Western USA: treasure chest for the nation

By Ellsworth Dickson

West of the Mississippi, historically, there have been huge metal discoveries and staking rushes such as the Comstock Lode and the 1849 California Gold Rush, In more recent years, Vancouver`s Chester Millar pioneered the heap leach gold recovery process in southeastern California at Glamis Gold’s successful Picacho Gold Mine – a technology now commonly used everywhere.

Today, the Western USA continues to be one of the world’s important mineral producers and a favourite destination for Canadian investment for its prospectivity, secure mineral tenure and ease of access (not counting the temporary COVID-19 restrictions for Canadians with US projects). There are far too many companies to cover; we can only hit a few highlights.

In the northwest, the famous Coeur d’Alene District of northern Idaho has produced tremendous quantities of silver, lead and zinc – and still does at Hecla Mining’s Lucky Friday Mine that has been in production for almost 80 years.

However, the real star of the Western USA is Nevada – the biggest gold producer in the United States. The Nevada Bureau of Mines and Geology has published an official report on the Silver State’s mining operations – Major Mines of Nevada. As reported in the publication, Nevada’s mining industry recorded approximately US$8.1 billion in total value of all commodities in 2019, representing a 3.8% decrease from the US$8.42 billion value recorded in 2018. Nearly 85% of all value was driven by gold and silver, which contributed over US$7.1 billion, based on the actual gross proceeds reported to the Nevada Department of taxation.

According to the U.S. Geological Survey, Nevada remains the nation’s top gold producer with about 87% (173 tonnes) of the U.S. total (200 tonnes) and would rank fifth in world gold production, behind China (420), Australia (330), Russia (310) and Canada (180).

Nevada is also the scene of numerous exploration ventures seeking gold, silver and copper.

In western Nevada, the flagship project of Eros Resources Corp. is the Bell Mountain Gold Project where a positive preliminary economic assessment (PEA) was completed in 2017. The gold deposits are amenable to heap leaching – see profile below.

Gold79 Mines Ltd. [AUU-TSXV] is exploring three gold projects; two in Nevada – the Jefferson Canyon and Tip Top gold projects and a third located in Arizona – the Gold Chain Project – see profile below.

Goldcliff Resource Corp. [GCN-TSXV; GCFFF-OTCBB] has a 100% option agreement with Ely Gold Royalties Inc. [ELY-TSXV; ELYGF-OTCQB] to acquire the Aurora West property in Mineral County.

Nevada Copper Corp. [NCU-TSX] owns the Pumpkin Hollow Mine 100 miles southeast of Reno, an underground operation now in production and an open pit development.

Hard rock mining in Arizona generates US$4.29 billion that includes US$482 million in company and employee taxes from a total payroll of US$1.23 billion. In fact, 66% of U.S. copper output came from Arizona in 2018. If Arizona were a country, it would be the seventh largest producer of copper in the entire world. The state consistently produces between 70,000 and 80,000 tonnes of copper per month.

However, Arizona has been a significant gold producer as well. To the end of 2019, Arizona has produced more than 16 million troy ounces (498 tonnes) of gold with a large part a by-product of copper mining.

Northern Vertex Mining Corp. [NEE-TSXV; NHVCF-OTC] reported production of 12,401 gold equivalent ounces for Q4 2020 at its Moss Mine in the Oatman District, northwest Arizona.

Taseko Mines Ltd. [TKO-TSX, LSE; TGB-NYSE American] is in the permitting stage for its in-situ Florence Copper Project 65 miles southeast of Phoenix.

In southeast California, Equinox Gold Corp. [EQX-TSX; NYSE American] produced 141,300 ounces of gold in 2020 from its 100%-owned Mesquite Mine in Imperial County. The company’s Castle Mountain Mine on the Nevada border produced 5,300 ounces after declaring commercial production in late November 2020. It is expected the mine will produce some 200,000 ounces of gold annually.

Also in southeast California, Southern Empire Resources Corp. [SMP-TSXV] is exploring the past-producing Oro Cruz mine and the adjacent 100%-owned American Girl mine property where significant historical gold resource remain from previous operations – see profile below.

Up in the Motherlode country, Providence Gold Mines Inc. [PHD-TSXV] is exploring the optioned Tuolumne property that hosted a past-producing gold mine.

