GFG Drills 4.82 g/t Gold over 26.0 Metres and Continues to Intercept Multiple Gold Zones at the Montclerg Gold Project

GFG Resources Inc. (TSX-V: GFG) (OTCQB: GFGSF)Â (“GFG” or the “Company”) reports new assay results from three drill holes that have intersected multiple zones of significant gold mineralization at the Montclerg Gold Project (the “Project” and/or “Montclerg”), located 48 kilometres (“km”) east of the prolific Timmins Gold District in Ontario, Canada (See Figure 1).

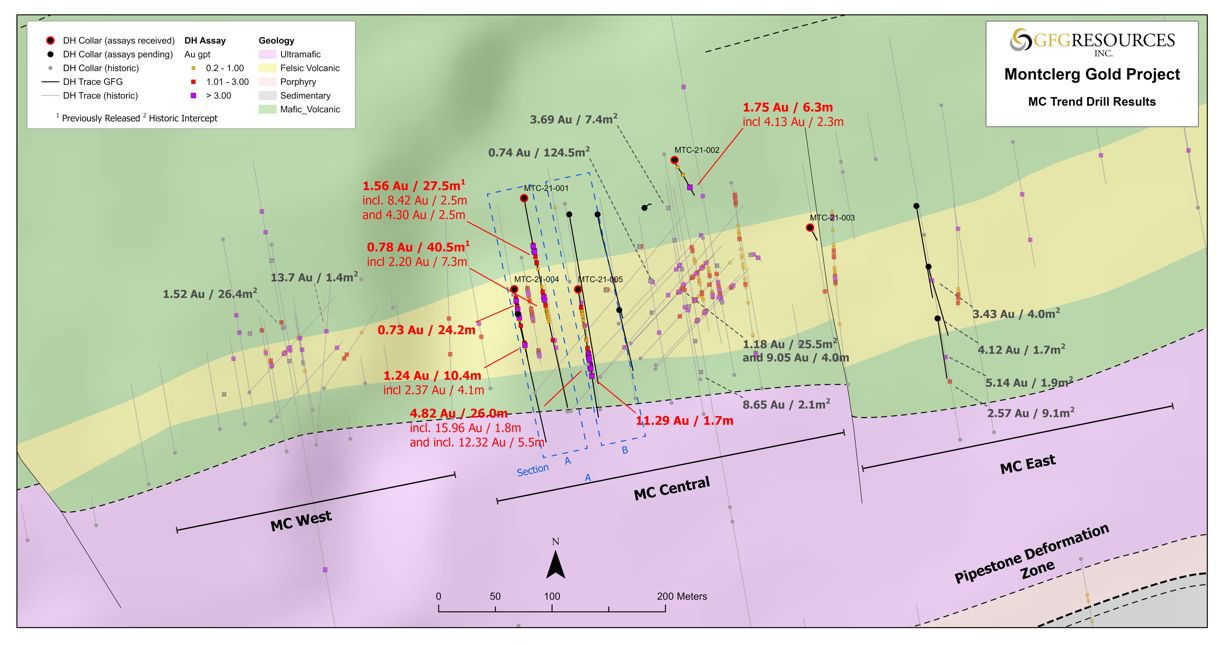

During the fourth quarter of 2021, the Company drilled a total of 3,210 metres (“m”) from 14 holes in its inaugural Phase 1 drill program. To date, the Company has received drill assay results from five holes and have successfully returned both high-grade and bulk tonnage intercepts from the MC Central target (see Table 1 and Figures 2-6) with highlights including:

Hole MTC-21-005:

- Upper Footwall zone: 4.82 grams of gold per tonne (“g/t” Au) over 26.0 m including 12.32 g/t Au over 5.5 m; and

- Upper Footwall zone:Â 11.29 g/t Au over 1.7 m

Hole MTC-21-004:

- Upper Main zone:Â 0.73 g/t Au over 24.2 m;Â and

- Lower Main zone: 1.24 g/t Au over 10.4 m including 2.37 g/t Au over 4.1 m

- Lower Footwall zone: 1.23 g/t Au over 15.5 m including 3.09 g/t Au over 3.3 m

Brian Skanderbeg, President and CEO commented, “These great results confirm our belief in the potential for both high-grade and bulk tonnage gold mineralization at Montclerg. We are very encouraged by the stacked nature of the system, impressive widths and the relationship to historic drill holes that extend over a strike length of more than 1.3 km. The intensity of the alteration, veining and sulphidation that we are seeing are consistent with a multi-stage, large-scale gold system. Hole MTC-21-005 is the best hole ever drilled on the Project and may be amongst the best greenfield intercepts from the Timmins region over the past decade. As we await the remaining assays, drilling at Montclerg will resume in the coming weeks.”

