Negro Province in the Patagonia region of southern Argentina. The 100%-owned Amarillo Grande Project (AGP) covers 300,000 hectares, and contains the Ivana near-surface deposit, which hosts the largest NI 43-101 compliant uranium resource in the country.

AGP includes several major target areas over a regional trend, with uranium and vanadium mineralization in loosely consolidated sandstones and conglomerates, at or near surface. The area is flat-lying, semi-arid and accessible year-round, with nearby rail, power and port access.

A positive preliminary economic assessment announced in February, 2019, envisages a surface mining operation that would deliver mill feed to a nearby processing plant or stockpiles at an annual rate of 4.7 million tonnes per year (13,000 tonnes per day).

According to the PEA, a future mining operation could produce 17.5 million pounds of uranium and 6.0 million pounds of vanadium over a projected mine life of 13 years. Annual uranium production is expected to be 1.35 million pounds.

The pre-production capital for such an operation is estimated at US$128.05 million, plus US$35.46 million of sustaining capital.

However, the Ivana deposit covers only a small fraction of the AGP property and the company is currently working to identify multiple new zones of uranium-vanadium mineralization throughout the large project area.

That optimism is based in part on a detailed review and reinterpretation of over 14 years of geological data which has outlined two areas that are thought to have the potential to host uranium-vanadium mineralization that is similar to Ivana.

The company recently said it is proceeding with the necessary steps to permit initial drill testing of the two newly prioritized target areas, including the Cateo Cuatro Target located 32 kilometres southwest of the Ivana deposit and the Ivana East target, which is located 10 kilometres northeast of the Ivana deposit. Blue Sky is permitted to drill on Ivana Central and Ivana Norte where the upcoming drill program will start. While drilling these targets, the company expects to receive the permits for drilling the Ivana East and Cateo Cuatro targets. “With the expansion upside at Ivana and the discovery potential for new uranium and vanadium resources throughout the district-scale property, we expect Amarillo Grande to continue to improve its value proposition,” said Blue Sky President and CEO Nikolaos Cacos.

The company recently said it is proceeding with the necessary steps to permit initial drill testing of the two newly prioritized target areas, including the Cateo Cuatro Target located 32 kilometres southwest of the Ivana deposit and the Ivana East target, which is located 10 kilometres northeast of the Ivana deposit. Blue Sky is permitted to drill on Ivana Central and Ivana Norte where the upcoming drill program will start. While drilling these targets, the company expects to receive the permits for drilling the Ivana East and Cateo Cuatro targets. “With the expansion upside at Ivana and the discovery potential for new uranium and vanadium resources throughout the district-scale property, we expect Amarillo Grande to continue to improve its value proposition,” said Blue Sky President and CEO Nikolaos Cacos.

In order to fund that effort, Blue Sky recently said it is raising $5.46 million from a private placement of 42 million units priced at 13 cents per unit.

Each unit will consist of one common share and one transferrable common share purchase warrant. The warrants entitle the holder to buy one additional common share for $0.25 per share for three years from the date of issue.

Global Atomic Corporation [GLO-TSX; GLATF-OTCQX; G12-FSE] is a company that offers investors a unique combination of high-grade uranium development and cash flow from its expanded and modernized recycling facility in Turkey that produces zinc concentrate.

Global Atomic Corporation [GLO-TSX; GLATF-OTCQX; G12-FSE] is a company that offers investors a unique combination of high-grade uranium development and cash flow from its expanded and modernized recycling facility in Turkey that produces zinc concentrate.

But what really sets this company apart from its competitors is the recently acquired mining permit for its flagship Dasa Uranium Project located in the West African Republic of Niger.

The fact that the permit is now in place raises the possibility that the company could be in production with its own mine and processing operation in a recovering uranium market.

It’s a scenario that could be a huge win, not only for investors, but also for Global Atomic President and CEO Stephen G. Roman, who has a deep background in the uranium sector dating back to the 1960s when his father ran Denison Mines Limited and its operations at Elliot Lake, Ontario.

The uranium industry has been struggling since a 2011 earthquake and tsunami in Japan disabled three reactors at the Fukushima nuclear plant, causing their cores to melt down, forcing Japan to shut down 50 nuclear reactors that remained intact.

The devastating repercussions in Japan sent uranium prices tumbling from US$72.63 a pound, and convinced some countries to decommission their nuclear reactors and switch to other fuels.

But the spot price has rebounded to US$30.40 a pound from a low of US$18 a pound in November 2016, and Roman expects to see further recovery in the next two or three years. Any increase would likely have positive implications for the company’s shares, which on January 12 were trading at $1.47 in a 52-week range of $1.68 and 23 cents.

“Despite current low spot prices, future uranium market fundamentals are encouraging, driven by robust demand for nuclear power generation and the pressing need for scalable low-carbon energy sources,” Roman has said.

Global Atomic aims to capitalize by developing the Dasa Project, a large, high-grade uranium deposit situated 105 kilometres south of the established uranium mining town of Arlit. Global resources at the site are estimated to be in excess of 250 million pounds of U3O8.

Roman has indicated that the company could develop the project in stages in order to keep start-up capital expenditures low. A preliminary economic assessment announced in May, 2020, focuses on Phase 1 of a larger mine development at Dasa that would target profitable production over a 12-year mine life with annual production of 4.4 million pounds.

“The study demonstrates that the Dasa Project can be a significant new supplier of uranium in the form of yellowcake even in this low uranium price environment,” the company said. “Over an optimized Phase 1 mine plan, using a base uranium price of US$35 per pound, the operation generates an after-tax NPV of US$211 million or an IRR of 26.6% at an all-in-sustaining cost of US$18.39 a pound.

The initial cash cost is estimated at US$203 million, including a 20% contingency.

With an eye to reducing the initial capital needed to bring Dasa into production, Global Atomic has been in discussions with Orano Mining regarding the possible delivery of uranium-bearing ore from its Dasa Project to Orano’s Somair facility for processing.

With an eye to reducing the initial capital needed to bring Dasa into production, Global Atomic has been in discussions with Orano Mining regarding the possible delivery of uranium-bearing ore from its Dasa Project to Orano’s Somair facility for processing.

Orano Mining, formerly known as AREVA, is France’s largest uranium mining and nuclear fuel company.

In 2017, Global Atomic signed a memorandum of understanding with Orano Mining to supply a minimum of 100,000 tonnes per year for five years of uranium-bearing rock to Orano’s operations in Arlit, about 100 kilometres north of Dasa. However, its ultimate goal is to have its own processing facility on site.

Global Atomic’s other key asset is a 49% interest in the Befesa Silvermet Turkey SL (BST) which has the capacity to process 110,000 tonnes per annum of electric arc furnace dust (EAFD), which can produce 50 to 60 million pounds of payable zinc concentrate.

The company’s share of the Turkish joint venture EBITDA (earnings before interest, tax, depreciation and amortization) was $5.9 million in the first nine months of 2020. The company has said the outlook for the zinc recycling business is improving due to rising prices and the continuing recovery of the Turkish steel industry.

The company’s share of the Turkish joint venture EBITDA (earnings before interest, tax, depreciation and amortization) was $5.9 million in the first nine months of 2020. The company has said the outlook for the zinc recycling business is improving due to rising prices and the continuing recovery of the Turkish steel industry.