New Age Metals Signs Binding Agreement with Mineral Resources Limited a Major Australian Lithium Producer, on its Manitoba Lithium Division

Lithium Spodumene-Lepidolite Surface Mineralization at Lithium One Project

New Age Metals Inc. (TSX.V: NAM; OTCQB: NMTLF; FSE: P7J.F) (“NAM” or “Company”) is pleased to announce that it has entered into a binding term sheet with a wholly owned subsidiary of Australian lithium and iron ore producer, Mineral Resources Limited (MRL). Under the terms, MRL can earn up to a 75% interest in NAM’s Manitoba lithium division.

- NAM enters into a legally binding term sheet with MRL with respect to NAM’s Manitoba lithium projects

- MRL has the right to acquire an initial 51% interest by completing C$4,000,000 of exploration and development activities and C$400,000 in cash payments within 42 months from the Effective Date

- MRL can earn an additional 14% interest (65%) by completing a NI 43-101 compliant mineral resource estimate and Pre-Feasibility Study on developing a spodumene concentrate operation at one or more of NAM’s Projects

- MRL can earn an additional 10% interest (75%) by funding the Project to the point of a final construction decision made by MRL

- NAM shall have the option to complete an initial public offering of NAM’s joint venture interest or spinning out NAM’s minority joint venture interest into a public vehicle holding such minority joint venture interest

- NAM intends to complete a maiden drill program on its Lithium Two Project in October 2021. Lithium Two hosts a historic non-NI 43-101 compliant mineral resource of 544,000 tonnes at 1.4% Li2O

Harry Barr, Chairman & CEO commented: “The stated mandate for our lithium division since acquisition of our projects was to secure a strategic partner with exploration, development, and production expertise, and this agreement with Mineral Resources Ltd fulfills our objective. Mineral Resources is one of the worlds largest lithium producers with a current market capitalization of approximately A$9 billion. This agreement comes at an opportune time in the market where North American lithium demand is high and there is a growing need to introduce local supply to meet that demand. Manitoba is an underexplored region in North America for lithium and rare elements. This is a strategic transaction for New Age shareholders as it provides both, a non-dilutive financing for the development of our substantial lithium division through a partnership with one of the worlds largest producers and the flexibility to finance our share of the projects through various methods. Our phase one exploration plan is to complete a maiden drill program at our Lithium Two Project and ground proof geophysical targets that were identified earlier this year.

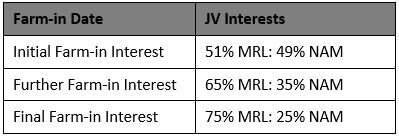

Term Sheet Summary

The binding term sheet provides the framework by which Lithium Mineral Resources Pty Ltd, a wholly owned subsidiary of MRL, has the right to acquire up to a 75% beneficial interest in the Tenements owned by Lithium Canada Development – a wholly owned subsidiary of New Age Metals (the Tenements) as follows:

- an initial 51% interest (Initial Farm-in Interest) by completing C$4,000,000 of exploration and development activities on the Tenements (Initial Farm-in Obligation) within 42 months from the Effective Date (Initial Farm-in Period) with a minimum mandatory expenditure of C$1,000,000 of exploration and development activities within 18 months. In the event MRL earns the Initial Farm-in Interest, the parties agree to establish an unincorporated joint venture in relation to the Project (JV) on the Farm-in Date of the Initial Farm-in Interest. The JV assets will be beneficially owned by the JV parties in proportion to their JV interest, see Table 1 below. During the Initial Farm-in Period, NAM will act as manager and shall perform the Initial Farm-in Obligations under the direction of and on behalf of, MRL, and in return, charge a management fee for conducting its exploration and development activities.

- a further 14% interest (Further Farm-in Interest) by completing a NI 43-101 compliant Pre-Feasibility study on developing a spodumene concentrate operation at one or more of the Projects, including the completion of a compliant resource statement (Further Farm-in Obligation) within five (5) years from the Effective Date (Further Farm-in Period); and

- a final 10% interest (Final Farm-in Interest) by funding the Project to the point of a final construction/investment decision (FID) made by MRL (Final Farm-in Obligation, and collectively with the Initial Farm-In Obligation and the Further Farm-in Obligation, the Farm-In Obligations) within seven (7) years from the Effective Date (Final Farm-in Period).

Table 1: JV interests of the JV parties at each Farm-in Date

In consideration of NAM entering this term sheet, MRL will pay to NAM a sum of C$400,000 according to the following schedule: C$100,000 on the Effective Date and on each of the first three (3) anniversaries of the Effective Date.

At FID, NAM may elect to sell (Put Option) and MRL may elect to buy (Call Option), NAM’s JV Interest on the following terms:

- NAM or MRL may provide notice to exercise the Put Option (or royalty conversion option in the case of NAM – see below) or Call Option (as applicable) within 30 days of FID.

- if either party exercises their option, MRL will pay NAM fair market value for NAM’s JV Interest (Sale Consideration);

- at MRL’s election, up to 50% of the Sale Consideration can be settled with an equivalent value in ordinary shares in MRL.

Fair market value will be determined by an independent mining valuation expert appointed by the parties.