Assay and Drillhole Analysis

In the Phase 1 program, the Company completed 11 holes focused on the MC Central target and three holes on the MC Eastern target; testing a strike length in excess of 500 m. The 14 holes varied in length from 125 to 400 m and tested a strike length of over 500 m. The program systematically tested the strike and dip-extensions of MC Central and MC East targets and the prospective MC Footwall corridor. Assay results are pending for the remaining nine holes and the Company expects to report these results throughout the first quarter.

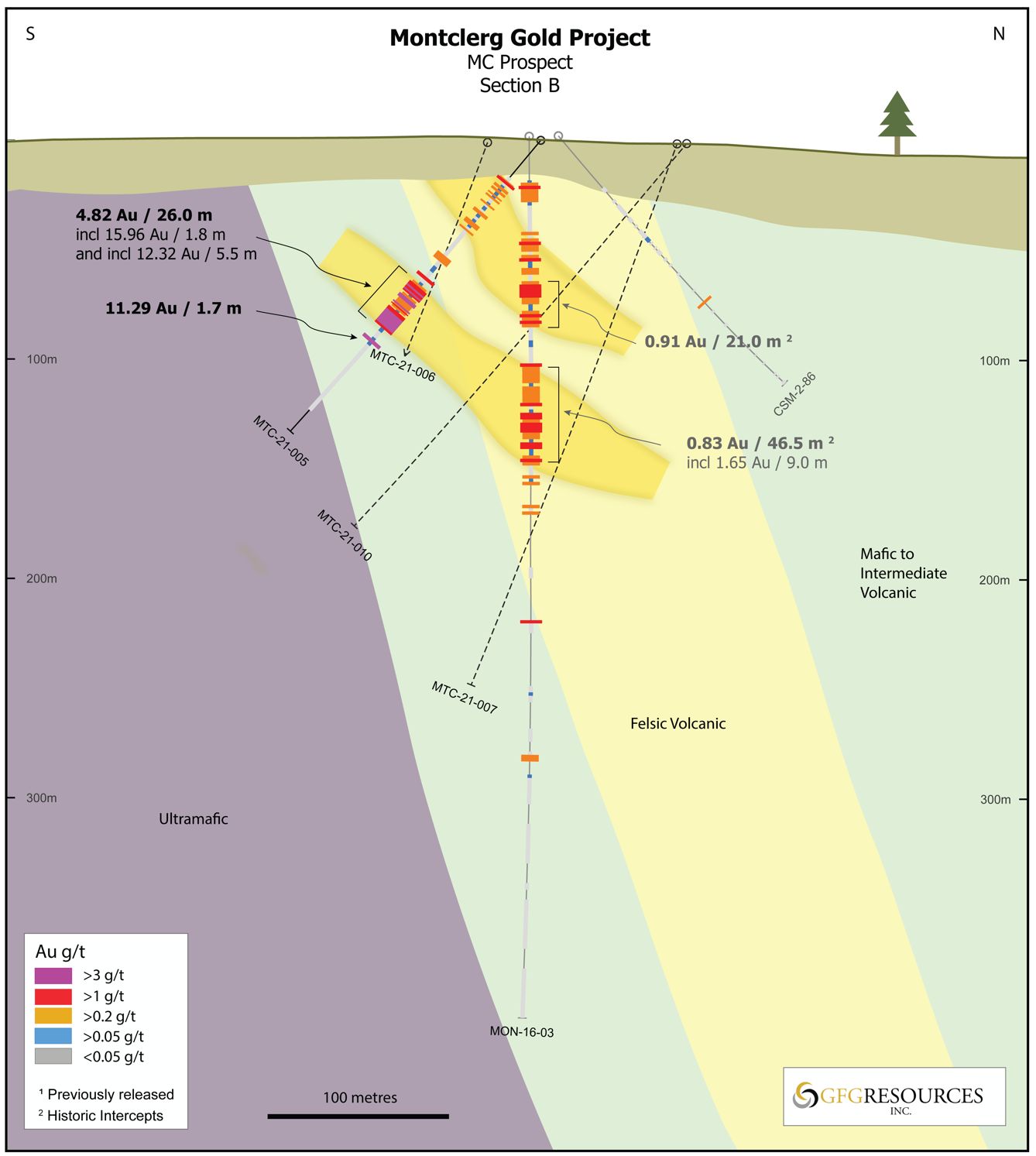

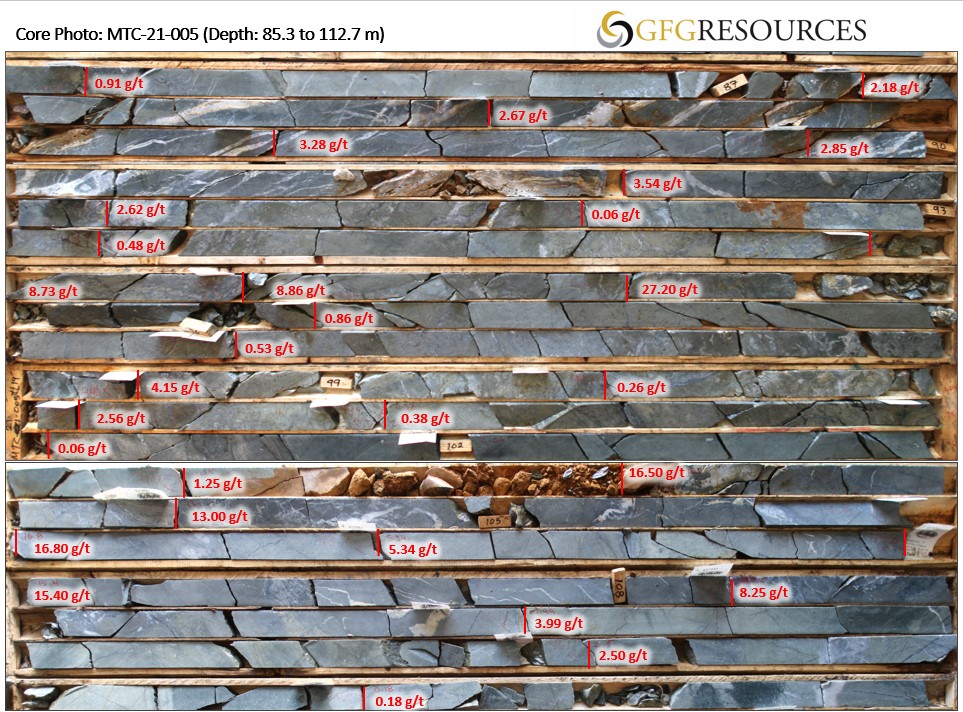

Drill hole MTC-21-005 was drilled to test the Upper Footwall zone at depths of less than 150 m vertical. The hole successfully encountered a zone of intense sericite, carbonate and silica alteration, moderate quartz veining, and 1 to 10%, and locally to 25%, disseminated pyrite and arsenopyrite at, and directly below the contact with the mafic volcanic footwall. This mineralized zone returned 4.82 g/t Au over 26.0 m and included two sub-intervals that graded 15.96 g/t Au over 1.8 m and 12.32 g/t Au over 5.5 m. A second zone of alteration and sulphidation was encountered deeper in the hole and returned 11.29 g/t Au over 1.7 m. Follow-up drill holes are pending on this shallow high-grade intercept, and it is a priority for the up-coming drill program.

