White Gold Corp. Makes New High-Grade Discovery Intersecting 6.94 g/t Gold over 19.50m and 1.36 g/t Gold over 18.50m at the Ulli’s Ridge Target in Maiden Diamond Drill Program

White Gold Corp. (TSX.V: WGO, OTCQX: WHGOF, FRA: 29W) (the “Company”) is pleased to report assay results for the maiden diamond drilling program on its Ulli’s Ridge target located approximately 3 km southwest of the Company’s flagship Golden Saddle and Arc deposits and 11 km south of the Company’s VG deposit. The Golden Saddle and Arc deposits have a combined mineral resource of 1,139,900 ounces Indicated at 2.28 g/t Au and 402,100 ounces Inferred at 1.39 g/t Au(1), and the VG deposit hosts an Inferred gold resource of 267,600 ounces at 1.62 g/t Au(2). This maiden diamond drilling was part of the Company’s fully funded 2021 exploration program backed by partners Agnico Eagle Mines Limited (TSX: AEM, NYSE: AEM) and Kinross Gold Corporation (TSX: K, NYSE: KGC) on its extensive 420,000 hectare land package in the emerging White Gold District, Yukon.

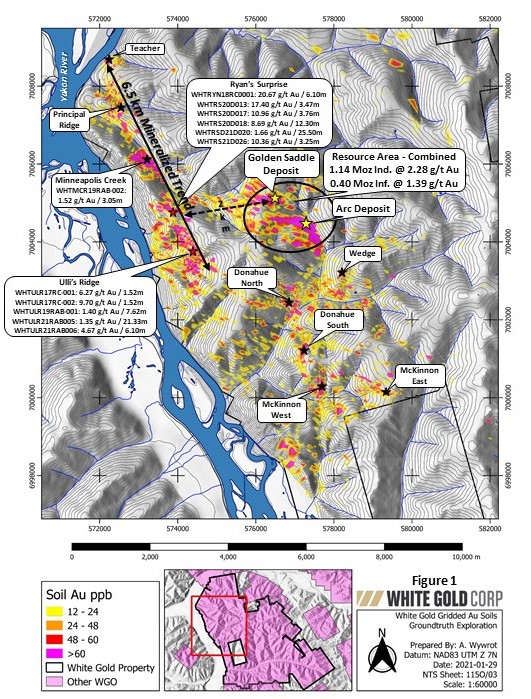

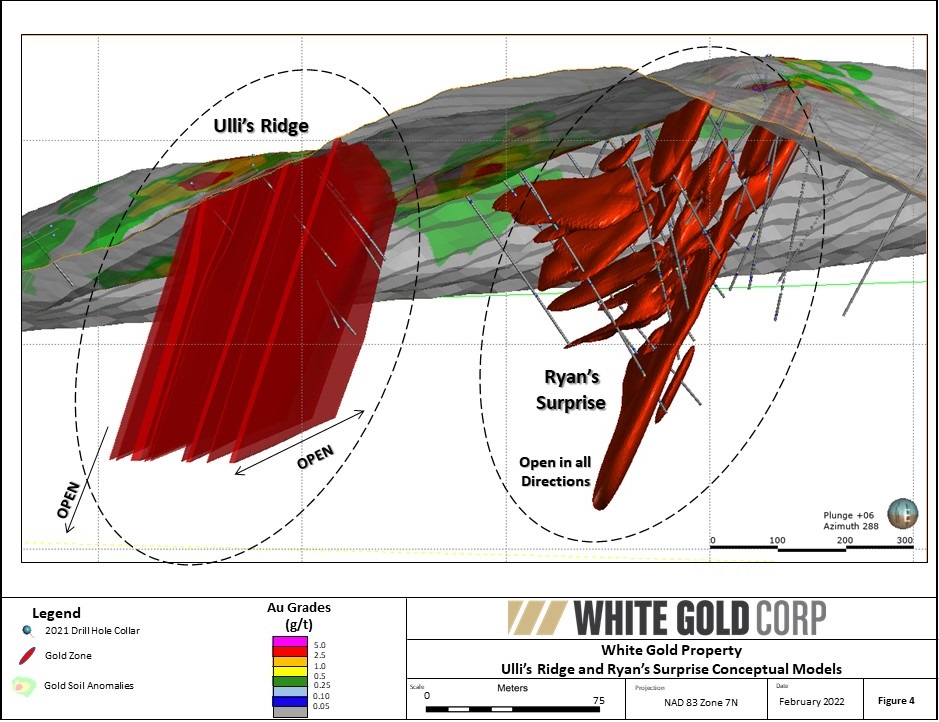

The Ulli’s Ridge target is located immediately south of the Ryan’s Surprise target, with both targets situated on a 6.5 km long x 1.0 km wide northwest-southeast trend of anomalous gold and arsenic in soils, which extends from the Ulli’s Ridge target in the south to the Teacher showing