In Custer County, south-central Colorado, Viscount Mining Corp. [VML-TSXV; VLMGF-OTCQB] recently drilled 702.7 g/t silver over 14.9 metres, including 1,259 g/t silver over 7.6 metres at its Silver Cliff Project.

In northeast Washington State, Adamera Minerals Corp. [ADZ-TSXV; DDNFF-OTC] formed a joint venture with senior mining company Hochschild Mining LLC to finance exploration on its Cooke Mountain gold project.

In Oregon, Paramount Gold Nevada Corp. [PZG-NYSE American] recently filed a Feasibility Study for the proposed high-grade, underground mining operation at its Grassy Mountain gold project 22 miles southwest of Vale, eastern Oregon.

There is much exploration and mining activity in the Western United States and, despite some slowdowns due to the COVID-19 virus, many projects are advancing.

Southern Empire Resources Corp. [SMP-TSXV; SMPEF-OTC; 5RE-FSE] is focused on the acquisition, exploration, and development of gold deposits in North America.

Southern Empire Resources Corp. [SMP-TSXV; SMPEF-OTC; 5RE-FSE] is focused on the acquisition, exploration, and development of gold deposits in North America.

Southern Empire is led by legendary geologist Ron Netolitzky and Dale Wallster, Chairman and CEO respectively. Both have long careers with significant mineral deposit discoveries and subsequent takeovers by major mining companies.

SMP is exploring the past-producing 2,160-hectare (5,338-acre) Oro Cruz mine and the adjacent 100%-owned American Girl mine property (collectively the “Oro Cruz Gold Project”), located in the Cargo Muchacho Mountains of southeastern California. The Oro Cruz Gold Project is 22.5 km (14 miles) southeast of Equinox Gold Corp.’s operating Mesquite gold mine and 25 km north from the City of Yuma, Arizona.

Southern Empire’s management strongly believes that they can find significant gold mineralization on the Oro Cruz Gold Project, where extensive historical large-scale open-pit and underground mining of the American Girl, Padre y Madre, Queen and Cross oxide gold deposits occurred between 1987 and 1996. During that period, gold was recovered by both heap leaching of lower-grade and milling of higher-grade material until declining gold prices curtailed mining operations in 1996.

At closure, the Oro Cruz mine still had many gold targets yet to be fully tested and Southern Empire believes it can add significantly to the existing historical inferred resource, estimated at 341,800 ounces of gold based on 4,386,000 tonnes averaging 2.2 g/t gold at a cut-off grade of 0.68 g/t gold (4,835,000 tons at 0.07 oz/ton gold). Based on impressive historical drill results such as 10.7 metres of 20.9 g/t gold and 12.2 metres of 13.4 g/t gold, company geologists are of the view that there is still a great deal of gold to be discovered in the untested down-dip extensions of the historical inferred resources and elsewhere on the property.

At closure, the Oro Cruz mine still had many gold targets yet to be fully tested and Southern Empire believes it can add significantly to the existing historical inferred resource, estimated at 341,800 ounces of gold based on 4,386,000 tonnes averaging 2.2 g/t gold at a cut-off grade of 0.68 g/t gold (4,835,000 tons at 0.07 oz/ton gold). Based on impressive historical drill results such as 10.7 metres of 20.9 g/t gold and 12.2 metres of 13.4 g/t gold, company geologists are of the view that there is still a great deal of gold to be discovered in the untested down-dip extensions of the historical inferred resources and elsewhere on the property.

There is also gold remaining in the old heap leach pads and waste rocks dumps that could generate early cash flow. Southern Empire has shipped samples from its recently completed first phase sonic drill program of 20 holes on the two historical heap leach pads. In addition, airborne magnetic and radiometric geophysical surveys have been flown over the entire property and surface and underground LiDAR surveys have been recently completed at Oro Cruz.

Being a past producer, Southern Empire has a head start in development. Existing infrastructure, including paved road access, a high voltage power transmission line, existing historical heap leach pads, some 3 km of underground development and a local skilled work force already exist.