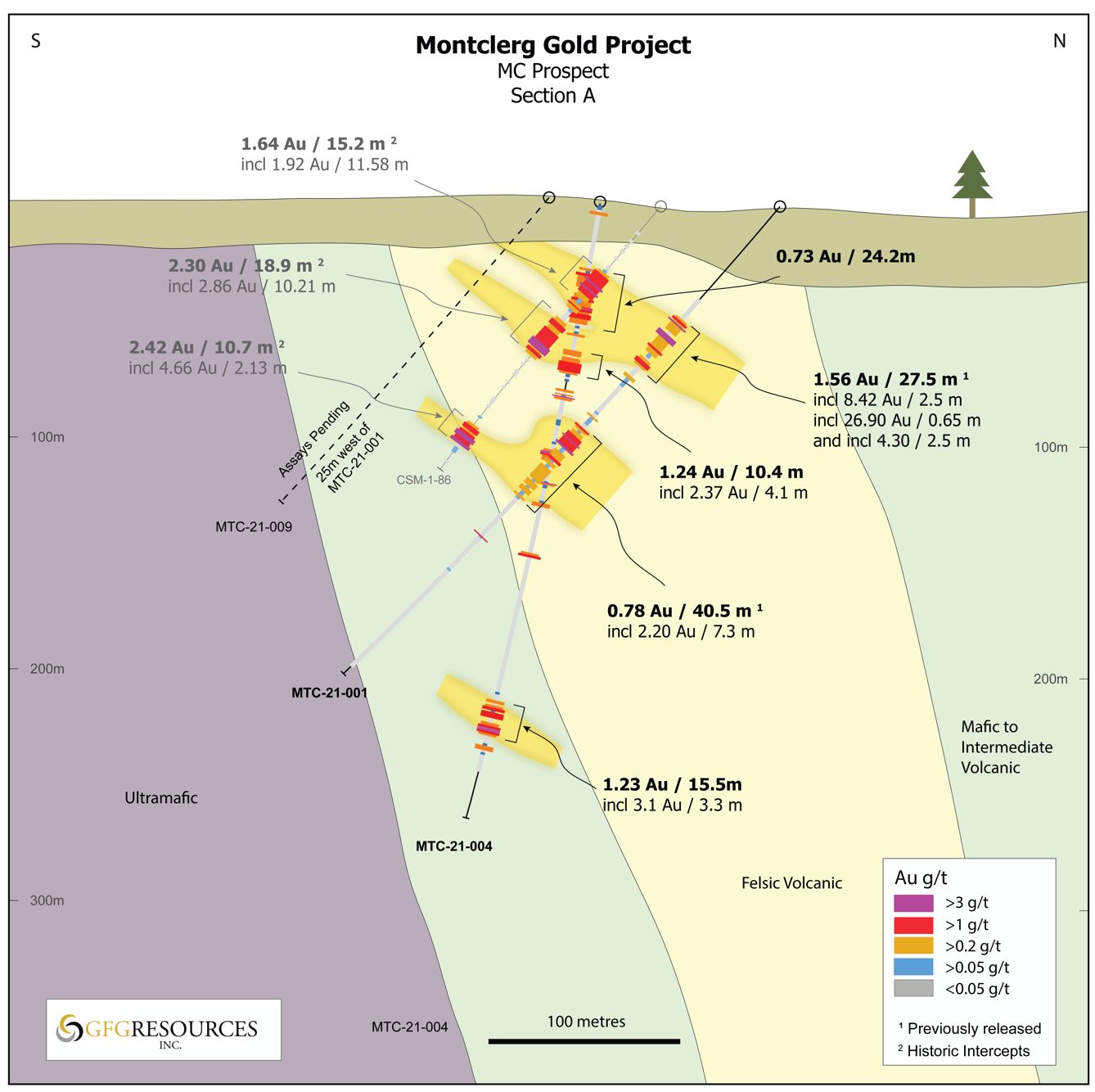

Drill hole MTC-21-004 was drilled to test the westward extension of the Main zone above 100 m depth and a possible extension of the Lower Footwall zone within the mafic volcanics to the south. Within the felsic volcanic package two mineralized zones were intersected and graded 0.73 g/t Au over 24.2 m and 1.24 g/t Au over 10.4 m. These zones are characterized by moderate to strong silicification and sericite alteration, 1 to 10% quartz veining and trace to 3%, and locally up to 10%, disseminated pyrite and arsenopyrite. The Lower Footwall zone was encountered and graded 3.09 g/t Au over 3.3 m.

Drill hole MTC-21-002 was drilled to test for down dip extension of the Lower Footwall zone at MC Central. Highly-carbonate altered and sulphidized mafic volcanic rocks were encountered between 357.2 and 363.5 m down hole corresponding to expected location of the targeted zone. This interval returned 1.75 g/t Au over 6.3 m and included a sub-interval grading 4.13 g/t Au over 2.3 m. Historic drilling of the Lower Footwall zone returned high-grade intervals such as 9.05 g/t Au over 4.0 m, 9.23 g/t Au over 2.15 m, and 5.38 g/t Au over 3.2 m. This zone remains open, with assays pending on follow-up holes and remains a priority drill target for future programs.