in the north (Figure 1). The Ryan’s Surprise target has been a focus of diamond drilling over the past two field seasons, and in 2021 drilling was expanded southwards to the Ulli’s Ridge target. The goal of these drill programs was to identify new zones of gold mineralization with the potential to increase the Company’s significant gold resources.

Highlights Include:

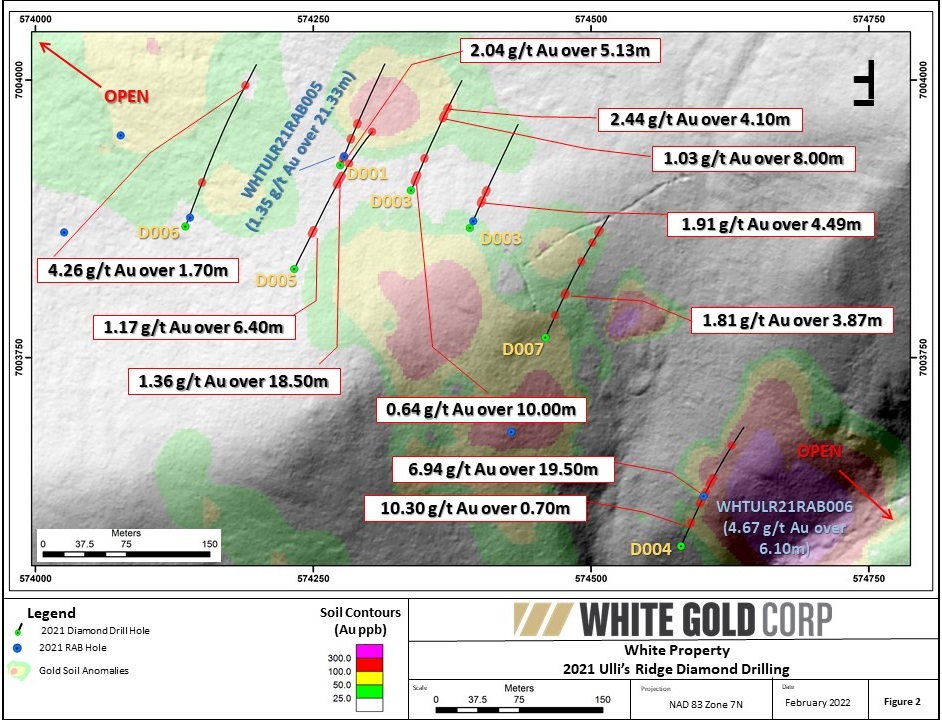

- 2021 diamond drilling at the Ulli’s Ridge target comprised 7 holes totalling 1,408.7m which tested an approximately 550m strike length where early season 2021 rotary air blast (RAB) drilling encountered encouraging gold mineralization including 4.67 g/t Au over 6.10m and 1.35 g/t Au over 21.33m.

- All holes intersected gold mineralization with significant results including:

- WHTULR21D004:Â 6.94 g/t Au over 19.50m, including 39.10 g/t Au over 1.50m and 45.40 g/t Au over 0.83m

- WHTULR11D005:Â 1.36 g/t Au over 18.50m including 5.19 g/t Au over 3.50m

- WHTULR21D001:Â 2.04 g/t Au over 5.13m

- WHTULR21D002:Â 1.03 g/t Au over 8.00m and 2.44 g/t Au over 4.10m

- WHTULR21D003:Â 1.91 g/t Au over 4.49m

- WHTULR21D006:Â 4.26 g/t Au over 1.70m

- WHTULR21D007:Â 1.81 g/t Au over 3.87m and 2.50 g/t Au over 4.65m

- Drilling at Ulli’s Ridge has now identified gold mineralization along an approximately 650m strike length with mineralization remaining open along strike and at depth.