In January 2021, Southern Empire received a positive decision letter from the U.S. Department of the Interior’s Bureau of Land Management (BLM) for its Oro Cruz exploration Plan of Operations. The BLM’s review of Southern Empire’s exploration plan determined that the plan is consistent with U.S. federal surface management regulations and meets the requisite content requirements. This important BLM decision allows for the initiation of the environmental review process and a public comment period before the BLM makes a final approval decision regarding Southern Empire’s proposed exploration.

Once final permitting is in hand, Southern Empire’s 2021 exploration plans include the establishment of 65 drill pads for Reverse Circulation (RC) and/or core drilling in seven target areas and associated temporary access road construction.

Other objectives of SMP’s 2021 exploration include geochemical and geophysical surveys, geological mapping of the open pits and underground workings to identify more drill targets areas and defining a compliant resource for the unrecovered gold hosted in the old heap leach pads. Metallurgical studies are also planned.

Another key asset of Southern Empire is its significant shareholdings in Augusta Gold Corp. [G-CSE; formerly Bullfrog Gold] of 1,625,000 Augusta shares and 1,125,000 warrants, together worth approximately $5 million. Barrick Gold is a large shareholder (15.3%) of Augusta Gold and Richard Warke’s holding company recently completed a $22 million financing in Augusta, which has an advanced gold project in Nevada.

Southern Empire is fortunate to have acquired the very prospective, past-producing Oro Cruz and American Girl properties situated in the Caborca Orogenic Gold Belt; geology that is host to successful gold mining operations such as Fresnillo Plc’s prolific Herradura mine (2019 gold production of 482,722 oz) and Equinox Gold’s Mesquite mine (2020 gold production of 141,300 oz).

Southern Empire Resources has 50,906,800 shares issued and outstanding and working capital of about $9.65 million (approximately $0.29 per share) as of February 16, 2021; truly a “Value Proposition”.

Eros Resources Corp. [ERC-TSXV; BPUZF-OTC] is a junior gold-focused company founded by famous Canadian geologist Ron Netolitzky.

Eros Resources Corp. [ERC-TSXV; BPUZF-OTC] is a junior gold-focused company founded by famous Canadian geologist Ron Netolitzky.

He has been directly associated with three major gold discoveries in North America, including two of Canada’s most successful high-grade precious metal mines – Snip and Eskay Creek. Both are located in the Golden Triangle area of British Columbia. The third is the Brewery Creek mine near Dawson City, Yukon.

His extraordinary lifelong success led him to be inducted into the Canadian Mining Hall of Fame in 2015. Netolitzky was assisted in the creation of Eros by Chief Financial Officer Andrew Davidson, and directors Tom MacNeill and Ross McElroy. Each has their own track record of success in bringing greenfield projects to production.

Eros’ two-pronged business approach consists of advancing its own gold project in Nevada and making strategic investments in other well positioned gold projects.

Its flagship project is the 100%-owned Bell Mountain Gold Project near Fallon, Nevada. A preliminary economic assessment (PEA) that was completed in 2017 (and which has not been updated to consider the current price of gold and silver) envisages a four-year mine life, with total production of 60,056 ounces of gold and 408,498 ounces of silver, before expansion based on renewed exploration.

Its flagship project is the 100%-owned Bell Mountain Gold Project near Fallon, Nevada. A preliminary economic assessment (PEA) that was completed in 2017 (and which has not been updated to consider the current price of gold and silver) envisages a four-year mine life, with total production of 60,056 ounces of gold and 408,498 ounces of silver, before expansion based on renewed exploration.

The PEA estimates a life-of-mine cash cost of US$759/oz produced, net of by-product silver and including royalty payments totalling US$2.56 million.

The PEA pegged the pre-tax present value (NPV @ 5% and internal rate of return at US$17.6 million and 41.4% respectively, along with a payback period of 1.7 years, using a US$1,300/oz gold price and US$17.50/oz silver price.

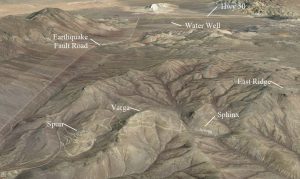

The deposits of the Bell Mountain Property (Spurr, Varga, Sphinx and East Ridge) generally are quite amenable to processing via heap leaching. Together they contain measured and indicated resources of 58,785 gold equivalent ounces. On top of that is 31,103 ounces of inferred gold equivalent ounces.