Table 1: Initial Assay Results from Montclerg Gold Project

| Hole ID | From (m) | To (m) | Length (m) | Au g/t | Zone |

| MTC-21-0011 | 62.50 | 90.00 | 27.5 | 1.56 | Upper Main |

| incl. | 63.50 | 66.00 | 2.5 | 8.42 | |

| incl. | 65.35 | 66.00 | 0.65 | 26.90 | |

| incl. | 71.50 | 74.00 | 2.5 | 4.30 | |

| and | 126.00 | 166.50 | 40.5 | 0.78 | Lower Main |

| incl. | 130.75 | 138.00 | 7.3 | 2.20 | |

| MTC-21-002 | 357.20 | 363.50 | 6.3 | 1.75 | Lower Footwall |

| incl. | 359.70 | 362.00 | 2.3 | 4.13 | |

| MTC-21-003 | Abandoned hole | ||||

| MTC-21-004 | 39.80 | 64.00 | 24.2 | 0.73 | Upper Main |

| and | 75.70 | 86.10 | 10.4 | 1.24 | Lower Main |

| incl. | 81.00 | 85.10 | 4.1 | 2.37 | |

| and | 230.50 | 246.00 | 15.5 | 1.23 | Lower Footwall |

| incl. | 241.70 | 245.00 | 3.3 | 3.09 | |

| MTC-21-005 | 86.00 | 112.00 | 26.0 | 4.82 | Upper Footwall |

| incl. | 94.30 | 96.10 | 1.8 | 15.96 | |

| incl. | 103.80 | 109.30 | 5.5 | 12.32 | |

| and | 118.90 | 120.60 | 1.7 | 11.29 | Upper Footwall |

1Â Previously released

*Drill intercepts are presented using a 0.20 g/t Au cut-off and as drilled length. Composites include internal dilution of up to 3 m at grades less than 0.2 g/t Au. True width is estimated to be 50 to 90% of drilled length.

Outlook

In 2022, the Company plans to complete approximately 10,000 m of drilling on its Timmins portfolio with an emphasis on the Montclerg Gold Project. In the first half of 2022, the Company will complete 3-4,000 m of drilling and while assay turnaround remains a challenge, a steady stream of assays is expected over the coming weeks and months. In addition to the on-going drill program, the Company will continue additional exploration activities and target development across the Montclerg Project.

At the Pen Gold Project, the Company will continue to refine and develop drill targets during 2022 and is planning a sonic till drilling program in Q1 2022. At this time, the Company is reviewing various alternatives to advance the Dore Gold Project and will provide further information as it becomes available.

At the Rattlesnake Hills Gold Project, metallurgical test work remains on-going with the Company’s joint venture partner Group 11 Technologies Inc. (“Group 11”). Initial metallurgical results from Group 11’s Stage 1 program are pending and GFG anticipates being able to provide an update in the near future. As the results become available, Group 11 will confirm next steps on conducting further laboratory testing and potential field work. Group 11’s goal is to demonstrate that the non-cyanide, water-based solution along with In-Situ Recovery technology can effectively recover gold and be applied to the gold mining industry.

About the Montclerg Gold Project

The Montclerg Gold Project is located 48 kilometres (“km”) east of the prolific Timmins Gold Camp and is adjacent to multiple current and historic gold mines (See Figure 1). The Project consists of patented and unpatented mining claims that cover 10 km of the highly prospective Pipestone Deformation Zone. GFG recently closed the acquisition of the Project, and in parallel with the drill program, will advance a systematic exploration program to evaluate and improve the property scale understanding.

Figure 1: Regional Map of GFG Gold ProjectsÂ

Figure 2: Montclerg Gold Project Plan View Map

Figure 3: Montclerg Gold Project Cross Section Map (Holes MTC-21-001 and 004)Â

Figure 4: Montclerg Gold Project Cross Section Map (Hole MTC-21-005)Â

Figure 5: Core Photos of MTC-21-005 from Montclerg Gold Project

Figure 6: Highlighted Core Photos of MTC-21-005 from Montclerg Gold Project

2021 Financing Disclosure

In connection with the C$3.1 million financing completed in November 2021, the Company wishes to correct its previous disclosure to confirm that it paid cash finder’s fees on portions of the financing totaling C$8,833, as opposed to C$7,833 as previously disclosed.Â

About GFG Resources Inc.