- All intercepts are at relatively shallow depths and when compared to the Ryan’s Surprise target which continues to intersect high-grade mineralization at greater depths, the Ulli’s Ridge target has significant expansion potential.

- A video overview from management discussing these results in more detail can be found at:Â https://www.youtube.com/watch?v=MNTCVUIXdTQ

- The Company is currently planning its fully funded 2022 exploration program, with details to be released in due course.

Figures accompanying this news release can be found at:Â https://whitegoldcorp.ca/investors/exploration-highlights/

Shawn Ryan, Chief Technical Advisor stated, “The significance of the high-grade gold found in Hole 4, which is also associated with high arsenic values, and very similar to rocks found around the Teacher showing to the north, is that it introduces a new style of high-grade gold target to follow up on. Historically, gold-arsenic anomalies were classified as Arc Style, which generally represented lower gold grade (< 2 g/t Au) potential, and therefore have seen limited exploration. When we look at the 99 percentile arsenic soil anomalies (> 200 ppm) we can clearly see a 6.5 km trend running in a NNW direction from Ulli’s Ridge to the Teacher Showing. Most of these gold-arsenic anomalies have never been prospected or looked at to date. This upcoming summer’s prospecting work will directly target this arsenic trend which hopefully leads to more new high grade gold discoveries.”

“We are very pleased with the results from our maiden drill diamond drill program at Ulli’s Ridge as they continue to demonstrate the extensiveness of gold mineralization in this area. Ulli’s is situated on a multi-kilometre gold in soil anomaly which hosts several other prospective targets in close proximity to our flagship deposits” stated David D’Onofrio, CEO. “Our 2021 program was very successful in identifying and expanding new areas of gold mineralization with the potential to increase White Gold’s significant resource base. I congratulate our team on making another new discovery in this prolific and underexplored district and look forward to following up on these exciting results.”

2021 Diamond Drilling Program

The 2021 diamond drilling program at Ulli’s Ridge comprised 7 holes totalling 1,408.7m with hole lengths ranging from 161.5m to 265.0m and was designed to test an approximately 550m strike length (Figure 2) where early season 2021 RAB drilling returned encouraging results including 4.67 g/t Au over 6.10m from 6.10m downhole in hole WHTULR21RAB006 and 1.35 g/t Au over 21.33m from 67.06m downhole in WHTULR21RAB005 (see Company news release dated November 01, 2021). All 7 diamond drill holes were drilled to the north-northeast (025°) at a dip of -50° (Table 2) to test multiple interpreted northwest-striking and shallowly to moderately southwest-dipping (025-060°) mineralized structures.

Results

The 2021 Ulli’s Ridge diamond drilling program successfully encountered gold mineralization along a 550m strike length at relatively shallow depths, to a maximum of 225m below surface. Mineralization remains open along strike and at depth and recent drilling further demonstrates the exploration potential along the property-scale gold soil geochemical trend located west of the Golden Saddle deposit and east of the Yukon River.