The deposits of the Bell Mountain Property (Spurr, Varga, Sphinx and East Ridge) generally are quite amenable to processing via heap leaching. Together they contain measured and indicated resources of 58,785 gold equivalent ounces. On top of that is 31,103 ounces of inferred gold equivalent ounces.

The company recently engaged McClelland Laboratories in Reno to estimate capital and operating costs (+20%) for the Bell Mountain Project.

Meanwhile, in an October, 2020 update, Eros said it had launched a soil geochemical survey to identify drill targets in order to expand the existing resource model. The company said it collected 1,000 soil samples on a 200 x 200-foot sample grid. Where bedrock was present, rock-chip samples were collected.

Eros said the samples will guide determination of drill targets by anomalous gold in soil and favourable geology (silicification) where present. Reverse-circulation exploration drilling will test targets as warranted.

The update came after Eros said it had submitted a Water Pollution Control Permit Application to the Nevada Bureau of Mining Regulation and Reclamation (BMRR). The submission was part of a continuing permit process which has included an approved mine plan of operations, an environmental assessment with a finding of no significant impact and a decision record approving advancement of the project.

The Principal Deputy of the U.S. Navy has also confirmed in a letter that they are committed to work with Bell Mountain in accommodating mine development adjacent to the Fallon Naval Air Station.

“We firmly believe the scale of the Bell Mountain can be further increased with additional exploration work on the property in the near term, and that’s what we plan to do,” Netolitzky said.

The company has said it hopes to make a production decision announced within the next 12 months

Aside from Bell Mountain, Eros has an actively managed equity portfolio consisting of hand-picked opportunities where management believes significant value can be achieved.

The depth of management experience provides valuable guidance in selecting opportunities and includes equity positions in Skeena Resources Ltd. [SKE-TSXV; SKREF-OTCQX; RXFB-FSE], Southern Empire Resources Corp. [SMP-TSXV] and MAS Gold Corp. [MAS-TSXV].

Eros recently upped its stake in MAS Gold to 11.8% via a private placement of 7.1 million flow-through units of MAS priced at $0.07 per unit. MAS Gold is advancing a string of advanced gold exploration properties in northern Saskatchewan.

Southern Empire is a gold-focused company and owns the American Girl Mine property in southeast California and the adjacent 100%-optioned Oro Cruz property located approximately 22.5 km southeast of Equinox Gold Corp.’s [EQX-TSXV; EQXGF-OTC] Mesquite gold mine, also in southern California. Skeena Resources is engaged in a redevelopment of the Eskay Creek and Snip mines.

Given the strength of its Bell Mountain gold development project and active investment portfolio, Eros believes it could be an opportunity for investors.

On February 16, 2021, Eros shares were trading at $0.095 in a 52-week range of 16.5 cents and $0.055.

Gold79 Mines Ltd. [AUU-TSXV] is a TSX Venture-listed company that offers low-risk exposure to early-stage precious metals exploration in Nevada, a U.S. state that was ranked as the most attractive jurisdiction in the world for mining by the Fraser Institute in 2019.

Gold79 Mines Ltd. [AUU-TSXV] is a TSX Venture-listed company that offers low-risk exposure to early-stage precious metals exploration in Nevada, a U.S. state that was ranked as the most attractive jurisdiction in the world for mining by the Fraser Institute in 2019.

Gold79 is run by a highly experienced management team and can call on the expertise of director James Franklin, a geoscientist and Canadian Mining Hall of Fame member, who spent much of his long career documenting the complex evolution of the Canadian Shield and its link to its phenomenal mineral wealth.

CEO Gary Thompson is the co-founder of Brixton Metals Corp. [BBB-TSXV] and previously held positions with EnCana Corp. (now rebranded as Ovintiv Inc.), Newmont Alaska Ltd., and NOVAGOLD Resources Inc. [NG-TSX].

Officers and directors of the company hold 15.3% of the 91.4 million (121.1 million fully diluted) common shares outstanding, which traded at $0.09 on February 1st, 2021 with a 52-week range of 14 cents and $0.02.

Gold79 holds 100% earn-in option and or purchase agreements on three gold projects. The two priority projects are located in Nevada. They are the Jefferson Canyon and Tip Top gold projects. The third is located in Arizona and is known as the Gold Chain Project.