All funding post-FID will be by the JV parties in accordance with their JV Interests.

At FID, MRL will provide NAM with a loan to fund its proportion of the development costs of the Project. The parties must enter into a loan agreement to record the terms of the loan, which must include:

- interest being payable at a rate that is equal to MRL’s weighted cost of capital at FID;

- the loan being repaid in priority to all other payments from net revenue received by NAM from the sale of its share of product from the Project.

At FID, NAM may withdraw from the JV by electing to either: convert its JV Interest to a 2.5% Net Smelter Returns (NSR) royalty on all lithium and other minerals that are extracted from the Project and sold at the mine gate and the JV will terminate; or exercise the Put Option.

Each JV party will own and be entitled to take that proportion of product produced from the Project equivalent to its JV Interest in kind.

Each party has a pre-emptive right to acquire the other party’s JV Interest if that other party proposes to sell, transfer or otherwise dispose of its JV Interest (including any sale, transfer or disposal that occurs by reason of a change of control of that other party). For greater certainty, NAM shall not be restricted from completing an initial public offering of NAM’s JV Interest or spinning out NAM’s minority JV Interest into a public vehicle holding such minority JV Interest as its sole asset and MRL’s pre-emptive right shall not apply in either of these instances.

About Mineral Resources Limited

Mineral Resources Limited is an innovative and leading mining services company, with a growing world-class portfolio of mining operations across multiple commodities, including iron ore and lithium. MRL has a diversified commodities portfolio located in the Pilbara and Yilgarn regions in Western Australia. The Company has developed two hard rock lithium operations in Western Australia making them one of the worlds largest owners of hard rock lithium mines.

About NAM

New Age Metals is a junior mineral exploration and development company focused on the discovery, exploration and development of green metal projects in North America. The Company has two divisions; a Platinum Group Metals (PGM) division and a Lithium/Rare Element division.

The PGM Division includes the 100% owned, multi-million-ounce, district scale River Valley Project, one of North America’s largest undeveloped Platinum Group Metals projects, situated 100 km northeast from Sudbury, Ontario. The Company completed a positive Preliminary Economic Assessment on the Project in 2019, and is fully financed to complete a Pre-Feasibility Study on the Project. A technical report is slated to be published by the end of the first half of 2022. In addition to River Valley, the Company is the 100% owner of the Genesis PGM-Cu-Ni Project.

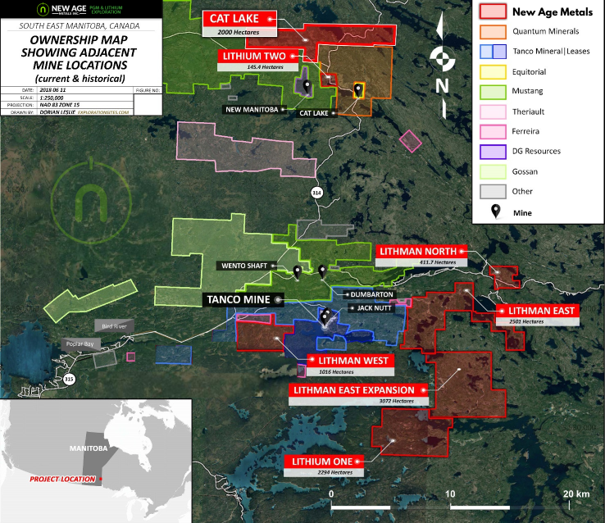

The Lithium Division is one of the largest mineral claim holders in the Winnipeg River Pegmatite Field, where the Company is exploring for hard-rock lithium and various rare elements, such as tantalum and rubidium. 2021 plans include drone-supported geophysics on at least five of the Company’s seven projects, and a maiden diamond drill program on the Company’s Lithium Two Project.

Our philosophy is to be a project generator with the objective of optioning our projects to major and junior mining companies to potentially develop them through to production. The Company is actively seeking an option/ joint venture partner for its road-accessible Genesis PGM-Cu-Ni Project in Alaska.

Investors are invited to visit the New Age Metals website at www.newagemetals.com where they can review the company and its corporate activities. Any questions or comments can be directed to info@newagemetals.com or Harry Barr at Hbarr@newagemetals.com or Cody Hunt at Codyh@newagemetals.com or call 613 659 2773.

Opt-in List

If you have not done so already, we encourage you to sign up on our website (www.newagemetals.com) to receive our updated news.

On behalf of the Board of Directors

“Harry Barr”

Harry G. Barr

Chairman and CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Cautionary Note Regarding Forward Looking Statements: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results and are based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. In addition, forward-looking statements include statements in which the Company uses words such as “continue”, “efforts”, “expect”, “believe”, “anticipate”, “confident”, “intend”, “strategy”, “plan”, “will”, “estimate”, “project”, “goal”, “target”, “prospects”, “optimistic” or similar expressions. These statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others, the Company’s ability and continuation of efforts to timely and completely make available adequate current public information, additional or different regulatory and legal requirements and restrictions that may be imposed, and other factors as may be discussed in the documents filed by the Company on SEDAR (www.sedar.com), including the most recent reports that identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company does not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Investors should not place undue reliance on forward-looking statements.