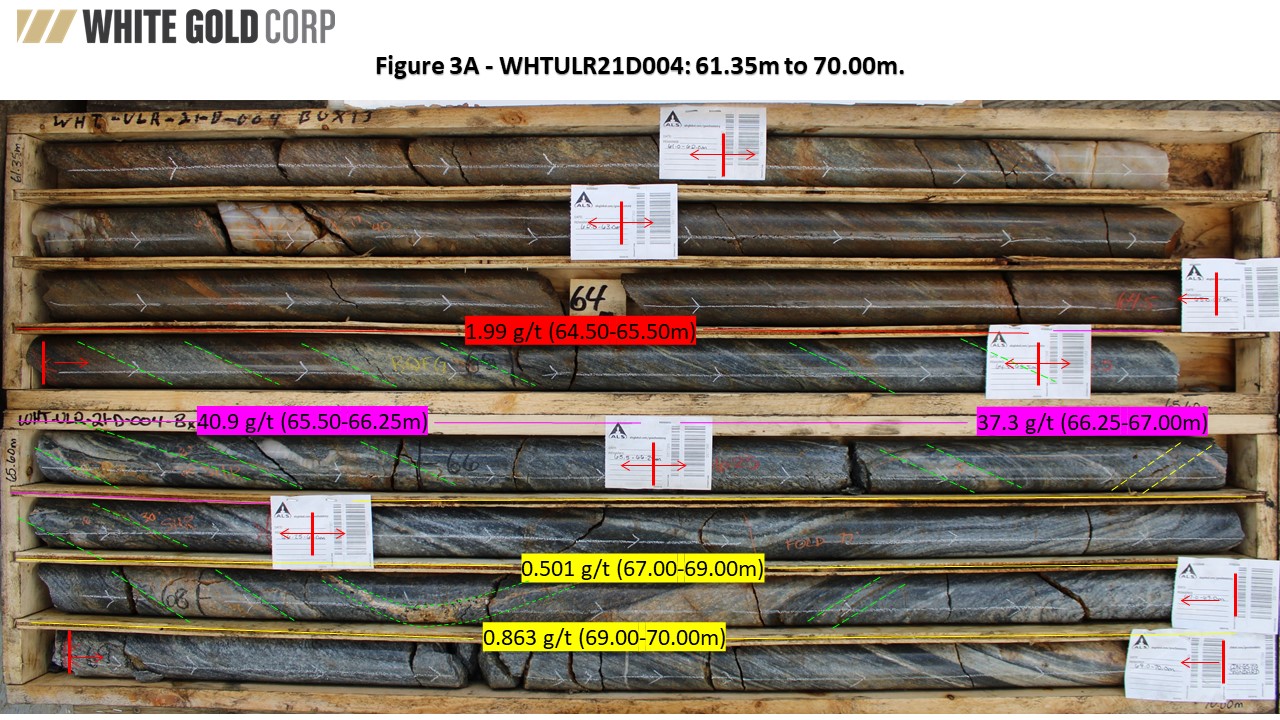

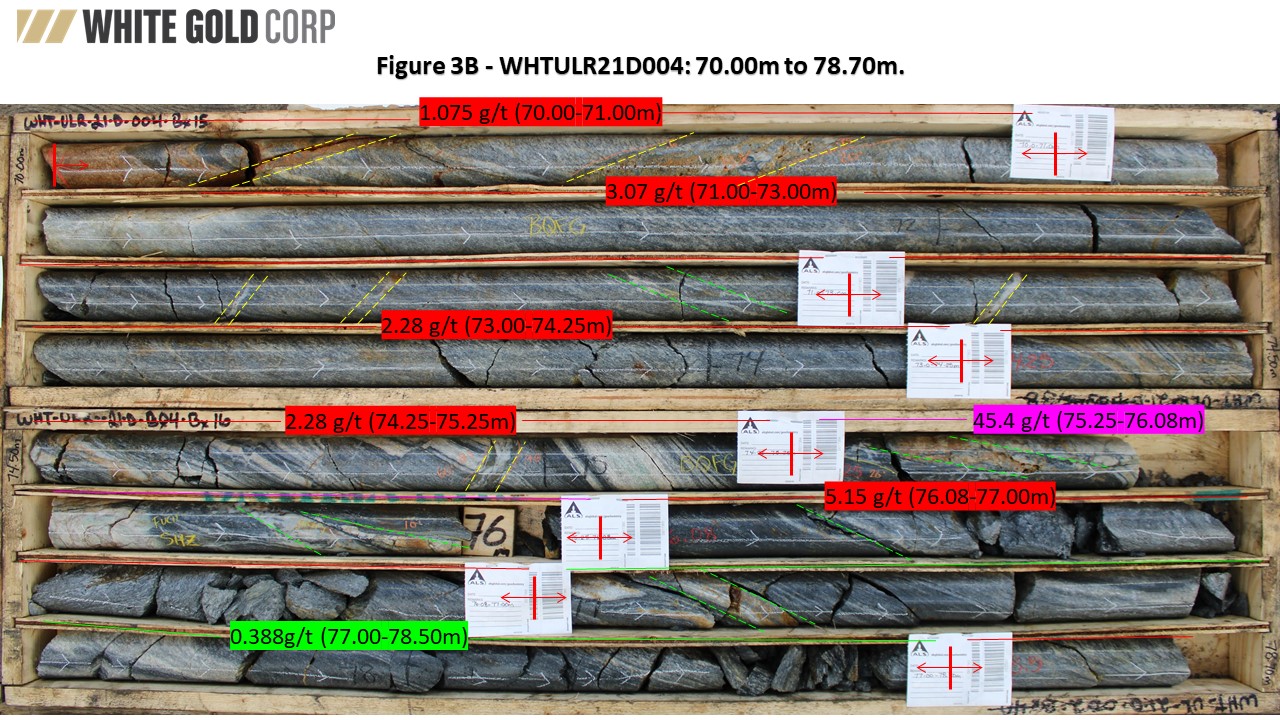

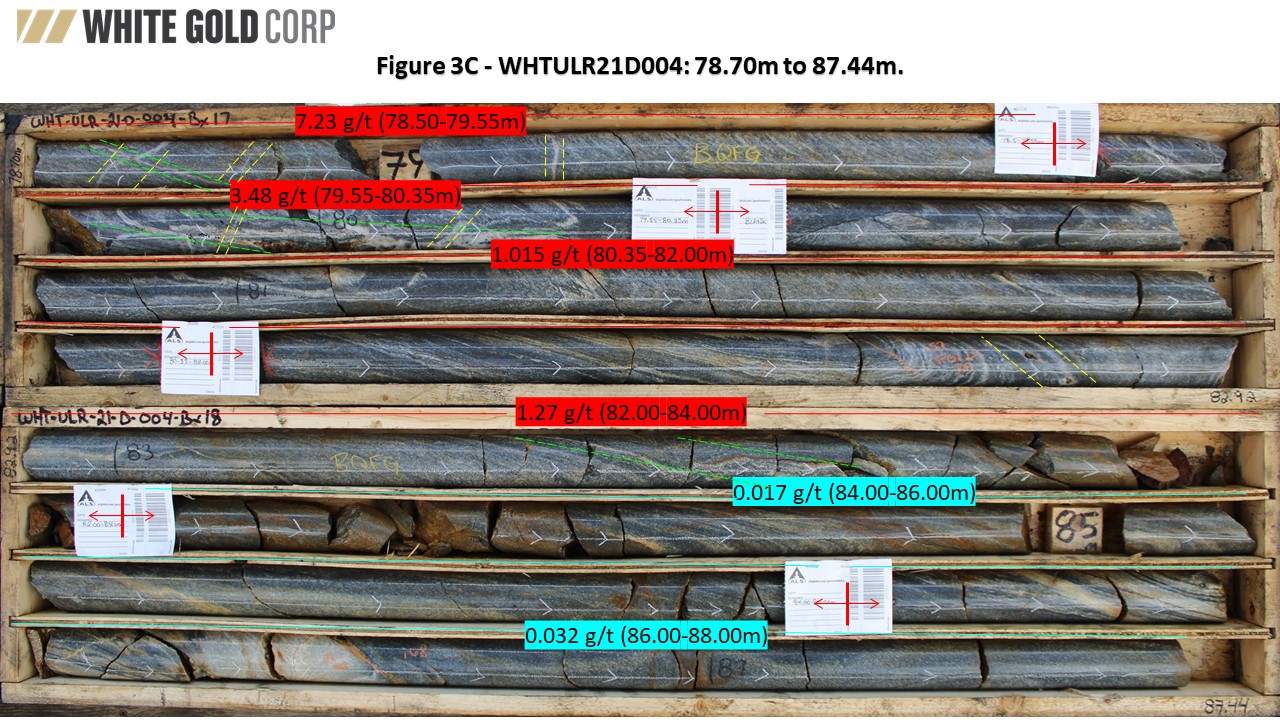

The strongest drilling results were returned from the southeasternmost hole, WHTULR21D004, which was drilled to test beneath RAB hole WHTULR21RAB006 (4.67 g/t Au over 6.10m). WHTULR21D004 intersected 6.94 g/t Au over 19.50m from 64.50m downhole, including high-grade subintervals of 39.10 g/t Au over 1.50m and 45.40 g/t Au over 0.83m (Figures 3 and 3A to 3C). A narrow high-grade zone was also encountered higher in the hole, returning 10.30 g/t Au over 0.70m from 35.20m.