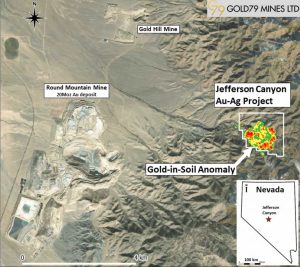

All three are located along the north-west trending Walker Lane Gold Belt, which played an integral role in the history of Nevada, beginning in 1859 with the discovery of the Comstock Lode, representing 8.5 million ounces of gold and 400 million ounces of silver. Stretching from Nevada into northwest Arizona, Walker Lane also hosts Kinross Gold Corp.’s [K-TSX; KGC-NYSE] Round Mountain Mine, a world-class low-sulfidation epithermal deposit that has produced 15 million ounces of gold to date with additional reserves and resources of 5 million ounces.

All three are located along the north-west trending Walker Lane Gold Belt, which played an integral role in the history of Nevada, beginning in 1859 with the discovery of the Comstock Lode, representing 8.5 million ounces of gold and 400 million ounces of silver. Stretching from Nevada into northwest Arizona, Walker Lane also hosts Kinross Gold Corp.’s [K-TSX; KGC-NYSE] Round Mountain Mine, a world-class low-sulfidation epithermal deposit that has produced 15 million ounces of gold to date with additional reserves and resources of 5 million ounces.

When Gold79 closed amalgamation last year with Territory Metals Corp., an unlisted private British Columbia company, it secured the right to acquire a 100% interest in the Tip Top gold project located in Esmeralda County, Nevada. The project contains low sulfidation, oxide gold-silver epithermal veins. Two of the veins historically produced 6,900 ounces of gold and some silver. Since 1980, the property has been drilled by five companies, with 143 drill holes covering 7,315 metres. The company believes there is significant exploration potential along the Tip Top vein system as well as other parallel veins.

The Jefferson Canyon Project covers a large volcanic-hosted epithermal gold-silver system, which is thought to be similar in style and age to the nearby Round Mountain mine.

Chairman and CEO Gary Thompson said: “Our work at Jefferson Canyon continues to highlight the significant potential of this asset. Our recently identified 4.0 km2 gold-in-soil anomaly, along with a compilation of historical drilling data suggests that this is an advanced exploration project.”

Gold79 has generated an internal block model of mineralization for the Jefferson Canyon Project. The block model was calculated based on 118 historical holes totaling 18,106 metres, providing 340,000 ounces AuEq at a 0.5 g/t AuEq cut-off to 428,000 ounces AuEq at a 0.5 g/t AuEq cut-off. Gold79 has projected an exploration target of 40Mt to 200Mt at 0.5 to 1 g/t AuEq for Jefferson Canyon. (Disclaimer: the estimate represented is a preliminary internal mineral resource estimate for the Jefferson Canyon project that is only intended for informational purposes. The resource is non-compliant under CIM NI-43-101 reporting standards and the stated figures cannot be relied upon.)

Gold79 has generated an internal block model of mineralization for the Jefferson Canyon Project. The block model was calculated based on 118 historical holes totaling 18,106 metres, providing 340,000 ounces AuEq at a 0.5 g/t AuEq cut-off to 428,000 ounces AuEq at a 0.5 g/t AuEq cut-off. Gold79 has projected an exploration target of 40Mt to 200Mt at 0.5 to 1 g/t AuEq for Jefferson Canyon. (Disclaimer: the estimate represented is a preliminary internal mineral resource estimate for the Jefferson Canyon project that is only intended for informational purposes. The resource is non-compliant under CIM NI-43-101 reporting standards and the stated figures cannot be relied upon.)

The Gold Chain Project is located near Bullhead City, western Arizona, is on BLMÂ Lands, and is about 12-15km north from Northern Vertex’s [NEE-TSXV] Moss Mine (oxide gold).The property covers numerous exposures of epithermal-style oxide gold mineralization similar to the Moss Mine. These are contained within an area of about 10 km2. Historical drill data from the 1980s have identified broad zones of oxide gold mineralization, ie. 0.5 to 1.6 g/t gold. The project is now permitted for drilling which is anticipated to begin in Q1-Q2 2021.

The goal for the company is to drill these high potential projects and to bring them into compliant resources categories and then grow these resources towards an economic deposit.