GFG is a North American precious metals exploration company focused on district scale gold projects in tier one mining jurisdictions, Ontario and Wyoming. In Ontario, the Company operates the Montclerg, Pen and Dore gold projects, each large and highly prospective gold properties within the prolific gold district of Timmins, Ontario, Canada. The projects have similar geological settings that host most of the gold deposits found in the Timmins Gold Camp which have produced over 70 million ounces of gold. The Company also owns 100% of the Rattlesnake Hills Gold Project, a district scale gold exploration project located approximately 100 kilometres southwest of Casper, Wyoming, U.S. In Wyoming, the Company has partnered with Group 11 through an option and earn-in agreement to advance the Company’s Rattlesnake Hills Gold Project with a technology that could revolutionize the gold mining industry. The geologic setting, alteration and mineralization seen in the Rattlesnake Hills are similar to other gold deposits of the Rocky Mountain alkaline province which, collectively, have produced over 50 million ounces of gold.

For further information, please contact:

Brian Skanderbeg, President & CEO

Phone: (306) 931-0930

or

Marc Lepage, Vice President, Business Development

Phone: (306) 931-0930

Email:Â info@gfgresources.com

Website:Â www.gfgresources.com

Stay Connected with Us

Twitter:Â @GFGResources

LinkedIn:Â https://www.linkedin.com/company/gfgresources/

Facebook:Â https://www.facebook.com/GFGResourcesInc/

Qualified Persons

Brian Skanderbeg, P.Geo. and M.Sc., President and CEO, is the Qualified Person for the information contained in this press release and is a Qualified Person within the meaning of National Instrument 43-101. Mr. Skanderbeg has reviewed the sampling and QA/QC procedures and results thereof as verification of the sampling data disclosed above and has approved the information contained in this news release.

Drill intercepts are historical and presented using a 0.20 g/t Au cut-off and as drilled length. Composites include internal dilution of up to 3 m at grades less than 0.2 g/t Au. True width is estimated to be 50 to 90% of drilled length.

Sampling protocols, quality control and assurance measures and geochemical results related to historic drill core samples quoted in this news release have not been verified by the Qualified Person and therefore must be regarded as estimates.

CAUTION REGARDING FORWARD-LOOKING INFORMATION

All statements, other than statements of historical fact, contained in this news release constitute “forward-looking information” within the meaning of applicable Canadian securities laws and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (referred to herein as “forward-looking statements”). Forward-looking statements include, but are not limited to, the future price of gold, success of exploration activities and metallurgical test work, permitting time lines, currency exchange rate fluctuations, requirements for additional capital, government regulation of exploration work, environmental risks, unanticipated reclamation expenses, title disputes or claims and limitations on insurance coverage. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate” or “believes”, or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results, “may”, “could”, “would”, “will”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotation thereof.

All forward-looking statements are based on various assumptions, including, without limitation, the expectations and beliefs of management, the assumed long-term price of gold, that the Company will receive required permits and access to surface rights, that the Company can access financing, appropriate equipment and sufficient labour, and that the political environment within Canada and the United States will continue to support the development of mining projects in Canada and the United States. In addition, the similarity or proximity of other gold deposits to the Rattlesnake Hill Gold Project, the Montclerg Gold Project, the Pen Gold Project and the Dore Gold Project is not necessary indicative of the geological setting, alteration and mineralization of the Rattlesnake Hills Gold Project, the Montclerg Gold Project, the Pen Gold Project and the Dore Gold Project.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of GFG to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: actual results of current exploration activities; environmental risks; future prices of gold; operating risks; accidents, labour issues and other risks of the mining industry; delays in obtaining government approvals or financing; and other risks and uncertainties. These risks and uncertainties are not, and should not be construed as being, exhaustive.

Although GFG has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. In addition, forward-looking statements are provided solely for the purpose of providing information about management’s current expectations and plans and allowing investors and others to get a better understanding of our operating environment. Accordingly, readers should not place undue reliance on forward-looking statements.

Forward-looking statements in this news release are made as of the date hereof and GFG assumes no obligation to update any forward-looking statements, except as required by applicable laws.