Hole WHTULR21D007 was drilled approximately 225m northwest of WHTULR21D004 and intersected multiple zones of mineralization grading from 1.5-2.9 g/t Au over widths of 0.5-4.65m. Narrow (0.5-1.0m) higher-grade subintervals within these zones grade from 5.7-9.0 g/t Au.

The remainder of the drilling included a cluster of five drill holes that tested an approximately 225m strike length, including holes WHTULR21D001, 002, 003, 005 and 006. Of these holes, WHTULR21D005 delivered the strongest results with a zone of 1.36 g/t Au over 18.50m from 139.50m, which included a higher-grade subinterval of 5.19 g/t Au over 3.50m. Highlights from other holes included 2.04 g/t Au over 5.13m from 9.00m in WHTULR21D001, 2.44 g/t Au over 4.10m from 125.50m in WHTULR21D002, 1.91 g/t Au over 4.49m from 53.86m in WHTULR21D003, and 4.26 g/t Au over 1.70m from 219.60m in WHTULR21D006.

Interpretation

Each of the 2021 diamond drill holes was surveyed with a borehole optical televiewer (OTV) which provides high-resolution digital imagery of the hole walls and provides key structural orientation data on lithological contacts, foliations, fractures, shear zones, veins, etc. This structural data was then integrated with drill core logs, digital core photos, and analytical results to produce a working model.

The OTV data show that structures strike consistently to the north-northwest, but two dominant dips and dip directions are evident (Figure 4): Set 1) foliations and certain parallel to subparallel veins, fractures, and breccia/shear zones dip shallowly (10-30°) to the east-northeast; and Set 2) veins and fractures dip steeply (60-70°) to the west-southwest. Although gold mineralization is associated with both sets of structures, gold grades may differ between the two sets. For example, the very high-grade gold intercepts in hole WHTULR21D004, which included 39.10 g/t Au over 1.50m and 45.40 g/t Au over 0.83m, are clearly associated with mineralized quartz veins and breccia/shear zones that dip shallowly to the east-northeast (Set 1). Consequently, the significantly higher-grade gold intercept in this hole may be explained by having drilled partially oblique to several of these high-grade veins. Nevertheless, high gold grades are also sometimes associated with Set 2 structures, as evidenced by a steeply west-southwest dipping mineralized vein in hole WHTULR21D005 that graded 15 g/t Au over 1.00m. More closely spaced drilling is required to better model these mineralized zones, determine gold grade variations, and estimate true thicknesses.

Given the encouraging results from the 2021 drill program, additional diamond drilling is warranted to further test the mineralized zones both along strike and at depth.

Table 1: Summary of Significant 2021 Diamond Drilling Gold Assay Results at the Ulli’s Ridge Target.

| Hole ID | From (m) | To (m) | Length (m)* | Au (g/t) |

| WHTULR21D001 | 9.00 | 14.13 | 5.13 | 2.04 |

| Inc. | 9.00 | 10.00 | 1.00 | 5.59 |

| And | 13.20 | 14.13 | 0.93 | 3.70 |

| Â | 39.15 | 42.20 | 3.05 | 1.02 |

| Inc. | 40.40 | 41.20 | 0.80 | 3.34 |

| Â | 63.00 | 66.05 | 3.05 | 1.19 |

| Inc. | 64.00 | 65.08 | 1.08 | 2.63 |

| WHTULR21D002 | 13.00 | 23.00 | 10.00 | 0.64 |

| Inc. | 13.00 | 15.00 | 2.00 | 1.15 |

| Â | 47.00 | 49.00 | 2.00 | 2.46 |

| 111.00 | 119.00 | 8.00 | 1.03 | |

| 125.50 | 129.60 | 4.10 | 2.44 | |

| WHTULR21D003 | 37.50 | 43.00 | 5.50 | 0.60 |

| Â | 53.86 | 58.35 | 4.49 | 1.91 |

| WHTULR21D004 | 35.20 | 35.90 | 0.70 | 10.30 |

| 64.50 | 84.00 | 19.50 | 6.94 | |

| Inc. | 65.50 | 67.00 | 1.50 | 39.10 |

| And | 74.25 | 79.55 | 5.30 | 10.52 |

| Inc. | 75.25 | 76.08 | 0.83 | 45.40 |

| 96.00 | 99.75 | 3.75 | 0.60 | |

| 106.00 | 106.70 | 0.70 | 2.74 | |

| 161.00 | 161.50 | 0.50 | 4.52 | |

| WHTULR21D005 | 55.45 | 61.85 | 6.40 | 1.17 |

| Inc. | 55.45 | 56.90 | 1.45 | 1.92 |

| Inc. | 60.05 | 61.85 | 1.80 | 2.10 |

| Â | 139.50 | 158.00 | 18.50 | 1.36 |

| Inc. | 139.50 | 143.00 | 3.50 | 5.19 |

| Inc. | 140.50 | 141.50 | 1.00 | 15.00 |

| 183.05 | 184.60 | 1.55 | 1.61 | |

| 264.30 | 265.00 | 0.70 | 3.33 | |

| WHTULR21D006 | 65.95 | 67.40 | 1.45 | 1.15 |

| Â | 219.60 | 221.30 | 1.70 | 4.26 |

| Inc. | 220.80 | 221.30 | 0.50 | 7.00 |

| WHTULR21D007 | 33.70 | 34.30 | 0.60 | 1.93 |

| 65.13 | 69.00 | 3.87 | 1.81 | |

| Inc. | 68.00 | 69.00 | 1.00 | 6.16 |

| 117.40 | 118.55 | 1.15 | 2.89 | |

| Inc. | 118.05 | 118.55 | 0.50 | 5.70 |

| 148.30 | 149.10 | 0.80 | 1.48 | |

| 164.55 | 169.20 | 4.65 | 2.50 | |

| Inc. | 166.05 | 166.55 | 0.50 | 8.99 |

*Note: All drill hole intercepts reported herein are core lengths. Currently there is insufficient data to estimate true thicknesses.

Table 2. Collar Details for 2021 Diamond Drill Holes at the Ulli’s Ridge Target.

| Hole ID | Collar Location (UTM NAD83, Zone 7) | Dip | Azimuth | Length | ||

| Â | Easting (m) |

Northing (m) |

Elevation (m) |

(deg) | (deg) | (m) |

| WHTULR21D001 | 574,274 | 7,003,923 | 673 | -50 | 25 | 168.2 |

| WHTULR21D002 | 574,338 | 7,003,901 | 696 | -50 | 25 | 175.0 |

| WHTULR21D003 | 574,391 | 7,003,867 | 719 | -50 | 25 | 161.5 |

| WHTULR21D004 | 574,581 | 7,003,580 | 643 | -50 | 25 | 193.0 |

| WHTULR21D005 | 574,233 | 7,003,830 | 675 | -50 | 25 | 265.0 |

| WHTULR21D006 | 574,135 | 7,003,868 | 631 | -50 | 25 | 253.0 |

| WHTULR21D007 | 574,459 | 7,003,768 | 714 | -50 | 25 | 193.0 |

| TOTAL | 7 holes | 1,408.7 | ||||

QA/QC

Analytical work for the 2021 diamond drilling program was performed by ALS Canada Ltd., an internationally recognized analytical services provider, at its North Vancouver, British Columbia laboratory. Sample preparation was carried out at its Whitehorse, Yukon facility. All diamond drill core samples were prepared using procedure PREP-31H (crush 70% less than 2mm, riffle split off 500g, pulverize split to better than 85% passing 75 microns) and analyzed by method Au-AA23 (30g fire assay with AAS finish) and ME-ICP41 (0.5g, aqua regia digestion and ICP-AES analysis). Samples containing >10 g/t Au were reanalyzed using method Au-GRAV21 (30g Fire Assay with gravimetric finish).

The reported work was completed using industry standard procedures, including a quality assurance/quality control (“QA/QC”) program consisting of the insertion of certified standards, blanks, and duplicates into the sample stream.

About White Gold Corp.

The Company owns a portfolio of 21,111 quartz claims across 31 properties covering over 420,000 hectares representing over 40% of the Yukon’s emerging White Gold District. The Company’s flagship White Gold property hosts the Company’s Golden Saddle and Arc deposits which have a mineral resource of 1,139,900 ounces Indicated at 2.28 g/t Au and 402,100 ounces Inferred at 1.39 g/t Au(1). Mineralization on the Golden Saddle and Arc is also known to extend beyond the limits of the current resource estimate. The Company’s recently acquired VG Deposit also hosts an Inferred gold resource of 267,600 ounces at 1.62 g/t Au(2). Regional exploration work has also produced several other new discoveries and prospective targets on the Company’s claim packages which border sizable gold discoveries including the Coffee project owned by Newmont Corporation with Measured and Indicated Resources of 2.17 Moz at 1.46 g/t Au, and Inferred Resources of 0.50 Moz at 1.32 g/t Au(3), and Western Copper and Gold Corporation’s Casino project which has Measured and Indicated Resources of 14.5 Moz Au and 7.6 Blb Cu and Inferred Resources of 6.6 Moz Au and 3.3 Blb Cu(4). For more information visit www.whitegoldcorp.ca.

(1) See White Gold Corp. technical report titled “Technical Report for the White Gold Project, Dawson Range, Yukon Canada”, Effective Date May 15, 2020, Report Date July 10, 2020, prepared by Dr. Gilles Arseneau, P.Geo., and Andrew Hamilton, P.Geo., available on SEDAR.

(2) See White Gold Corp. technical report titled “Technical Report for the QV Project, Yukon, Canada”, Effective Date October 15, 2021, Report Date November 15, 2021, available on SEDAR.

(3) See Newmont Corporation news release titled “Newmont Reports 2020 Mineral Reserves of 94 Million Gold Ounces Replacing 80 Percent of Depletion”, dated February 10, 2021:Â https://www.newmont.com/investors/news-release/default.aspx.

(4) See Western Copper and Gold Corporation news release titled “Western Copper and Gold Announces Significant Resource Increase at Casino”, dated July 14, 2020, available on SEDAR.

Qualified Person

Terry Brace, P.Geo. and Vice President of Exploration for the Company is a “qualified person” as defined under National Instrument 43-101 - Standards of Disclosure of Mineral Projects and has reviewed and approved the content of this news release.

Cautionary Note Regarding Forward Looking Information

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “proposed”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, the Company’s objectives, goals and exploration activities conducted and proposed to be conducted at the Company’s properties; future growth potential of the Company, including whether any proposed exploration programs at any of the Company’s properties will be successful; exploration results; and future exploration plans and costs and financing availability.

These forward-looking statements are based on reasonable assumptions and estimates of management of the Company at the time such statements were made. Actual future results may differ materially as forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to materially differ from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors, among other things, include:

the expected benefits to the Company relating to the exploration conducted and proposed to be conducted at the White Gold properties; the receipt of all applicable regulatory approvals for the Offering; failure to identify any additional mineral resources or significant mineralization; the preliminary nature of metallurgical test results; uncertainties relating to the availability and costs of financing needed in the future, including to fund any exploration programs on the Company’s properties; business integration risks; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, silver, base metals or certain other commodities; fluctuations in currency markets (such as the Canadian dollar to United States dollar exchange rate); change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining and mineral exploration; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); the unlikelihood that properties that are explored are ultimately developed into producing mines; geological factors; actual results of current and future exploration; changes in project parameters as plans continue to be evaluated; soil sampling results being preliminary in nature and are not conclusive evidence of the likelihood of a mineral deposit; title to properties; ongoing uncertainties relating to the COVID-19 pandemic; and those factors described under the heading “Risks Factors” in the Company’s annual information form dated July 29, 2020 available on SEDAR. Although the forward-looking statements contained in this news release are based upon what management of the Company believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders that actual results will be consistent with such forward-looking statements, as there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements and information. There can be no assurance that forward-looking information, or the material factors or assumptions used to develop such forward-looking information, will prove to be accurate. The Company does not undertake to release publicly any revisions for updating any voluntary forward-looking statements, except as required by applicable securities law.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

For Further Information, Please Contact:

Contact Information:

David D’Onofrio

Chief Executive Officer

White Gold Corp.

(647) 930-1880

ir@whitegoldcorp.ca

To Book a Meeting with Management:Â https://whitegoldcorp.ca/contact/request-information/